U.S. October Employment - Special factors add to weakness, but trend looks less strong after revisions

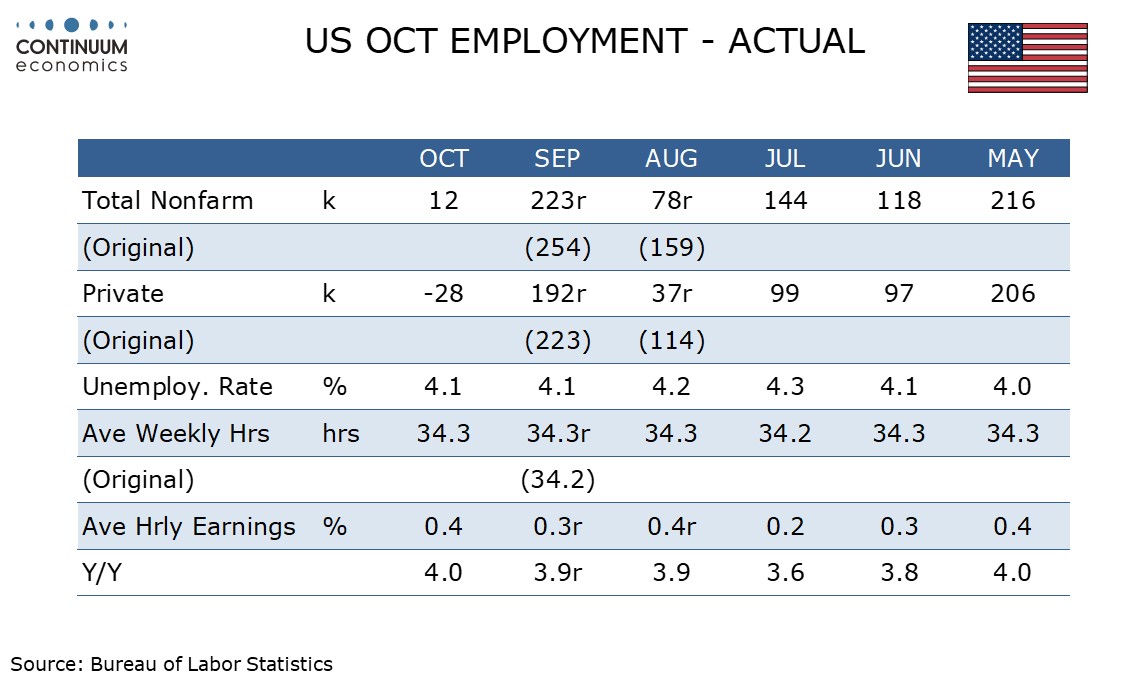

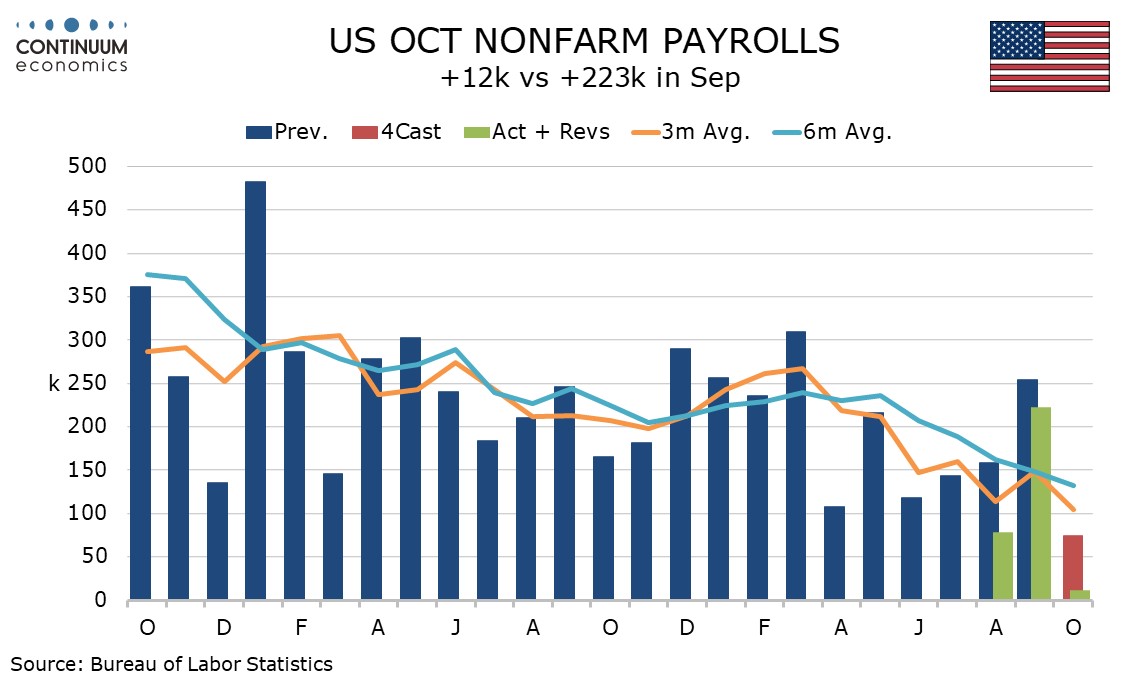

October’s non-farm payroll is well below consensus with a 12k increase with weakness impacted by a strike at Boeing and hurricanes, though probably also in part due to a correction from an above trend September, and negative revisions make the trend going into this report less strong than it was. The workweek is holding up and average hourly earnings are stronger than expected with a 0.4% rise but with negative revisions. Unemployment is unchanged at 4.1%, with both employment and the labor force falling, both probably depressed by weather.

