China: Depreciation Rather Than Devaluation

We feel that a devaluation of the Yuan is unlikely in 2024, both to avoid potentially politically destabilizing capital outflows but also to avoid upsetting the next U.S. president. Policy is geared more towards controlled depreciation to help competiveness but reduce other risks. The Yuan has also become weaker over the past two years. We see scope for 7.40 on USDCNY by end 2024.

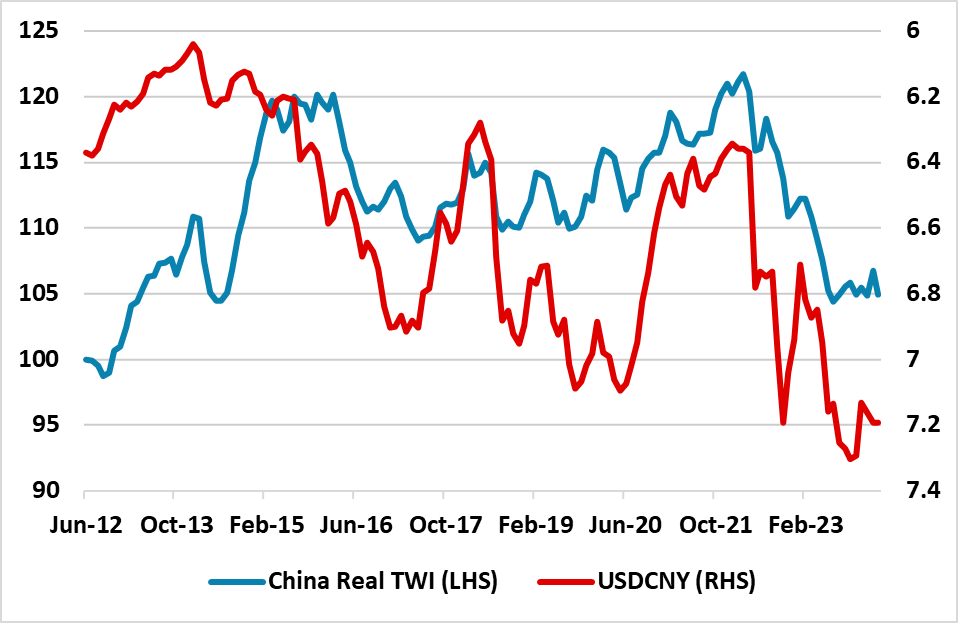

Figure 1: China Real Effective Exchange Rate and Inverted USDCNY

Source: Datastream/Continuum Economics

Source: Datastream/Continuum Economics

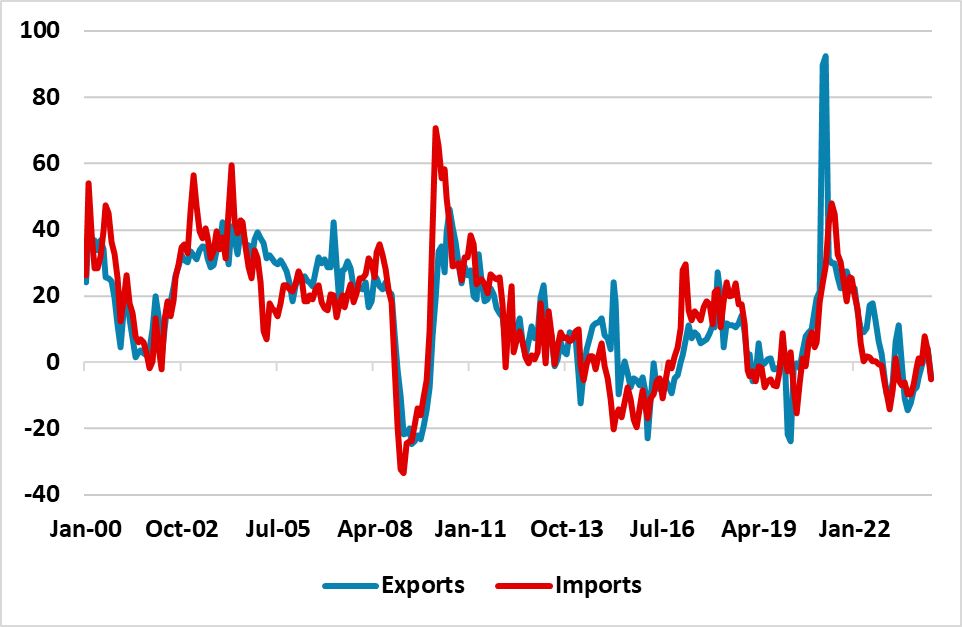

Speculation has been seen in markets that China could decide to devalue the Yuan, given China authorities concerns over exports; low China inflation and the weakness of competitor currencies such as the Japanese Yen and South Korean Won. Exports weakness (Figure 2) are not just a reflection of weak growth in Europe, but also lower market share for China exports in the U.S. and EZ. China exporters are suffering from supply chains being reshaped and Western countries trying to reduce reliance on China exports post Ukraine war and in case U.S./China relations take a major turn for the worse e.g. China/Taiwan tension or a reelected Donald Trump. Previous Yuan slides against the USD (Figure 1) in 2015/16 and 2018 are also being cited.

