Yield Curve Disinversion To Resume?

For 2024 as a whole, we see a strategic process of yield curve inversion lessening and swing to a positive shaped yield curve by year-end. For 10-2yr this process will likely be clearer in the U.S. for two reasons. Firstly, Fed Funds is more divergent from neutral policy rates than in the EZ, but also better Fed forward guidance means that 2yr U.S. yields will fall as 2025 and 2026 rate cuts are more heavily discounted. Secondly, 2yr Bund yields are at a bigger discount to the ECB deposit rate compared to 2yr U.S. Treasury yields to Fed Funds, which means that the ECB needs to deliver a couple of cuts before the EZ market can discount more.

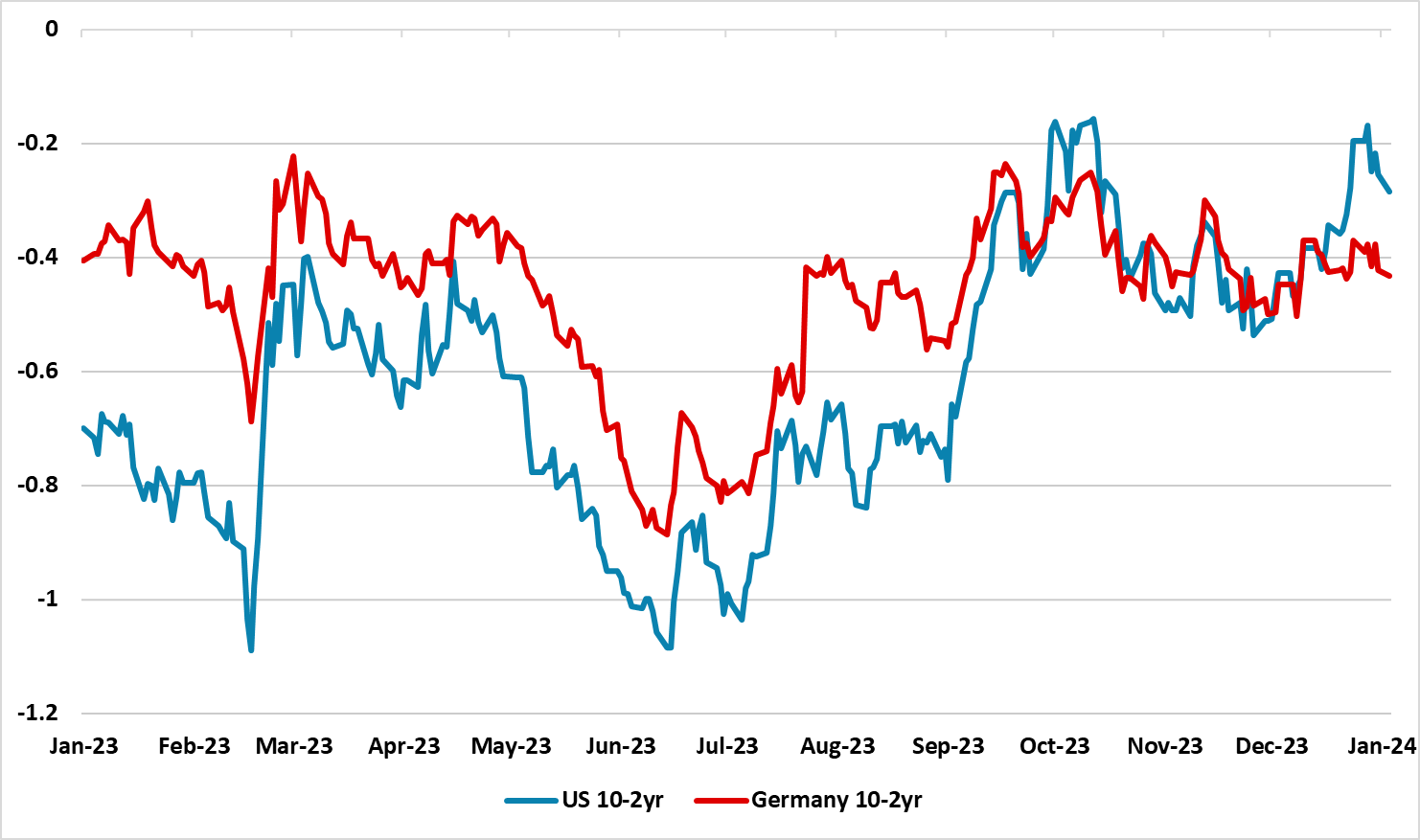

Figure 1: U.S. and Germany 10-2yr (%)

Source: Datastream/Continuum Economics

Since summer 2023, major government bond markets ex Japan have seen a swing towards less yield curve inversion (Figure 1) prompted by a sense that rates are peaking; 2024 will see Fed and ECB rate cuts and that 10yr yields were too low. The extreme optimism of early January has been tempered (here) and now the markets are biased towards 4-5 rate cuts from the Fed and ECB this year. January has also seen the U.S. yield curve in the 10-2yr area become slightly more inverted. What are the prospects for government bond markets and yield curves in the coming months?