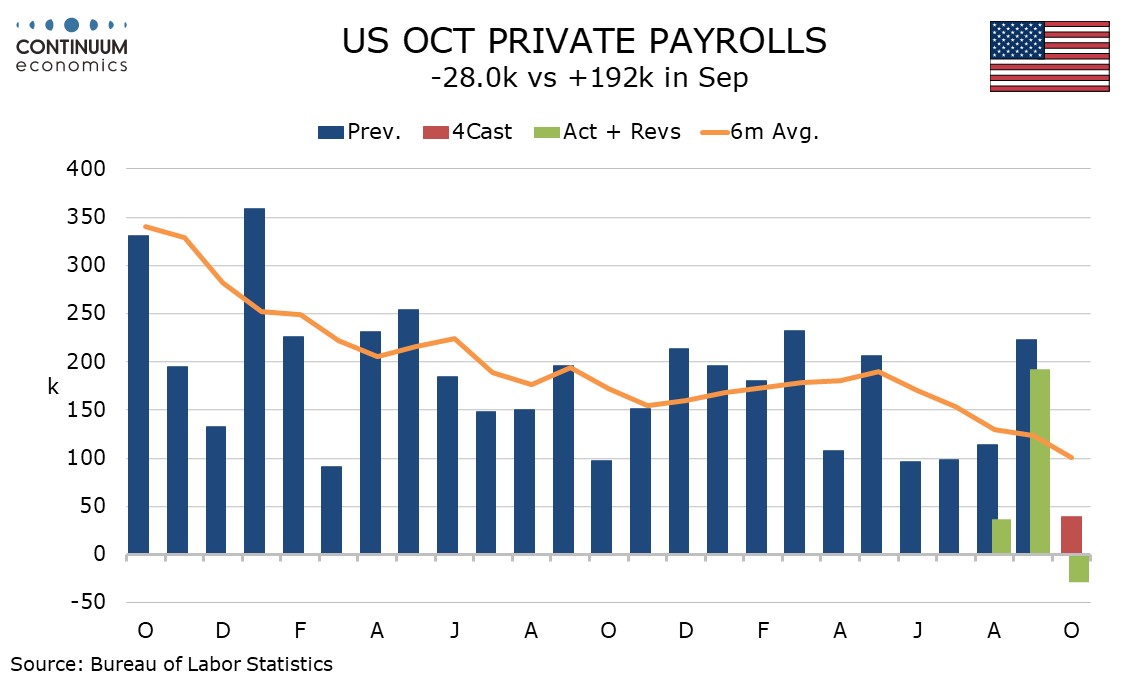

October’s payroll rose by only 12k with the private sector seeing a decline of 28k, September’s strong payroll was revised down by 31k to 223k with August revised down by 81k to a weak 78k. Net negative revisions are 112k overall and 108k in the private sector. In the last five months only September at 192k saw a private sector gain of over 100k.

If October’s weakness is partially a correction from September strength as well as the more obvious special factors, then the underlying picture is quite subdued. The 3 month averages are 104k overall and 67k for the private sector, with respective 6 month averages at 132k and 101k.