Figure 2: China Exports and Imports Growth (12mth 2mma USD (%))

Source: Datastream/Continuum Economics

We feel that depreciation is more likely than devaluation in 2024 for a number of reasons

· Yuan has already fallen 22/23. USDCNY has fallen in the past few years, as China has not followed the DM rate tightening cycle and if anything has been intermittently cutting short-and long-term rates. A decline in the real Yuan effective exchange rate has also been evident in this period (Figure 1), despite Yuan strength against other DM currencies. China inflation rate has been below DM countries such as the U.S. and EZ, which without a change in nominal exchange rates means a decline in the real effective exchange rate. Thus China competitiveness now is not as bad as 2015 or 2018.

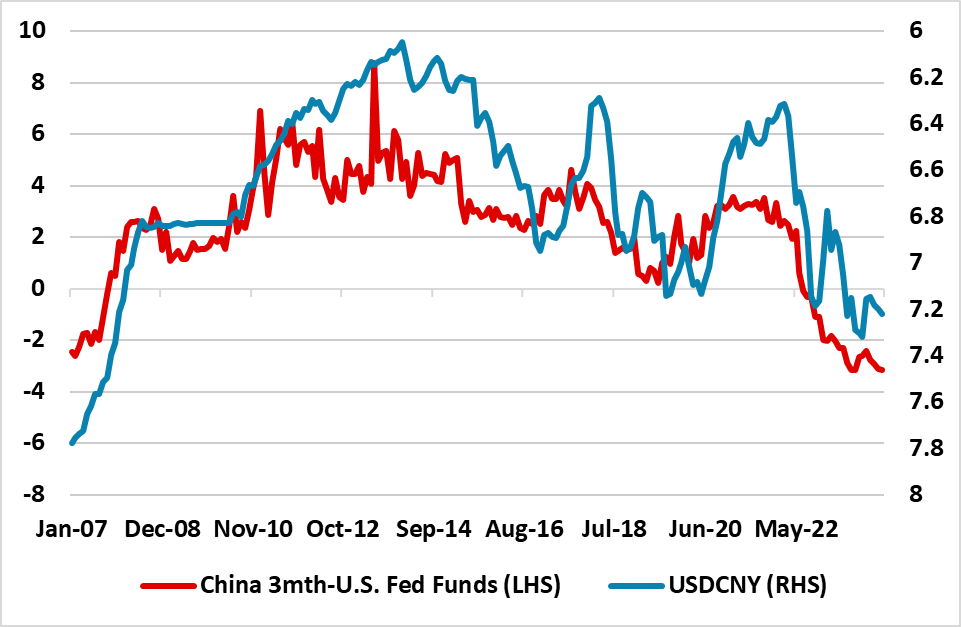

· Capital outflow fears. China authorities are fearful that too much Yuan weakness could cause increased capital outflows, which would be a sign of political discontent with China’s authorities. Domestic politics thus argues against a devaluation and more towards a controlled Yuan decline if the authorities want to support competitiveness. PBOC policy is also consistent with this approach with a willingness this year to cut the 5yr LPR rate more than the 1yr rate. Interest rate differentials still argue for some further Yuan weakness (Figure 3), but our baseline forecast is 7.40 for end 2024.

Figure 3: China 3mth-U.S. Fed Funds and USDCNY (%)

Source: Continuum Economics

· U.S. Election. A 2024 devaluation of the Yuan is also unlikely with the November U.S. elections. A yuan devaluation would likely prompt the next U.S. president politically to take tougher action towards China. China does not want to fall into this trap. It was noticeable that Yuan depreciation only accelerated in 2018 after the then president Trump became aggressive on tariffs not in 2017. We feel that China’s authorities will want to see who is U.S. president; who controls U.S. Congress and if Donald Trump is reelected as president whether threats come first and tariffs only later in his presidency. If Trump introduced heavy tariffs against China in 2025 then it would likely produce coincident depreciation of USDCNY towards 7.80, but China will not anticipated U.S. risks via a preemptive 2024 Yuan depreciation.