U.S. March CPI - Pre-tariff momentum appears lower than was realised

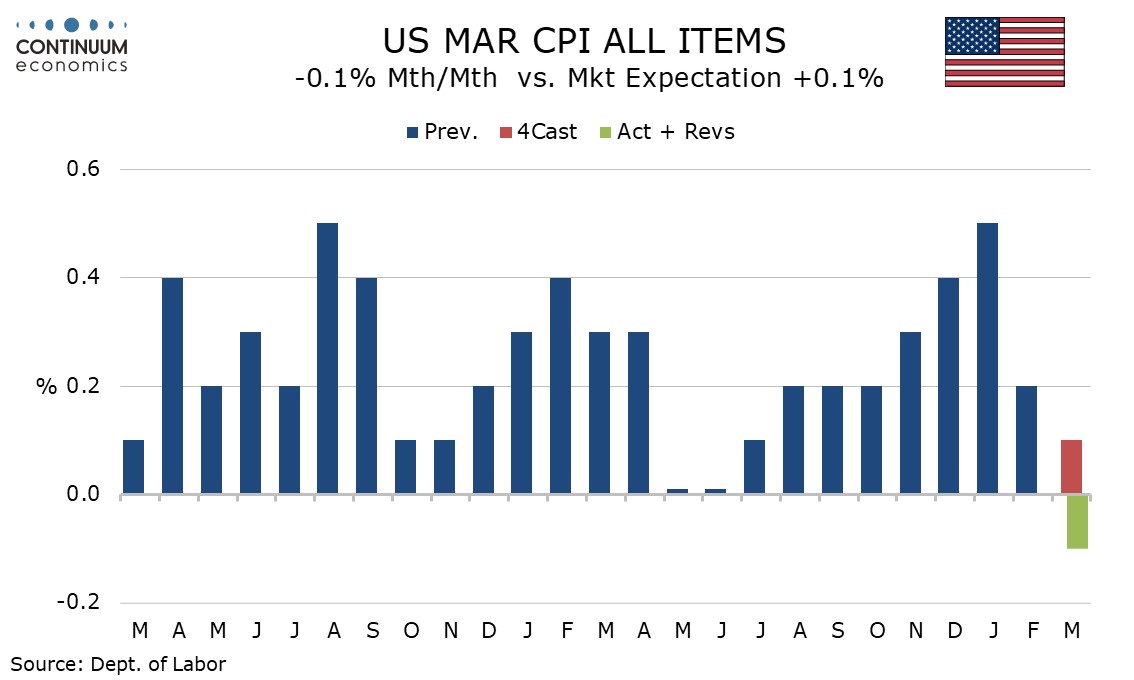

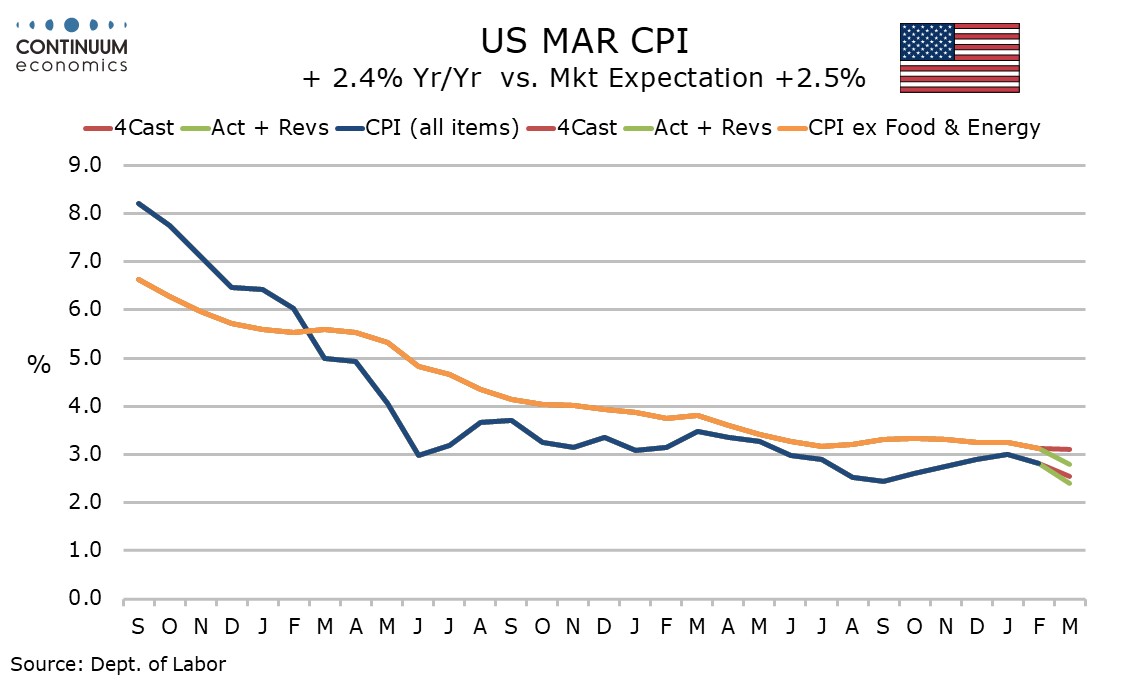

March CPI comes as a pleasant surprise, a 0.1% decline overall led by an expected dip in gasoline, but the 0.1% rise ex food and energy is well below consensus and recent trend and suggests the inflationary pressures entering the trade war are lower than was previously thought. Initial claims, up 4k to 223k are as expected and suggest the labor market remains healthy. Continued claims fell by 43k to 1.85m.

