BoE Preview (Sep 19): A Dovish Hold?

Given weakness in private sector jobs data that undermines BoE GDP optimism, and given what we think could be a downside surprise to the BoE in CPI data due the day before the decision, we would not rule out a further BoE rate cut when the MPC gives it next verdict on Sep 19. More likely, given reservations evident in the closeness of the MPC vote last month to cut Bank Rate by 25 bp to 5.0%, caution will prevail with no cut this month but with more clear dissent. Either way, no policy guidance will be offered save to say (still) decisions ahead will be made on a meeting-by-meeting basis, albeit leaving the door open for a November cut. But the cuts to around 3.7% that the main inflation projections last month were based on suggestions of more to come and we think somewhat further than this with two more 25 bp moves this year and 100 bp in 2025, this still leaving the policy stance in restrictive territory.

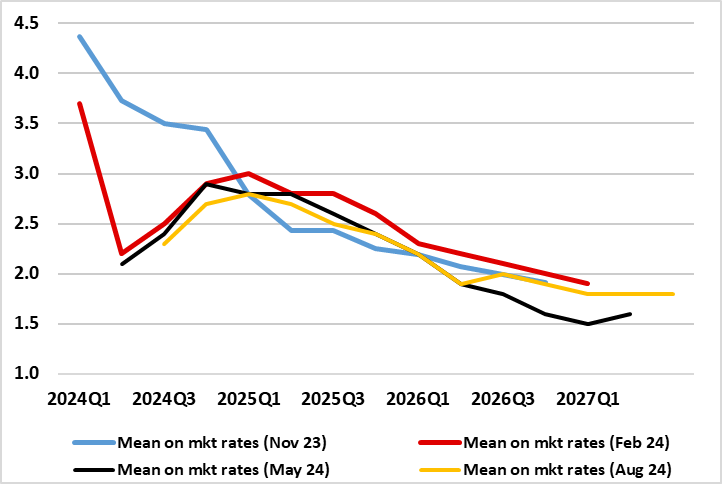

Figure 1: A Still-Clear Inflation Undershoot Even with Upside Risks

Source: BoE MPR, last four vintages

QT Decisions Due

The MPC will update its thinking on QT at this meeting in September, involving what the reduction in the stock of UK government bonds held for monetary policy (QT) purposes will be over the 12-month period from October 2024 to September 2025. The MPC is likely to keep the pace of QT largely unchanged, again setting it at £100 bn. That would leave the asset purchase facility (APF) stock at end-September 2025 at just over £550 bn given that at the conclusion of the current 12-month gilt reduction at the end of this month, it will stand at £658 bn.

Notably, that end-Sep 2025 assumed figure would be very close to what the BoE thinks what UK banks require. This so-called Preferred Minimum Range of Reserve (the level of liquid reserves banks needed both to meet regulatory requirements and to ensure they can meet daily payments) is estimated by the BoE to be somewhere between £ 345 bn to £ 490 bn. However, this does not mean that an end to QT is in sight toward the end of next year, as Governor Bailey wants to go further with QT, ensuring that as the level of reserves falls below the amount banks desire, they meet their needs by borrowing from the BoE against pledged collateral. Importantly, for the BoE, this desire to change the composition of its balance sheet, would leave it with less interest rate risk. What may otherwise occur – and would be designed to help liquidity issues in the gilt market - is to broaden the range of bonds sold to includes those with less than 3-year maturities

The likelihood that QT will continue beyond 2025 is important fiscally too given that the current budget rule is based around a definition of government net debt that excludes the BoE. What this means though is that as the BoE continues with sales the worse is the government’s fiscal situation. On this measure estimates made by the Office for Budget Responsibility suggest this reduces fiscal leeway (ie at the end of the projected 5-year budget outlook) by £ 25 bn. If the BoE is implying that it is going to change the motivation of its asset sales (ie from reducing its balance sheet size to changing its composition), Chancellor Reeves may have a genuine fiscal and economic rationale to change the definition of government net debt to go with obvious political ones. A range of options are available.

Another New Member

Of course, there will be more splits and the decision last month was in effect down to that of the newest MPC member. This reflects marked MPC personnel churning at the moment. Clare Lombardelli took part in her first MPC meeting in August, her policy leanings still being unclear and her decision to cut may have been as much tactful than fundamental. Otherwise, it may be notable that policy hawk Haskel attended his final MPC meeting last month; it will be interesting to see how new MPC recruit Alan Taylor fares.

Fan Charts Influential

While the recent Bernanke Report recommended phasing out the so-called fan chart forecasts, their importance lingers, not least at the current juncture as they again point to a clear undershoot of the 2% target on a sustained basis in the latter part of the forecast horizon as seen in the Monetary Policy Report (MPR). That such projected undershoots have not triggered rate cuts hitherto is partly (to us) puzzling. As Figure 1 shows the undershoot appears to be less marked than in May but this is purely on a mean basis with the modal view actually a notch lower that in the May MPR at 1.5%, this encompassing an explicit upside risk embodies in the mean numbers (a so-called skew) to address price persistence risks.

Regardless, with the BoE underscoring that its allegiance to its target applies at all times, the fact that CPI inflation has been well above target has been the telling factor in recent decisions prior to this. But this is no longer the case and even amid modest upward growth projections, any rise from the current near-target inflation rate is seen still as temporary. Crucially in presentational terms, the move was framed as making policy less restrictive and we still think that the implied reduction in Bank Rate to 3.7% (in the August Monetary report) as markets had been discounting would still leave policy very much in restrictive mode. This is one reason why we anticipate greater/faster easing.

BoE Considerations

Otherwise, it is clear that real activity data are now having more of an impact on MPC thinking regarding how durable and sizeable is the disinflation process. We still question the extent to which the economy is improving both in terms of size and durability given the more negative signs emanating from fiscal data and particularly jobs numbers – while there are clear reservations about the accuracy of ONS labor market data the figures for payrolled employees are more authoritative and thus the increasing size of contracting jobs numbers is a cause for concern.

As for the fiscal side, new Chancellor Reeves has already made spending cuts and now tax rises loom at the Oct 30 Budget. They add to what to us are still downside activity risks even amid better business surveys which to us more reflect improved confidence in political stability ahead. What remains the case is that last month’s updated BoE projections largely validate the rate path then discounted by markets, with below target inflation, this possibly suggesting larger easing cycle than the two moves then seen through this year and a view that largely is still the case.