Trump now Front-Runner for President

There is little sign yet that President Joe Biden is willing to step down after his disastrous debate performance though opinion polls will need to be watched for signs that the Democrats could do better with another candidate. The debate has left former President Donald Trump as the more likely, but not certain, winner in November, something that may persist even if Biden does step down.

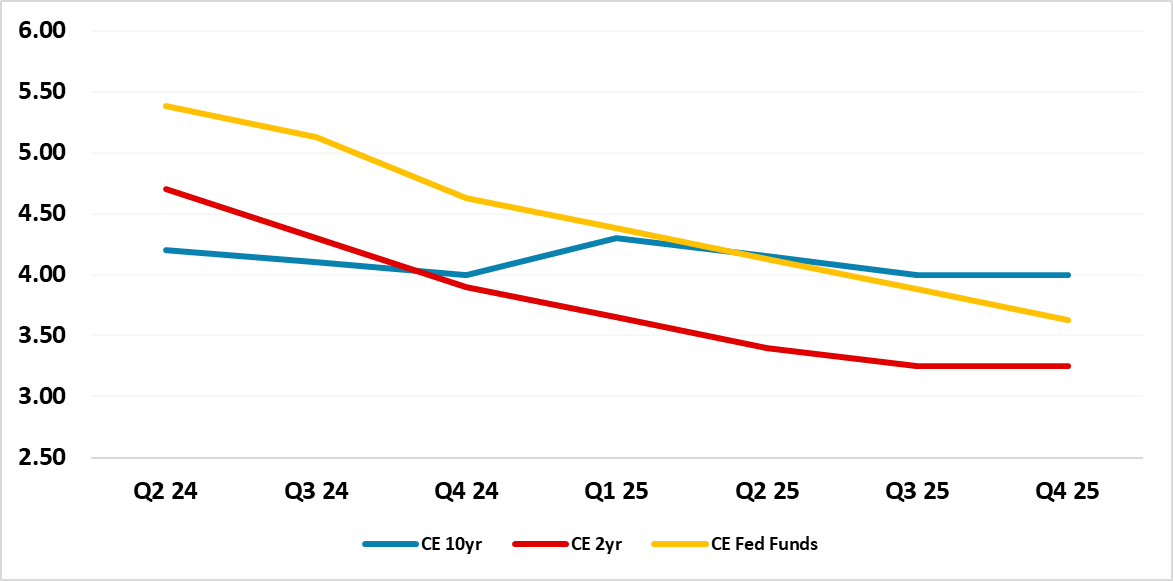

In terms of markets, we have already included fiscal stress in H1 2025 in our 10yr government bond yield forecast (Figure 1) and yield curve steepening. For U.S. equities, optimism about extending parts of the 2017 tax cuts could be overdone, given the current overvaluation in contrast to 2017.

Figure 1: CE Forecasts for Fed Funds, 2 and 10yr Government Bond Yields

Source Continuum Economics

Trump now a clear favorite for November

Opinion polls clearly judge Trump as the winner of the debate and also show an increasing majority expressing concerns about Biden’s age. However there has so far not been much change in voting intentions between Trump and Biden, with most voters having already made up their minds and Trump’s own debate performance, while less damaging than Biden’s, not winning much praise from neutral observers. Still, the polls do show Trump maintaining a narrow lead overall and in most of the key swing states, and it is going to be harder for Biden to close the gap now. In what had been a race too close to call, Trump is now the clear favorite, even if the gap is still narrow.

That is likely to remain the case even if Biden drops out

If as seems likely, Trump continues to hold only a narrow lead, the pressure on Biden to drop out is likely to fade. Only if polls show Trump clearly extending his lead, and suggest an alternative Democratic candidate could do better, would pressure on Biden to drop out increase. Biden however cannot be forced to drop out, and any decision to do so would be his.

Should Biden drop out, the decision on his replacement would be made by the delegates to the Democratic convention, currently pledged to Biden, scheduled on August 19-22. Biden could ask the delegates to back Vice President Kamala Harris, who before the debate was polling weaker than Biden, or open up the contest to other candidates. Both would be risky options given Harris’ unpopularity and the risk that a contested convention would expose the divisions within the Democratic Party, those on the Israeli-Palestinian conflict being particularly heated.

Should there be a contested convention, debates and opinion polls could guide the choice of the delegates. Currently Democratic polls suggest that Harris is the front runner if polling clearly below 50%, with California Governor Gavin Newsom the only other potential candidate consistently above 10%. There are several potential candidates who are seen as having more appeal in swing states, such as Michigan Governor Gretchen Whitmer and Transport Secretary Pete Buttigieg, though whether any significant Democrat, who all declined to challenge Biden, would challenge Harris, is unclear. Polls do not currently show much difference in how any of the potential candidates would perform versus Trump. Should Biden drop out, the most likely candidate would be Harris, unless one challenger breaks out with impressive debate performances. Should that happen, Trump’s status of front runner could come under threat, but that does not look a high probability scenario.

Biden’s troubles not seen hurting Democratic prospects for Congress

While before the debate we saw the race for President as too close to call, we had a cautious leaning to the Democrats regaining control of the House due to the unpopularity of the Republican leadership and the Republicans regaining control of the Senate due to a larger number of Democrat incumbents facing close races. We do not believe Biden’s debate performance has undermined Democratic chances in Congress. In fact, if Trump is increasingly perceived as the likely winner, the Democrats may get a boost from those hoping to provide some restraint on him.

