China Excess Production: Exports Going Cheap?

China excess of production over domestic demand is causing disinflation pressures in China, but also leading to a fall in export prices as China companies seek buyers for production. Though this is a helpful factor to the global inflation debate, it is causing trade tensions with the U.S. and EU over electric vehicles (EV).

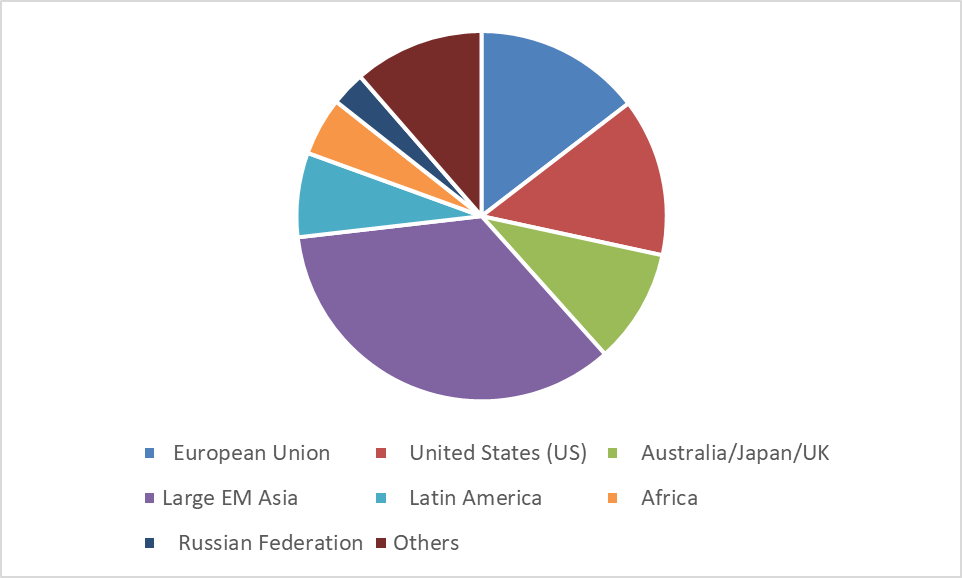

Figure 1: China Exports Biased to EM Not DM (% of Total Exports)

Source: China GACC

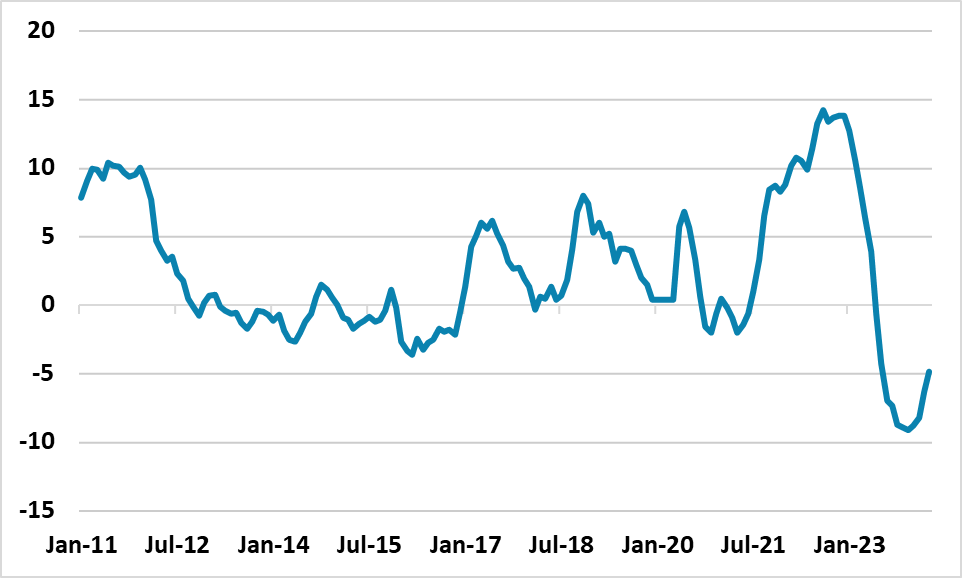

China May trade data shows a pick-up in exports, which likely reflects an improvement in the global economy into late Q2. However, it also reflects a keener interest of China’s companies to export, given that soft domestic demand is not absorbing production. This comes at a time when China authorities are keen for a pick-up in high tech manufacturing production (electric vehicles/renewables). This excess production over consumption has already caused disinflation pressures in China and is the main reasons for subdued core inflation. However, China companies are also cutting export prices (Figure 2) to help export momentum at a time when China’s growth is unbalanced and dependent on public investment and slowing consumption growth (here). China exports share to EM has also been growing, with 35% of exports going to large EM countries in Asia versus 14.6% to EU and 13.8% to the U.S., given China trade concerns in the U.S. (Figure 1). May figures also show export growth to EM -- Brazil 25% Yr/Yr, Asean 4.1% versus U.S. -2.4% Yr/Yr and -5.0% EU.

Figure 2: China Export Prices (Yr/Yr %)

Source: Datastream/Continuum Economics

While this is one factor in the wider global inflation picture, the declining export prices from China is causing some political fallout. President Biden has already announced increased tariffs against China electric vehicles from 25% to 100% from August 1 and a decision from the EU is expected shortly after the current EU parliamentary election. Expectations are that China EV tariff into the EU will be increased from 10% to 15-25%, though opposition exists in France and Germany before the final decision. China is likely to retaliate (EU pork and wine) but not escalate. China does not want a 2018 style trade war, given the imbalances in the domestic economy. It also wants to avoid anything that increases the chances of Donald Trump being re-elected and risking a deeper trade war with the U.S. than under another Biden administration.