The January 25 ECB meeting and January 31 Fed meeting will likely see central bank not wanting to encourage hopes of early rate cuts and also perhaps tempering the scale of cuts still discounted. This could cause some further upward adjustment in yields, though the scale of long speculative positions in bond markets has been tempered and some government bond yields will likely not rise much further.

Additionally, bond markets know that central banks are playing a communication game, in that dampening rate talk is tactical. Central banks do not want to be forced by markets, while some in the ECB also feel that the effects of previous tightening still need to take effect. We feel that by end 2024, that 4-5 cuts are feasible from the Fed and ECB, but that communications will only swing once rate cuts are close to arriving.

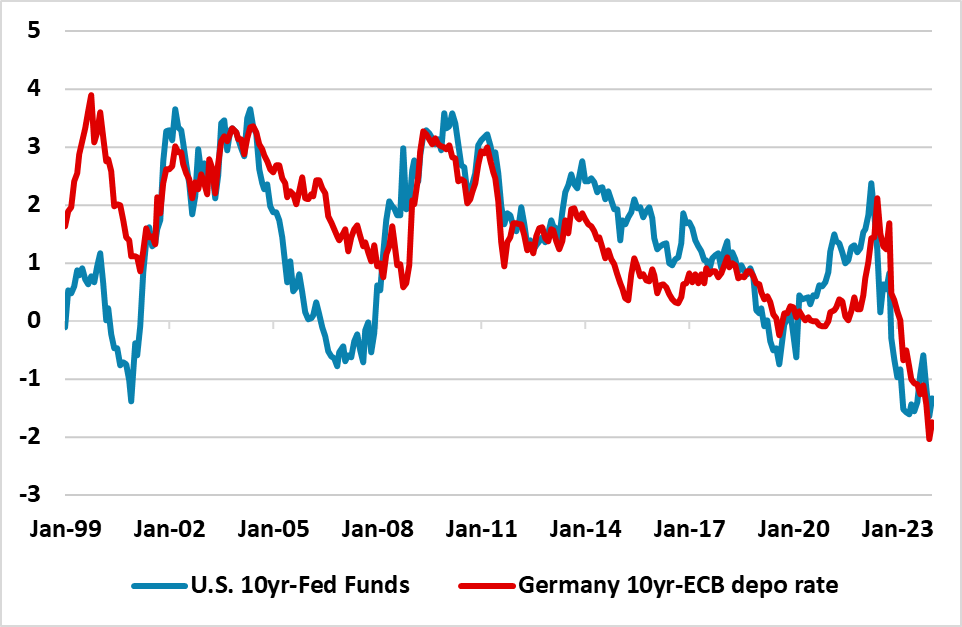

The situation for 10yr yields still remain tricky however, as 10-2yr yield curves are still inverted and traditionally easing cycles see a strategic swing to a positive shaped yield curve. Additionally, 10yr U.S. Treasury yields to Fed Funds are also more inverted than 2000 or 2007 (Figure 2), while 10yr Germany to ECB depo rate is substantially more inverted than 2008, 2011 or 2020.

Figure 2: 10yr U.S Treasury-Fed Funds and 10yr Germany-ECB Depo Rate (%)

Source: Datastream/Continuum Economics

Our bias is that government bond markets will now see choppy consolidation, as the January Fed and ECB meetings are unlikely to provide direction. Instead, the focus will be on incoming real sector and inflation data, where a contrast exists between the EZ in recession and a U.S. slowing but still showing intermittent resilience. However, the Fed’s forward guidance is better than the ECB. We may have to wait until new forecasts emerge from the ECB and Fed on March 7 and 20 respectively to get much direction for the U.S. and EZ government bond markets.

For 2024 as a whole, we see a strategic process of yield curve inversion lessening and swing to a positive shaped yield curve by year-end. For 10-2yr this process will likely be clearer in the U.S. for two reasons. Firstly, Fed Funds is more divergent from neutral policy rates than in the EZ, but also better Fed forward guidance means that 2yr U.S. yields will fall as 2025 and 2026 rate cuts are more heavily discounted. Secondly, 2yr Bund yields are at a bigger discount to the ECB deposit rate compared to 2yr U.S. Treasury yields to Fed Funds, which means that the ECB needs to deliver a couple of cuts before the EZ market can discount more.