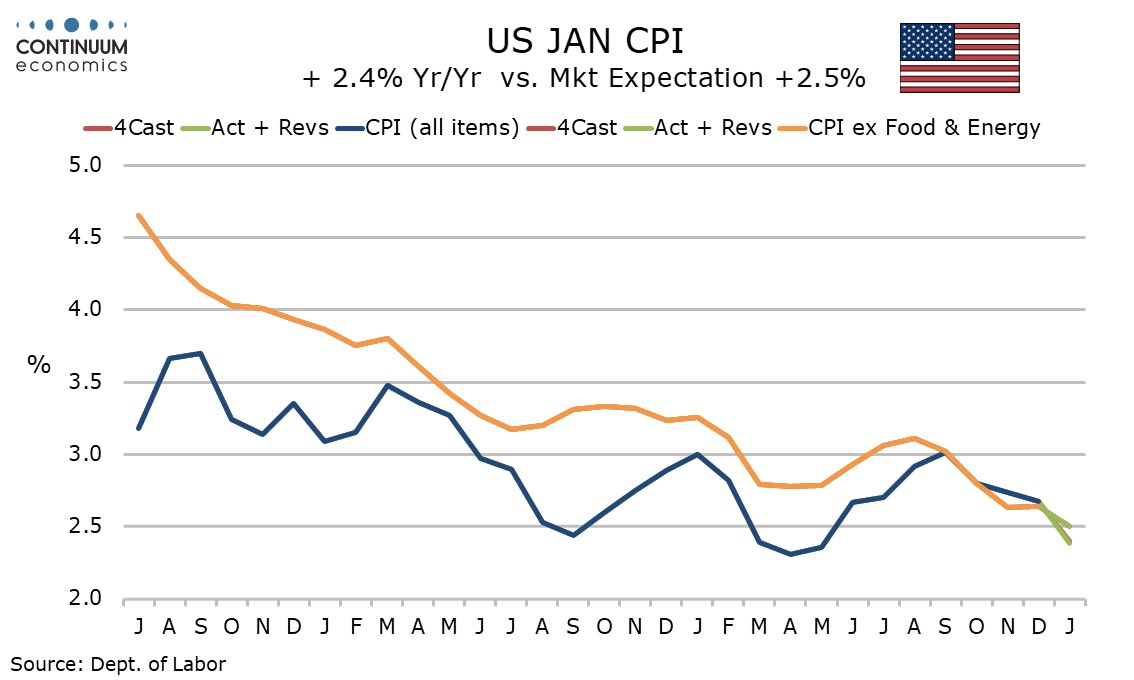

U.S. January CPI - Yr/yr ex food and energy pace slowest since March 2021

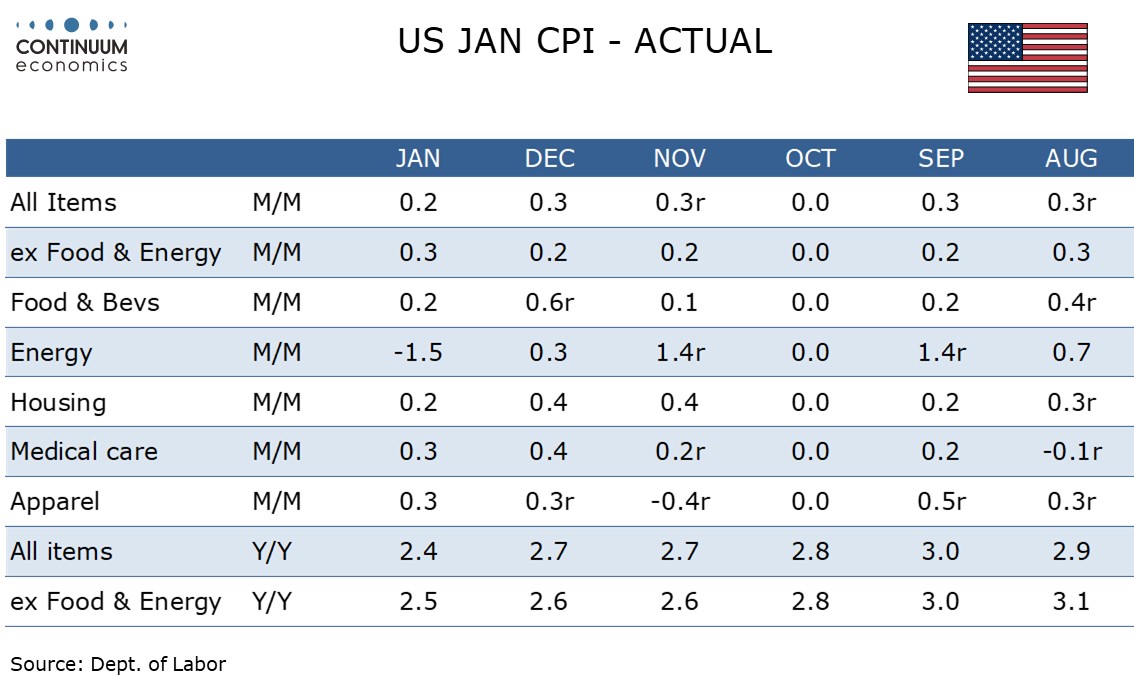

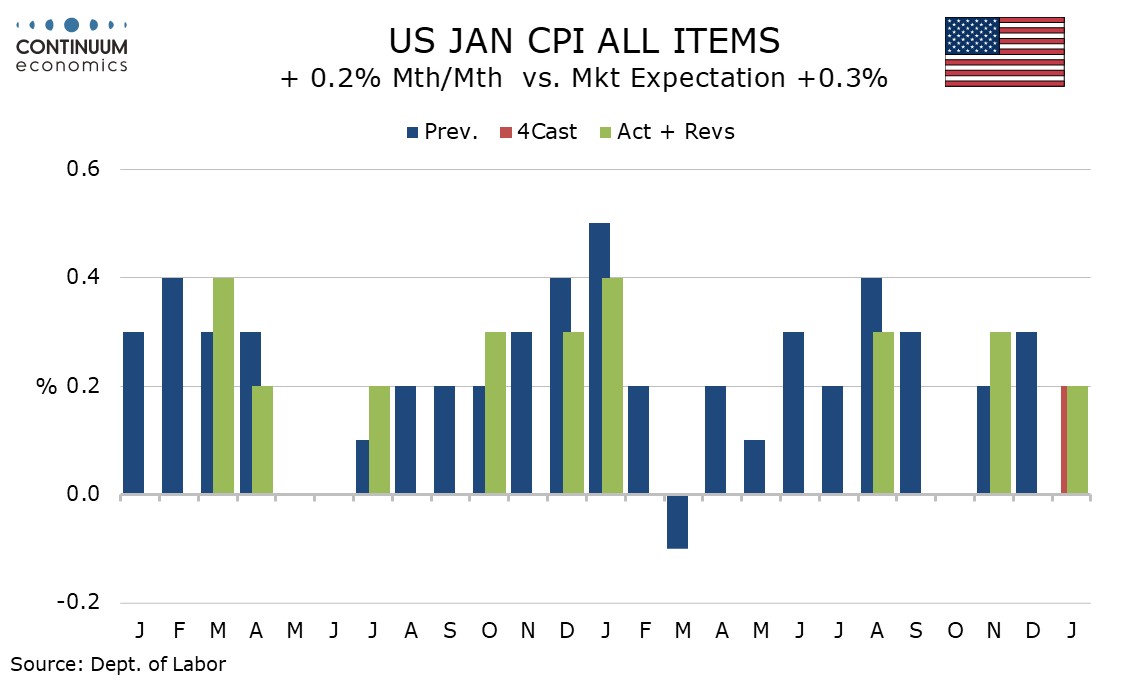

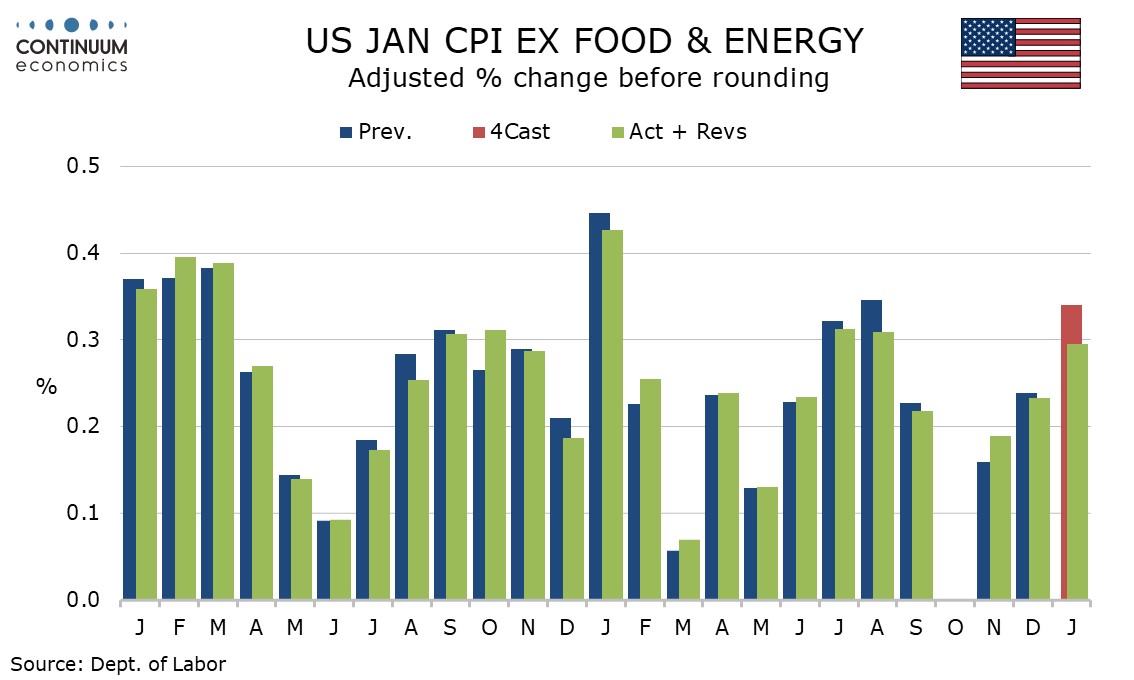

January CPI is slightly lower than expected at 0.2% overall though the ex food and energy rate at 0.3% is on consensus, with the core rate almost spot on 0.3% even before rounding. Given a strong year ago rise, yr/yr growth slowed, overall to 2.4% from 2.7% and the core to 2.5% from 2.6%, the latter the slowest since March 2021.

The Fed can take some modest comfort from the release even if the monthly core rate saw its firmest since August, given that January data has had a tendency to be firm in recent years. The new year does not appear to have produced a significant acceleration in tariff pass-through.