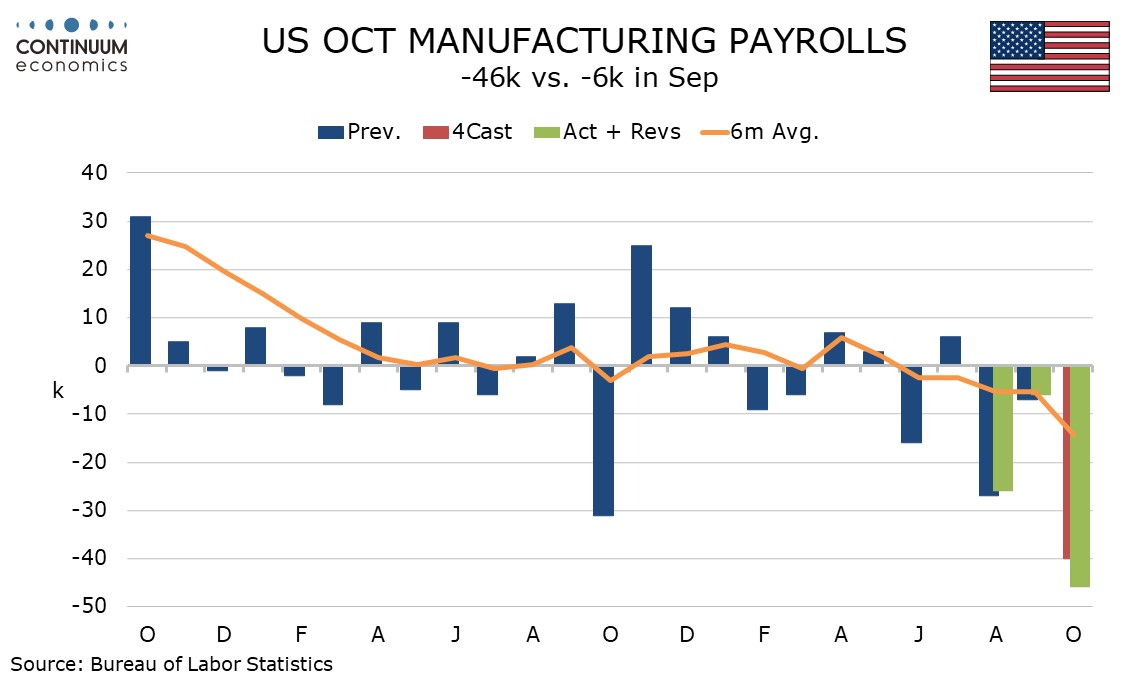

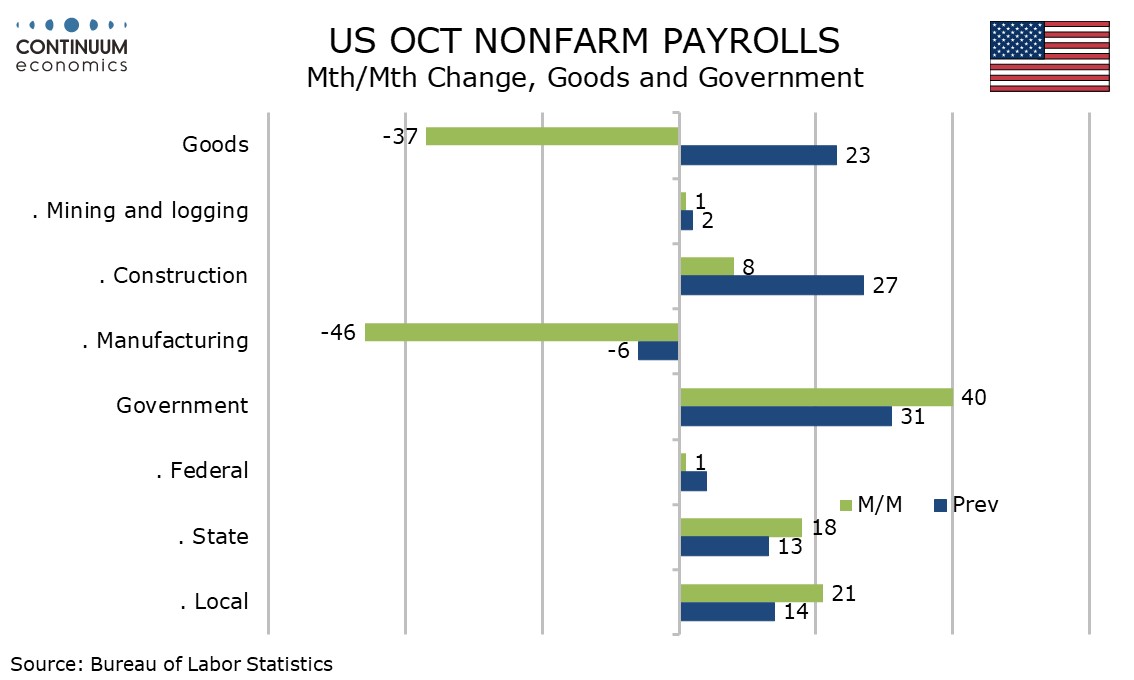

The Labor Dep’t states that a strike at Boeing likely subtracted 44k jobs from the manufacturing sector, which fell by 46k overall, more than the 33k on strike at Boeing meaning some indirect effects, while noting the impact of Hurricanes Helene and Milton but stating the net effect was impossible to quantify.

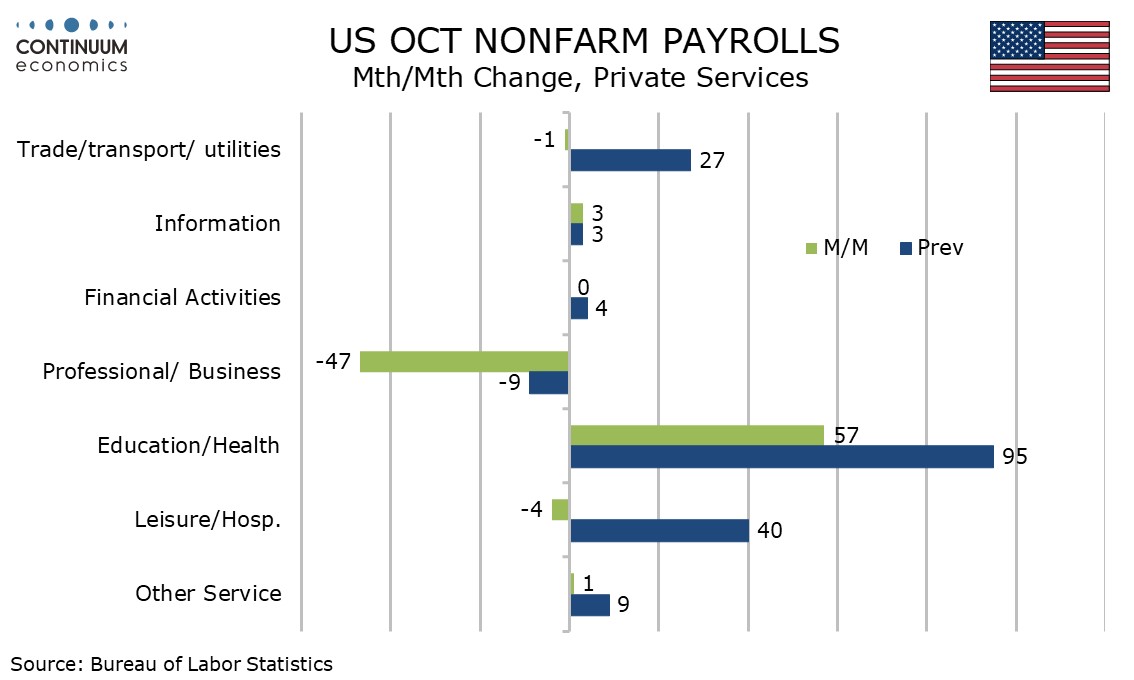

Sectors that were well below trend include temporary help at -48.5k which is probably impacted by the hurricanes, though recent trend has been around -20k per month. Leisure and hospitality is weather-sensitive, and a 4k decline there is the first since April, but coming after an above trend 40k rise in September. With trend around 20k per month the hurricane impact is not conclusive. Construction rose by 8k, its weakest since April, but was still positive.

In most other components employment did not change much outside gains in education and health of 57k and government at 40k. Education and health is below trend which is running around 80k per month but follows an above trend 95k in September, while government is only modestly above trend, with the election an obvious explanation.

