Bank Indonesia to Retain Policy Rate

Bank Indonesia (BI) will likely maintain the key 7-day reverse repo rate unchanged in March at 6%, in line with recent trends. The stability of the rupiah remains a crucial consideration for BI, alongside CPI inflation, which has moderated within the new target band of 2.5+/-1%.

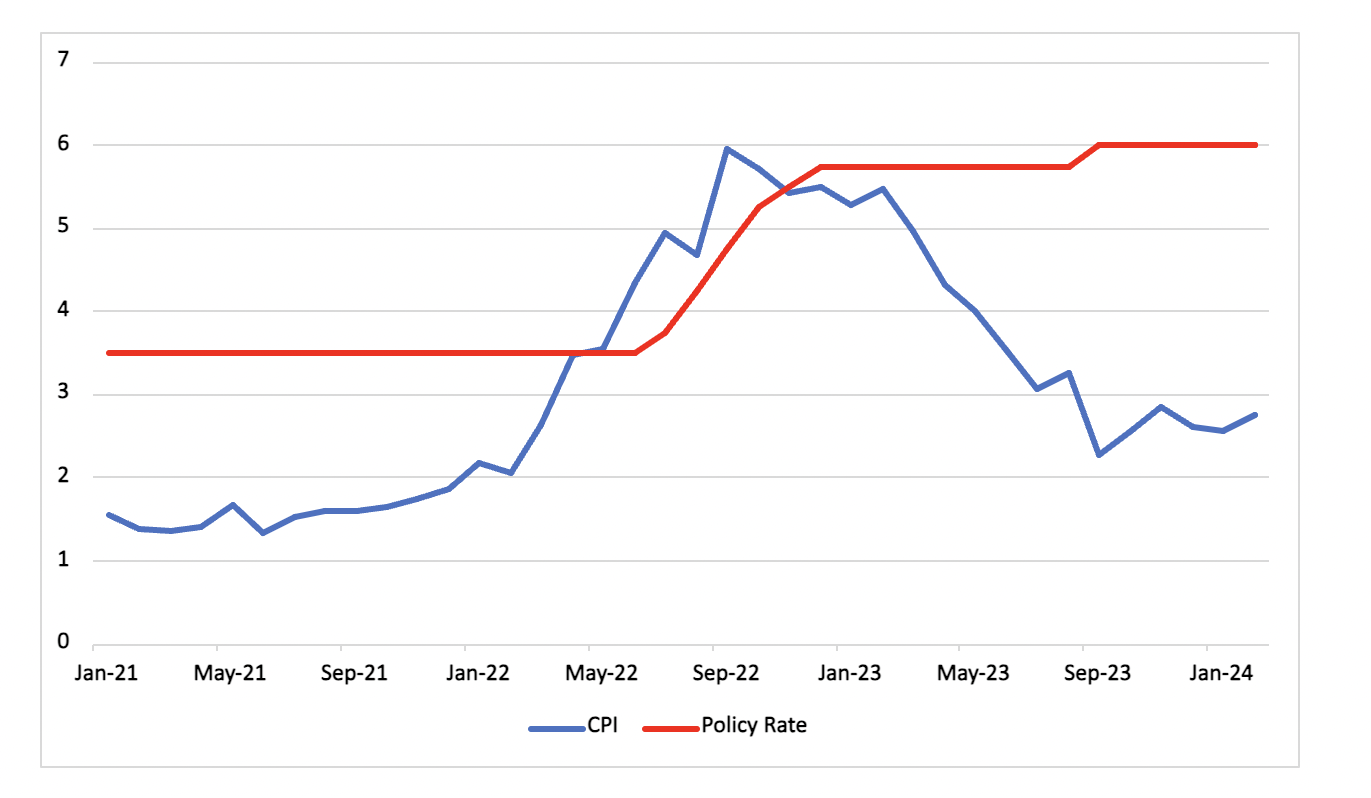

Figure 1: Indonesia Consumer Price Inflation and Policy Rate (% y/y)

Source: Continuum Economics

Bank Indonesia's upcoming rate decision is set against the backdrop of evolving economic indicators. With the key 7-day reverse repo rate likely to remain unchanged in March, following the trend observed from November 2023 to February 2024.

A pivotal consideration for the Bank Indonesia (BI) is the stability of the rupiah, which continues to influence rate adjustments. Despite the surprising rate hike in October 2023, recent months have seen BI tempering its monetary tightening stance amid interventions in the forex market to address rupiah depreciation. Meanwhile, real GDP growth has shown resilience despite monetary tightening measures. Accelerating to 5.04%y/y in Q4 2023, GDP growth for the full year stood at 5.05%, driven primarily by robust domestic demand. While BI foresees a growth range of 4.7-5.5% for 2024, supported by strengthened private consumption and investment, there's little urgency for rate cuts to stimulate growth, given the economy's steady expansion. Inflation dynamics, characterized by modest CPI inflation within the target band of 2.5+/-1%, provide room for BI to maintain its current stance. With CPI inflation at 2.7%y/y in February, and core inflation also well-contained, the inflation outlook remains stable, reducing the urgency for immediate rate cuts.

Exchange rate stability remains a paramount concern, with BI emphasizing its importance in recent Monetary Policy Committee (MPC) decisions. The central bank's commitment to maintaining rupiah stability underscores its cautious approach towards monetary policy adjustments, especially in light of the Federal Reserve's policy trajectory, which could influence interest rate differentials.

Looking ahead, BI's decision-making will likely prioritise exchange rate stability over immediate rate adjustments, with monetary easing not expected in the short term. The main policy rate is expected to stay at 6%. The alignment of BI's actions with those of the Federal Reserve underscores the cautious approach towards managing interest rate differentials and mitigating currency risks. Our expectation is of a 25 bps rate cut in early H2.