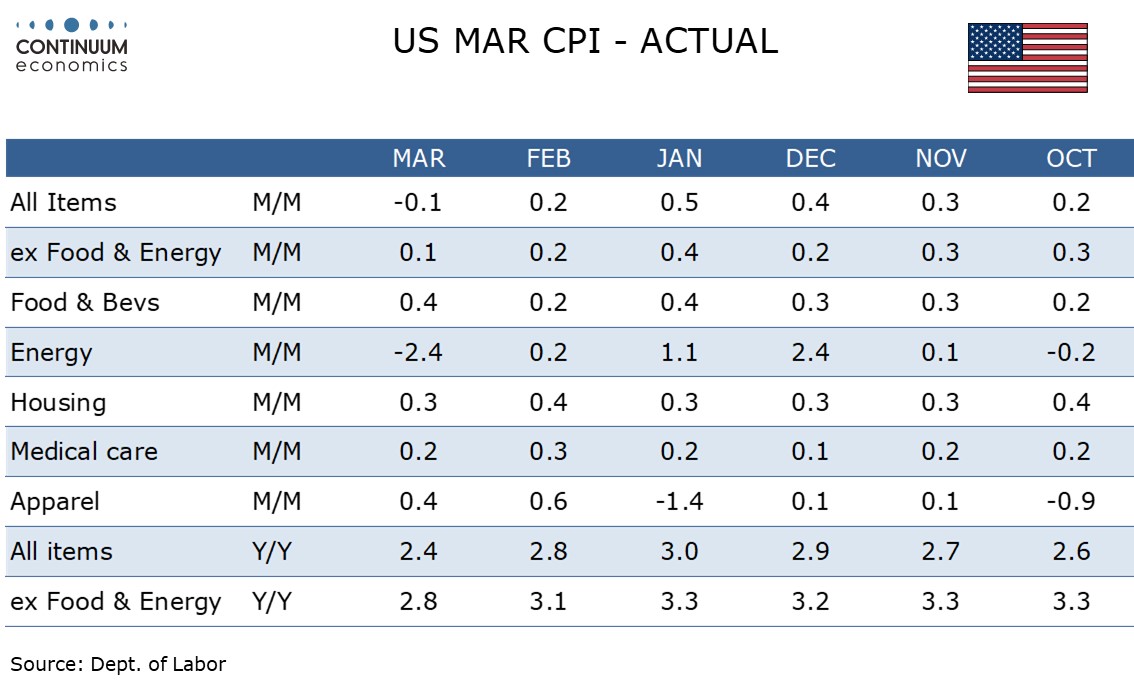

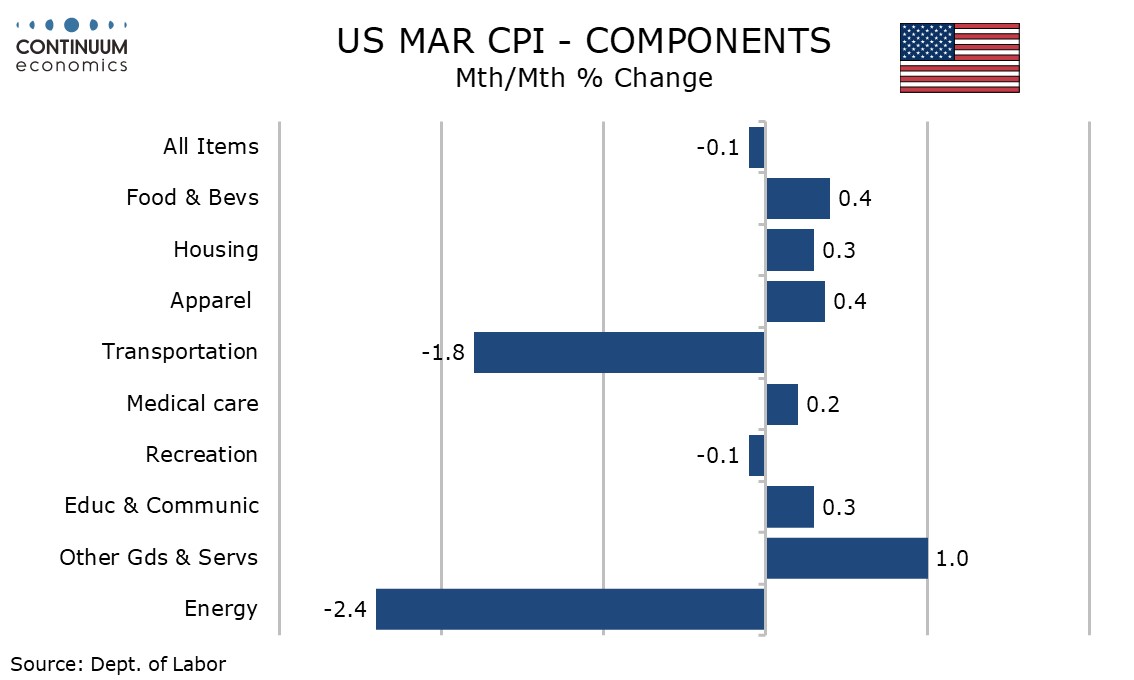

Gasoline prices fell by only 0.9% before seasonal adjustment but were down 6.3% seasonally adjusted, leading a 2.4% decline in energy. Food remains quite firm with a second straight rise of 0.4%, eggs still firm, up by 5.6%, after rising by over 10% in both January and February.

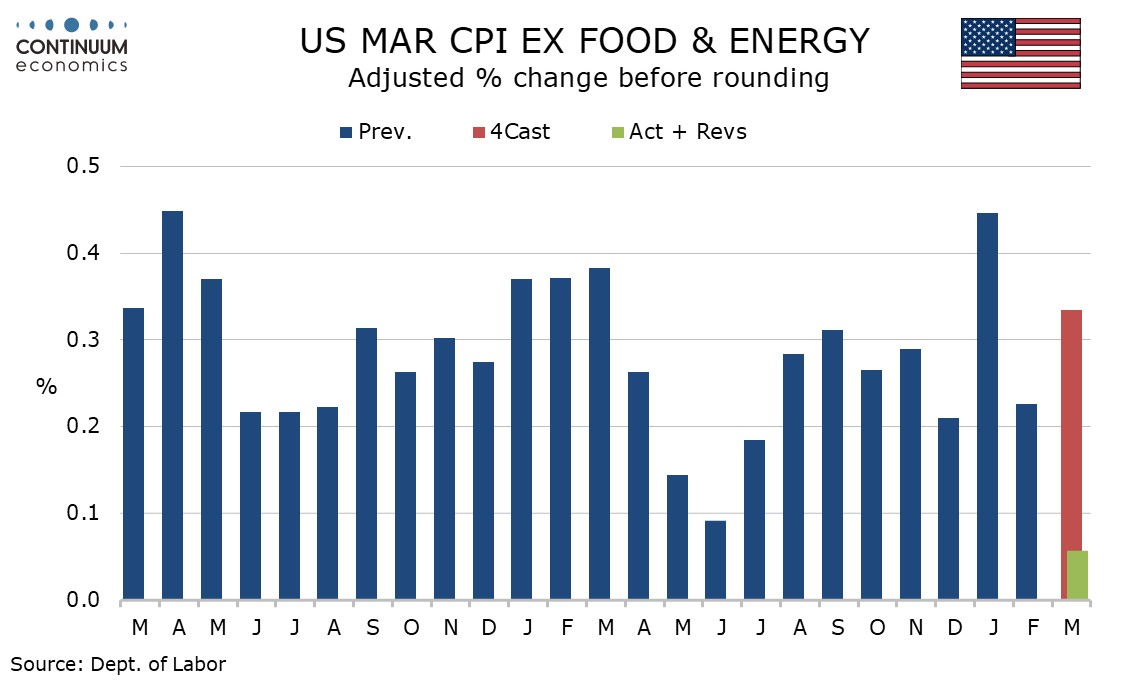

The ex food and energy rate was up only 0.057% before rounding, which is the lowest since January 2021. Commodities less food and energy fell by 0.1%, with a 0.7% fall in used autos, which is unlikely to persist with tariffs set to lift auto prices, and a 1.1% decline in medical care commodities looking erratic.

Services less energy rose by only 0.1%. The main negative was air fares, down by 5.3%, something that will not be repeated every month but softer oil prices and weaker demand as tourists boycott the US will restrain air fares going forward. Air fares are not a full explanation for the weakness. They fell a similar 4.0% in February but services less energy still rose by 0.3% in that month.

Owners’ equivalent rent rose by a slightly above trend 0.4% but lodging away from home was weak, down by 3.5%, another sign of weakness in tourism. Transportation service weakness went beyond air fares, with auto services, often a source of strength in recent months, seeing slippage, with auto insurance down by 0.8%.

Yr/yr CPI slipped to 2.4% overall from 2.8%, reaching its lowest since February 2021, while the ex food and energy rate fell to 2.8% from 3.1%, this the lowest since Marc 2021. While there are upside risks from tariffs going forward, this data suggests that before the tariffs hit, inflation had downward momentum.