China: Any Lessons from the 1997-98 Asian Crisis?

Overall, the warning from slow real credit growth on reduced credit supply and demand is the main lesson from the Asia crisis 1997-98. China High FX reserves; low borrowing overseas and dominance of domestic investors in Yuan markets argues against a currency crisis. Asia widespread banking crisis are also unlikely to be repeat in China, though we see growing banking stress among weak rural banks that in the worst case could be a rural banking crisis (here). Next week we shall compare and contrast China with Japan in 1990.

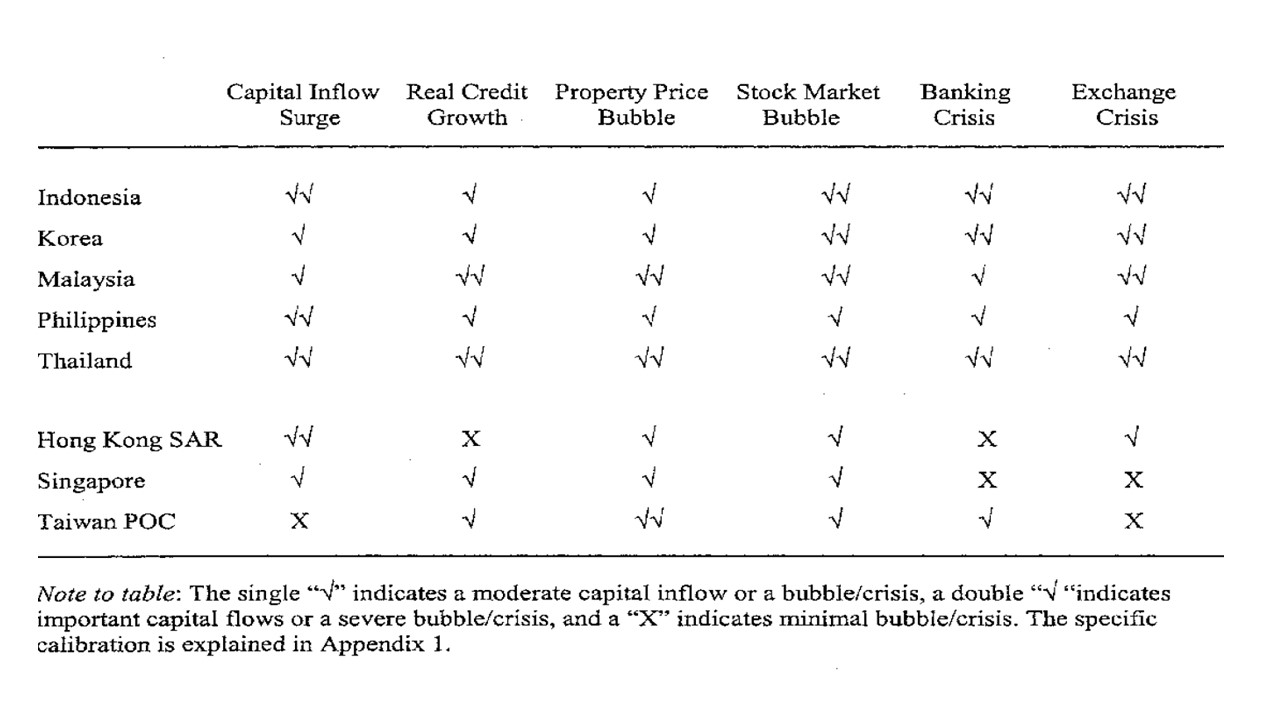

Figure 1: East Asia: Incidents of Asset Price Bubbles and Banking & Exchange Rate Crisis 1997-99

Source: IMF (here)

Can the 1997-98 Asian crisis provide any guidance on what will happen to China with the residential property market in crisis? In some areas the answer is no, but in others it is yes and the following points are worth noting

· China FX reserves better and less overseas creditors. The property price crash in Asian countries was amplified by weak current account position and overvalued exchange rates. Capital outflows including from overvalued equity markets then ran down low FX reserves quickly and some countries had to hike policy rates. Then devalued exchange rates hurt as countries debt issued in foreign currencies increased and choked off new inflows for finance. All of this caused recession and a secondary shock to property markets. In contrast China now has limited overseas borrowing, though the property sector has found it difficult to refinance in the international market in recent years. Secondly, creditors in China equity market have started to reduce exposure to China, but the size of China means that the government bond market still attract flows – while China markets are also dominated by Chinese investors subject to capital controls. Finally, China FX reserves are high. This all means that a currency crisis is unlikely and that the PBOC will keep interest rates at ultra-low levels.