Our call therefore now is a Trump Presidency, a Democratic House and a Republican Senate. This may make it hard for Trump to pass legislation. His initial priorities are likely to be immigration and making his 2017 tax cuts permanent rather than tariffs. He could also decide to take the credit in 2025 for a soft landing for the economy and inflation. However, if he fails to get his way on his priorities he may feel he has more scope to act without Congress’ approval on other issues, including tariffs. It is possible, even if his priorities are blocked, that Trump would be persuaded not to risk imposing large tariffs, particularly if the economy was doing well. However, even before the debate markets should have been taking the risks of another Trump presidency seriously. That is even more the case now.

What does this mean for financial markets?

Pre-election, the focus will remain on the presidential race to see whether any change of the polls occur or whether the Democrats work with an alternative candidate should Joe Biden decide to step down.

On our central scenario, a President Trump could move quickly on immigration, which would likely involve picking a fight with Mexico and thus producing some event risk for the Mexican Peso (here). Reducing immigration would also have a medium-term impact on the U.S. economy, as it would likely mean less employment and construction growth but also less growth in the labor force. CBO estimates that net immigration will fall from 3.3mln in 2023 to around 870k by 2027 (here).

On the budget front, Trump would want to see the parts of the 2017 tax cuts that are due to lapse December 2025 made permanent. If the Democrats control the House this would be a tough deal to reach, but is possible if Trump were to keep most of the IRA renewable tax breaks and also concede on the idea of reducing corporate tax from 21% to 15%. This would still mean a higher budget deficit multi year and would likely involve fiscal stress and a high risk of a downgrade from at least one of the rating agencies.

This type of scenario is already embedded in our government bond yield forecasts with a rise in 10yr yields in H1 2025 (Figure 1) – if Biden (or a different Democrat) is reelected then a GOP Senate will pick a fight on the debt ceiling. Fed decisions would be driven more by the underlying fundamental economic and inflation picture that we outlined in the June Outlook (here).

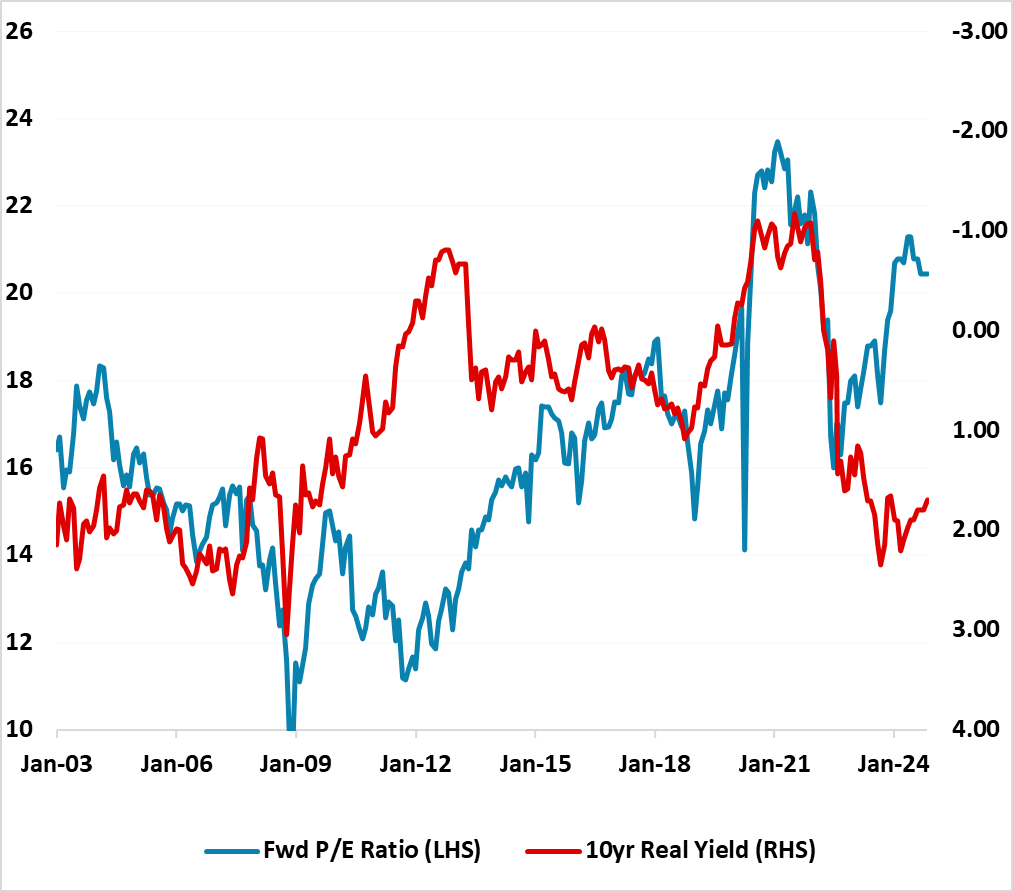

Figure 2: 12mth Fwd S&P500 P/E Ratio and 10yr U.S. Treasury Yield Inverted (Ratio and %)

Source: Continuum Economics with forecasts to end 2024

For the U.S. equity market, the Trump and GOP tax platform is regarded as positive for the equity market, but we are less sure. Making some existing tax cuts permanent has less economic impact than new tax cuts. Additionally, the U.S. equity market was not overvalued in early 2017, but is now and has higher 10yr real yields to compete with (Figure 2). Thus we see the tax cuts as being a mixed influence and other considerations could be negative and cause choppy consolidation.

Trump policies could also involve top civil servants being replaced by Trump appointees and undermining Fed independence. This would not go down well with global investors if it is too aggressive. Additionally, though we do not see Trump tariff proposals as a top priority in 2025, Donald Trump is unpredictable and this could involve an early fight on trade with China and also globally. We feel that this would be negative for U.S. equities, as it hurts global growth expectations but also risks temporary higher U.S. inflation that could temper Fed easing expectations.