U.S. 10yr Yields Fiscal Worries

• As 2025 progresses the budget bill is likely to cement prospects of an 8-9% budget deficit in the U.S. for years to come. This will likely hurt Treasuries most just before the budget deficit expands quarterly Treasury issuance in Q4 2025/Q1 2026. Worse we have a non-consensus call of 2026 Fed tightening on core PCE inflation rising into 2026 on stickiness/tariffs and tax cuts. This produce our call of 5% 10yr yields for end 2025, but we could be underestimating the adverse impact and our alternative scenario has 10yr yields rising to 5.50-5.75% (here).

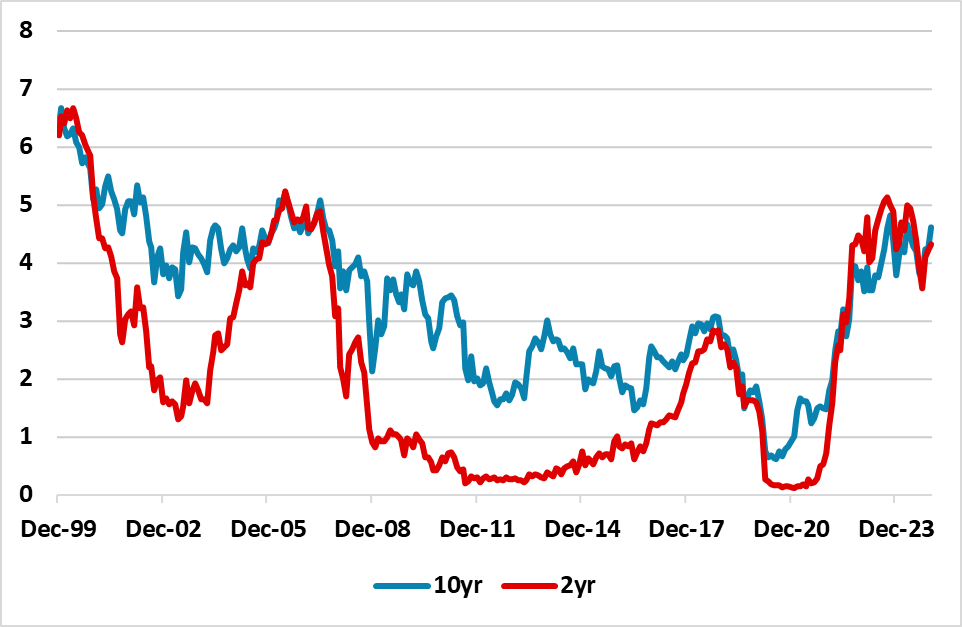

Figure 1: 10 and 2yr U.S. Treasury Yields (%)

Source: Datastream/Continuum Economics

10yr U.S. Treasury yields have moved higher through December with the FOMC signalling a more modest set of rate cuts for 2025. However, the rise in 2yr yields has stopped, but 10yr yields have continued to move higher. Only part of the answer is holiday thinned conditions, with concern over the budget deficit and issuance prospects being the fundamental driver.

Some asset management giants in the U.S. have expressed concern about the budget deficit trajectory as a reason to be underweight the long-end, which will likely expand when a 10yr budget bill is passed by the incoming Trump administration. The uncertainty is whether this will encompass mainly the renewal of lapsing 2017 tax cuts or will it be aggressive tax cuts. We feel that politics within the GOP will still mean aggressive rate cuts (here), as attempts to cut discretionary spending will likely fall well short of dreams of Musk/Bessant. This likely mean an 8-9% budget deficit, which in turn means intense funding and supply pressures. We remain less worried by the level of the government debt/GDP ratio, both due to the USD reserve status; still large Fed holdings and household debt/GDP have fallen a lot since the GFC. However, the combination of a large budget deficits through the remainder of the decade will likely see rating agencies worried about the trajectory and we still see a high risk of one to three rating agencies downgrading the U.S. in 2025.

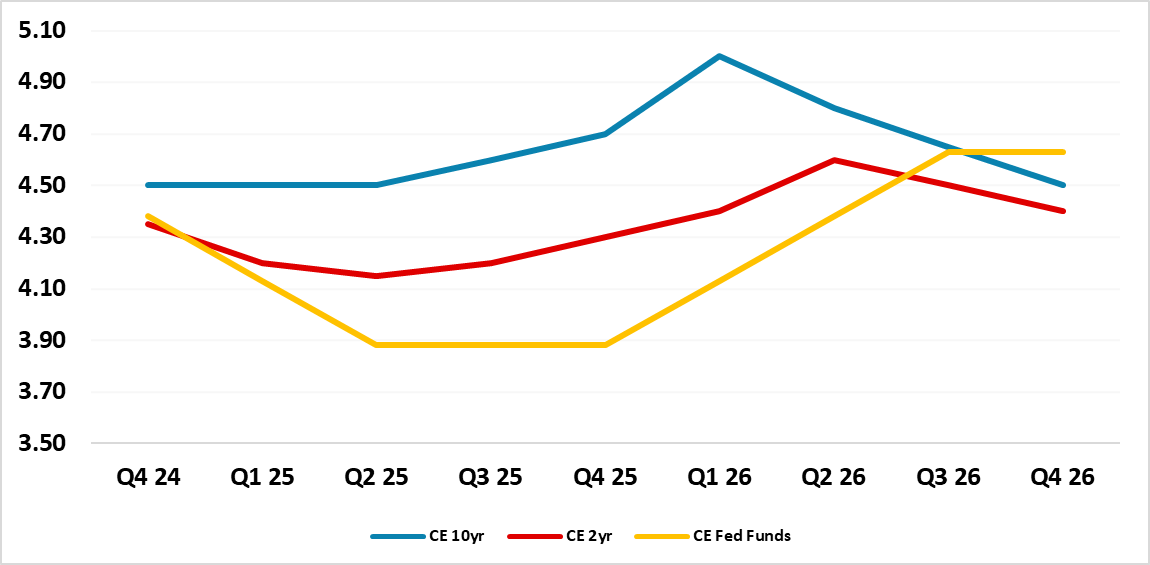

The key is timing in 2025. We would see the early days of the incoming administration trying to reassure the government bond market and U.S. Treasury secretary elect Bessant focusing on the 3-3-3 ambition including a 3% budget deficit. This could calm some of the concerns in the U.S. Treasury market in H1 (Figure 2). However, as the year progress the budget bill is likely to cement prospects of an 8-9% budget deficit. This will likely hurt Treasuries most just before the budget deficit expands quarterly Treasury issuance in Q4 2025/Q1 2026. Worse we have a non-consensus call of 2026 Fed tightening on core PCE inflation rising into 2026 on stickiness/tariffs and tax cuts. This produce our call of 5% 10yr yields for end 2025, but we could be underestimating the adverse impact and our alternative scenario has 10yr yields rising to 5.50-5.75% (here).

Figure 2: Fed Funds, 2 and 10yr U.S. Treasury Yields Forecasts (%)

Source: Continuum Economics