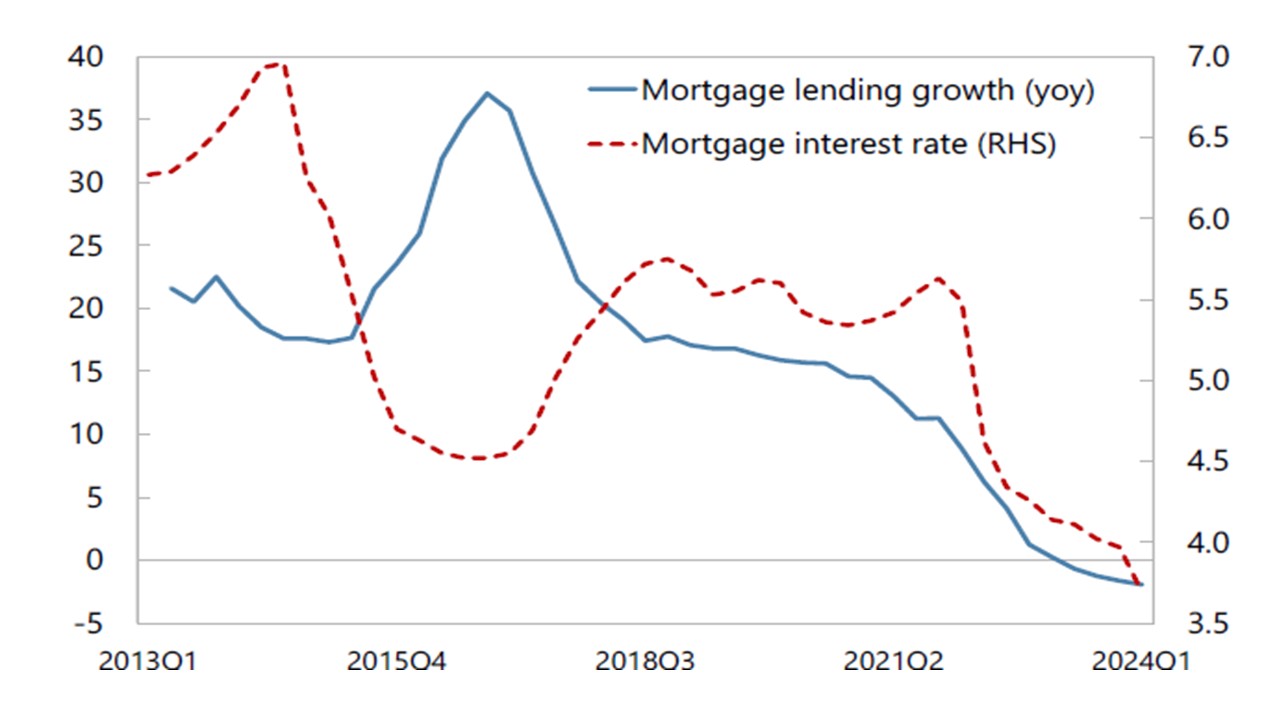

· Real Credit growth slows. As part of the violent boom and busts real credit growth slowed sharply during the Asian crisis as non-performing loans surged and economic conditions became challenging. China nominal and real credit growth has slowed sharply in recent years, as the boom in residential property has turned to bust. Residential construction has been hurt more than prices so far (here), but households are now paying down lending on a net basis (Figure 2) due to adverse wealth effects and this is hurting consumption growth (here). One extra dimension in China is that net lending to local government financing vehicles (LGFV) has turned negative as borrowing tightens despite low interest rates, this is hurting infrastructure spending and central government infrastructure programs are partially a substitute rather than adding new spending for the economy. Credit supply and demand are being hurt for some parts of the economy.