Overall the breakdown by sector does not provide conclusive evidence that October weakness is more due to hurricanes than a correction from September strength. However a fall in weekly jobless claims since the hurricanes suggest the hurricanes were a significant factor.

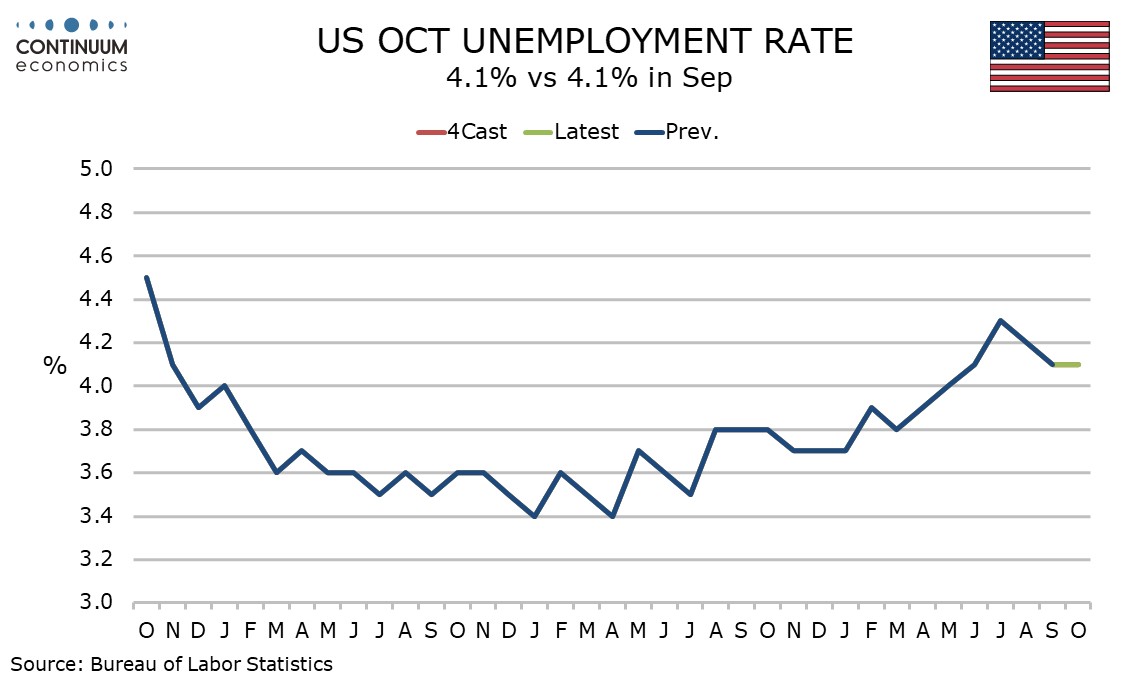

Unemployment was unchanged at 4.1% but before rounding increased to 4.145% from 4.052%. The household’s survey’s estimate of employment fell by 368k after a 430k September increase while the labor force fell by 220k after a 150k September increase. It is likely that hurricanes depressed both in October but employment at least was following an above trend September.