Given that CPI tends to outperform PCE prices the data could even be seen as consistent with target, though with core PCE prices, for which December data is not yet visible, looking set to see an unusual outperformance of CPI in Q4 2025, on target core PCE prices are unlikely to be seen soon. The CPI, while moderately encouraging, is not going to significantly accelerate the next Fed easing.

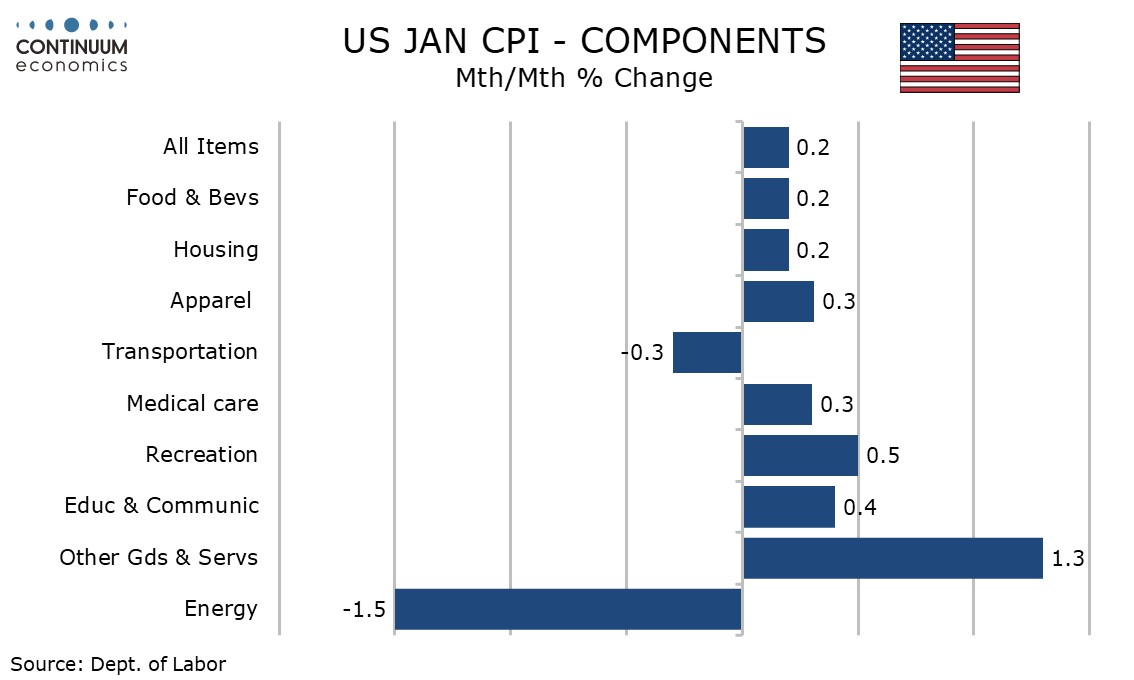

Goods CPI excluding food and energy was unchanged for a second straight month, though restraint came from a 1.8% fall in used autos, a second straight fall and steeper than December’s -0.9%. Commodities less food, energy and used trucks rose by 0.4%, with tobacco and smoking products firm at 2.1%. Food saw a modest 0.2% increase after a strong 0.6% in December, while gasoline fell by 3.2%.

Services excluding energy were on the firm side of trend at 0.4%. Air fares saw a very strong 6.5% increase though another volatile component, lodging away from home, was subdued at -0.1% after a strong December. Shelter rose by only 0.2% after a 0.4% December increase with owners’ equivalent rent also subdued at 0.2%.

CPI ex food, shelter and energy was quite firm at 0.4% (0.36% before rounding) versus 0.1% in December, though yr/yr growth at 2.1% is acceptably subdued. Looking at the two most obvious volatile moves, air fares added 0.07% to core CPI while used autos deducted 0.06%, almost offsetting each other.