UK August CPI Preview (Sep 18): Inflation Slips Back and Services Resilience Diminishes Further?

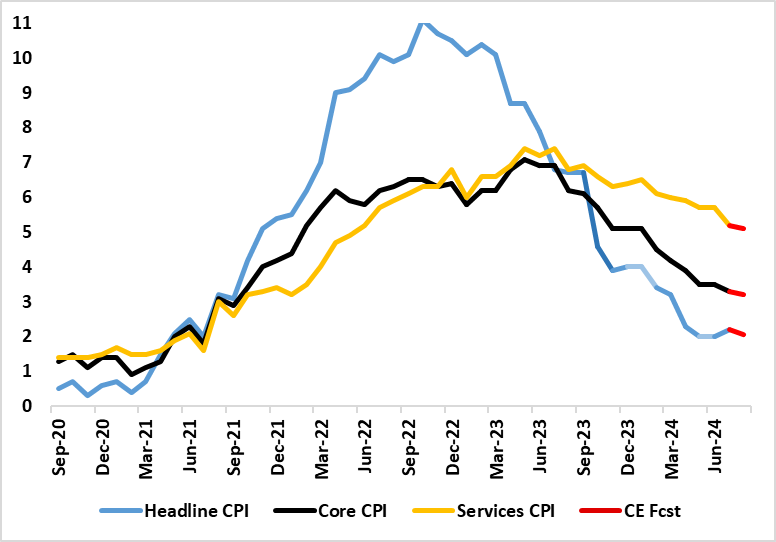

The July CPI was notable for the clear and larger-than-expected fall in services inflation, one driven by a fall in restaurant/hotel inflation, this often seen as a bellwether indicator of price persistence. Indeed, services inflation fell 0.5 ppt to 5.2%, a two-year low and well below the BoE projection. Even so, due to energy related base effects (related to the Ofgem price cap changes), the overall CPI headline rate rose to 2.2% in July from 2.0%, this projection being a notch below the consensus and a further notch under BoE thinking. We see this rise being partly reversed in August data, with a fall to 2.1%, this also seeing 0.1 ppt drops in both services and core inflation (Figure 1). If accurate, all these would be well below BoE projections, thereby possibly resurrecting rate cut hopes not least as the MPC is likely to have had early access to the CPI data and will this have time to make a full(er) analysis, possibly noting the implied drop in short-term price dynamics that would ensue (Figure 2)!

Figure 1: Modest but Broad Inflation Drop Ahead?

Source: ONS, Continuum Economics

As for underlying trends, the core fell to 3.3% in July (Figure 1), the lowest in almost three years and adjusted m/m data suggest a clear slowing short-term price dynamics. There are risks as a good part of the July services price inflation was due to so-called volatile items which may reverse. But we do not envisage services inflation actually rising back as BoE thinking envisages.

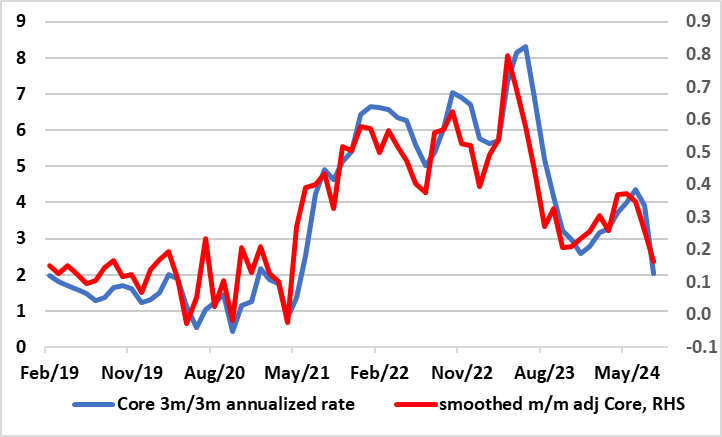

This makes any assessment using shorter-term adjusted measures are the more compelling. In this regard we, note that the July data did see fresh softer price dynamics on this basis both for services and the core and that the August data may do likewise. Indeed, either on a smoothed adjusted m/m basis or on the annualised basis preferred by the BoE, the August CPI data may show outcomes very much consistent with target (Figure 2).

Figure 2: Adjusted Core CPI Pressures Falling Afresh

Source: ONS, Continuum Economics, smoothed is 3 mth mov average