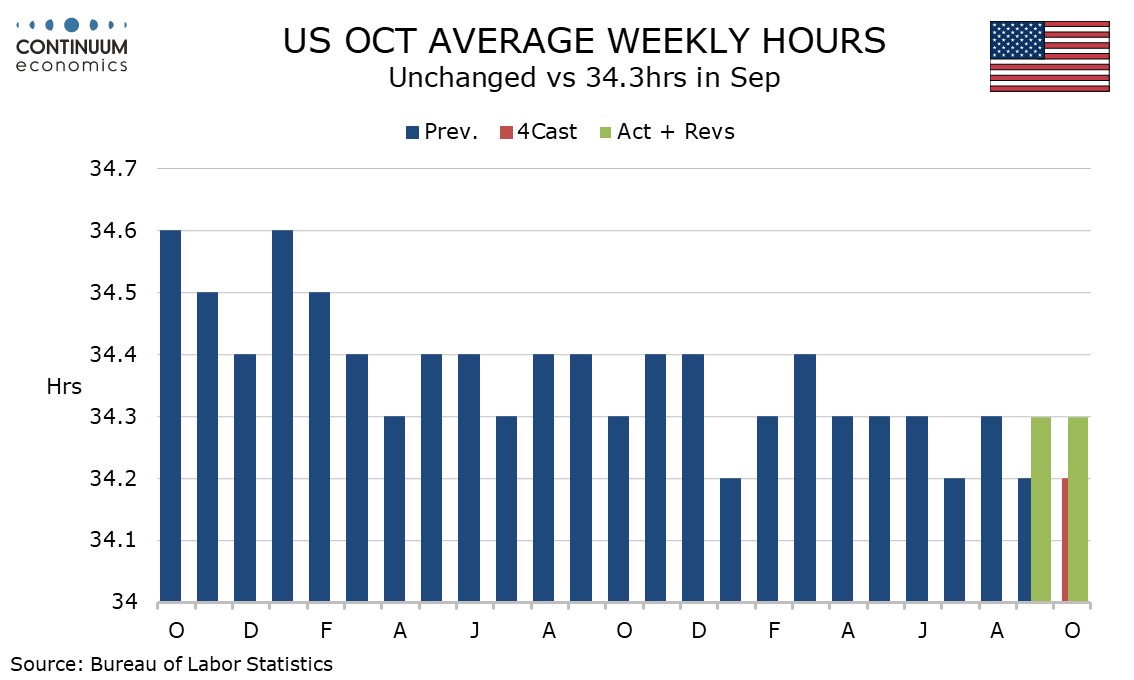

That the workweek held steady at 34.3 hours, with September revised up to 34.3 from 34.2, is a surprise to us as the workweek tends to be weather-sensitive. Aggregate hours worked were unchanged but fell by 0.3% for production and non-supervisory work.

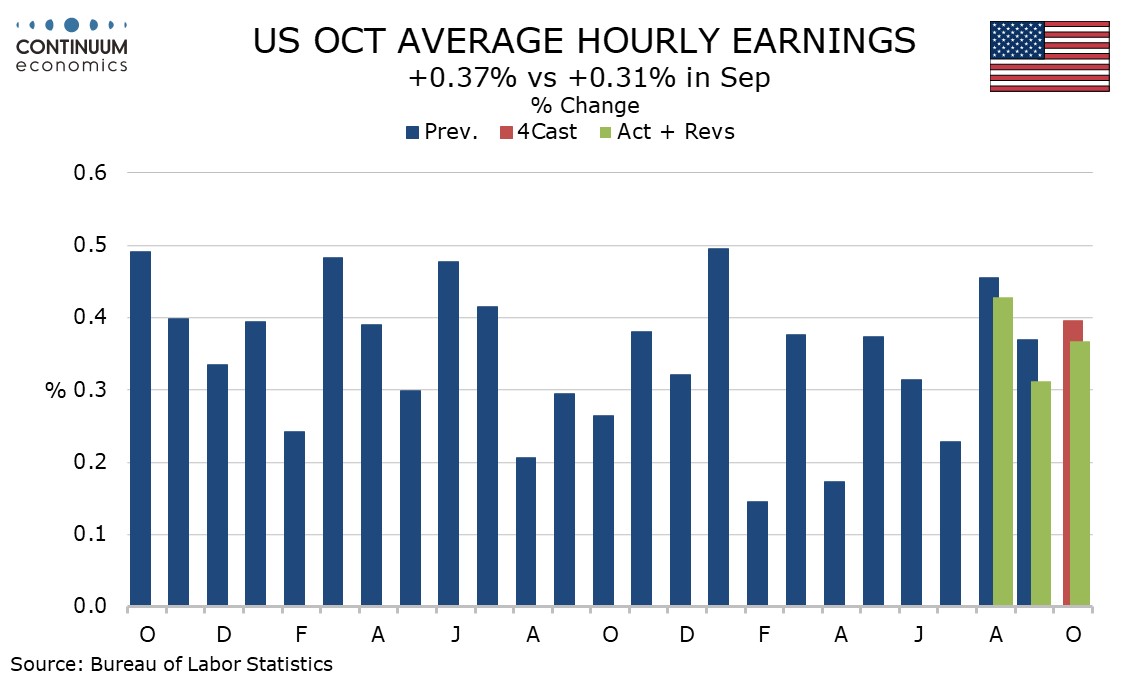

Average hourly earnings rose by 0.37%, above trend and consensus, but net of revisions the data was more in line with September revised down to 0.31% from 0.37% and August to 0.43% from 0.46%. Yr/yr growth rose to 4.0% only because September was revised down to 3.9%.