Figure 2: China Mortgage Market (%)

Source: IMF Article IV August 2024 (here)

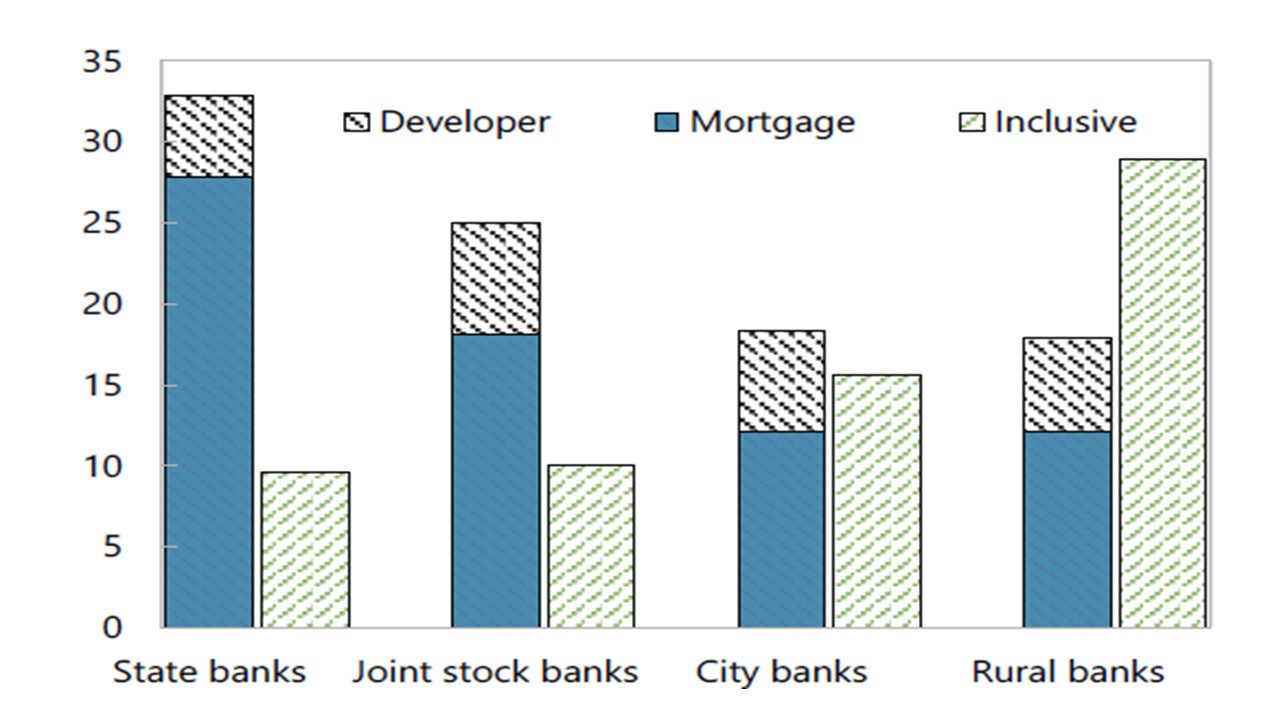

· Banking crisis or stress. The Asian crisis saw banking as well as currency crisis. So far China has experienced banking stress among weaker rural banks due to their larger exposure to developers and vulnerable parts of the property sector (Figure 3) but also due to lower capital ratios. The solution so far has been takeover and mergers to avoid the shock of bankruptcy undermining depositor’s confidence in the banking system. This takeover and merger process will likely grow as the lagged effects of the property crisis feeds through and China authorities are helped by the good financial state of major banks. The recent package of official measures includes extra capital for major banks, which suggest that they will likely become more active in takeovers of weaker banks. China authorities experience in bailing out the major banks in 1997-98 also means that other tools could still be rolled out e.g. bad bank asset management companies backed by the state. Our bias remains for select banking stress rather than a rural bank crisis, though a policy mistake could trigger the latter. However weak real credit growth still hurt the economy.

Figure 3: Percentage of Loans to Developer and Mortgages (%)

Source: IMF Article IV August 2024 (here)

Overall, the warning from slow real credit growth on reduced credit supply and demand is the main lesson from the Asia crisis 1997-98. China High FX reserves; low borrowing overseas and dominance of domestic investors in Yuan markets argues against a currency crisis. Asia widespread banking crisis are unlikely to be repeat, though we see growing banking stress among weak rural banks that in the worst case could be a rural banking crisis. However, we shall return to look at lessons from Japan property boom and bust next week.