Russia CPI Review: Moderate Fall in Inflation in September but Still Elevated

Bottom Line: According to Russian Federal Statistics Service data released on October 11, inflation cooled off to 8.6% YoY in September after hitting 9.1% both in August and July, but remained elevated due to surges in food and services prices, weakening Ruble (RUB), and huge military spending. The reading stays well above Central Bank of Russia’s (CBR) medium term target of 4% and puts CBR in a difficult position before MPC meeting on October 25, particularly taking into account that an autumn slide of the RUB is almost 15% contributing to inflation trajectory coupled with increasing military spending after Kursk incursion.

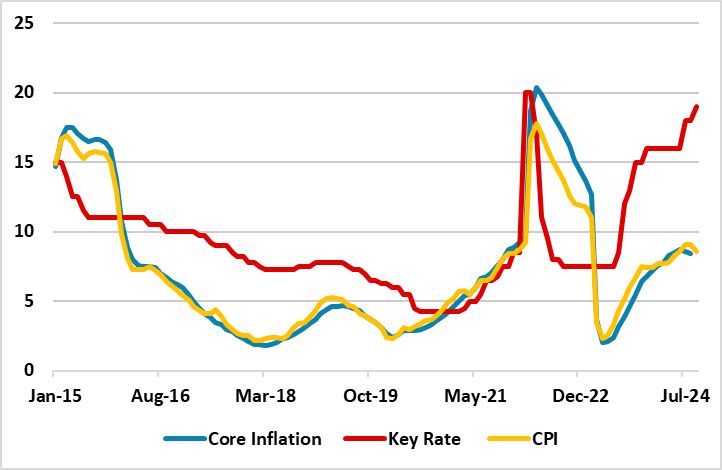

Figure 1: CPI, Core Inflation (YoY, % Change) and Policy Rate (%), January 2015 – September 2024

Source: Continuum Economics

According to Rosstat figures, the inflation rate continued to stay high at 8.6% YoY in September. MoM price growth fastened to 0.5% in September from 0.2% in August driven by the food and services prices, which surged by 9.2% and 11.6% in annual terms, respectively. Prices of nonfood goods went up by 5.6% YoY. In the nonfood segment, prices increased MoM for gas vehicle fuel (+3.6%), motor gasoline (+1%), and diesel fuel (+0.2%).

September’s 8.6% YoY inflation remained far above the CBR’s 2024 forecast range of 6.5–7.0%, and CBR’s medium term target of 4%. Despite moderate fall in September, we think the inflationary pressures remained strong basically due high military spending, strong fiscal policy, weakening RUB, and tight labor market.

First, the RUB weakness remains as a major concern over the inflation trajectory as RUB weakened by around 20% against the dollar in 2023, and lost 4.6% of its value just in September. (Note: RUB further weakened on October 10, remaining at its lowest against the USD since October 2023 at 97.4). We expect RUB would remain weak and volatile the rest of 2024 since the sanctions hurt. The weakness of the currency will likely continue to adversely impact inflationary expectations and pressures.

Additionally, Russian offensive operations in Ukraine and Ukraine’s surprising Kursk incursion continue leading to severe labour shortages as thousands of men either left the job market due to mobilization, or drawn into the weapons industry. Speaking about the historically low unemployment figures, president Putin indicated on October 9 that shortage of labour continue to create negative impacts over the economy. (Note: The labor market remains tight as the unemployment hit record-low figure of 2.4% in mid-2024).

Besides, strong military spending in Ukraine also ignites inflation to stay elevated. Ukraine’s Kursk incursion pumped the spending to new highs. Sources cite that Kremlin is set to boost its defense budget by almost 30% next year. The Russian government, under prime minister Mishustin, approved a draft 2025-2027 budget last week that envisaged defense spending rising sharply to 13.5 trillion RUB (USD145 billion) in 2025, up 25% from the 2024 level and amounting to 6.3% of GDP, according to the draft document translated by Reuters.

Due to the reasons mentioned above, we envisage annual average headline inflation to hit 7.9% and 6.1% in 2024 and 2025, respectively. (Note: According to a CBR’s survey in September, average annual inflation is expected to stand at 8.0%, 5.9% and 4.4% in 2024, 2025 and 2026, respectively). As restrictive monetary policy partly suppresses prices with lagged impacts, we feel cooling off inflation will take longer than CBR anticipates since inflation expectations of households and businesses continue to edge up. We also see the higher market rates had not yet fully affected the lending dynamics as activity in the corporate segment of the credit market remain high.

Taking into account that CBR lifted the policy rate by 100 bps to 19% on September 13 MPC meeting, -citing that inflation remaining far above the CBR’s targets-, basically to cool off the overheated economy given inflationary risks and its hawkish forward guidance, we think elevated inflation and weakening RUB would cause CBR to stay on red alert in Q4. We feel the risks to the outlook remain upside, and under current circumstances, it will not be surprising if CBR will decide to hike the key rate to over 20% either on MPC scheduled at October 25 or December 20 if RUB will continue to lose value sharply and inflation will not revert back as expected.