Free-Thematic-TA

View:

September 17, 2025

June 20, 2025

August 30, 2024

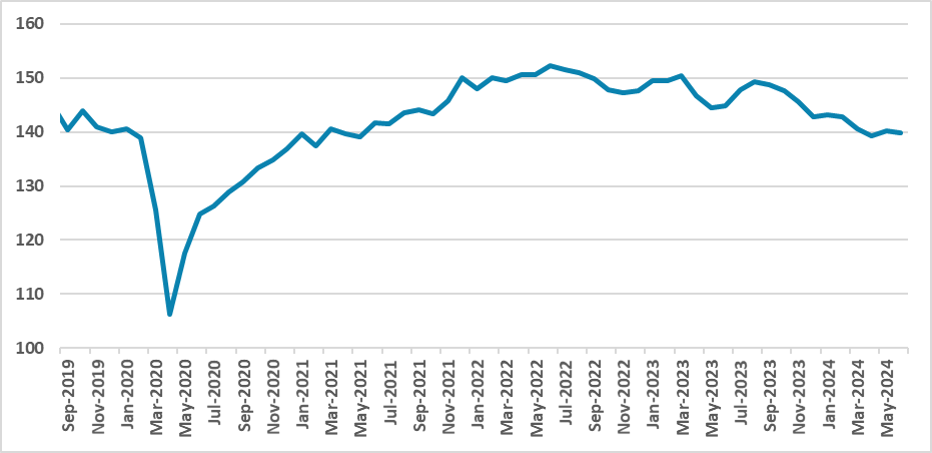

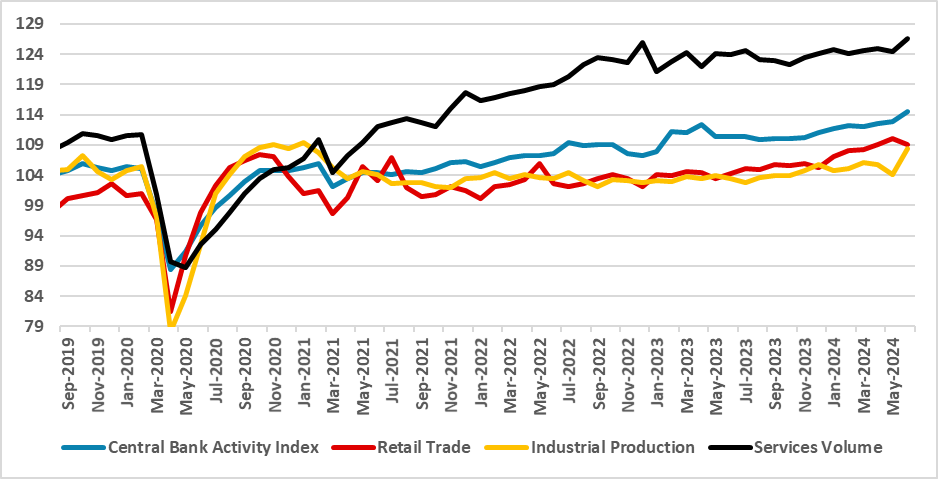

Strong Military Spending and Investment Growth Help Russian Economy Expand by 3.4% YoY in July

August 30, 2024 12:13 PM UTC

Bottom Line: According to the preliminary figures announced by the Russian Ministry of Economic Development, Russia's GDP grew by 3.4% YoY in June after expanding by 3% YoY in June driven by military production and investments. We foresee Russian economy will expand by 2.5% in 2024 despite aggress

August 29, 2024

August 28, 2024

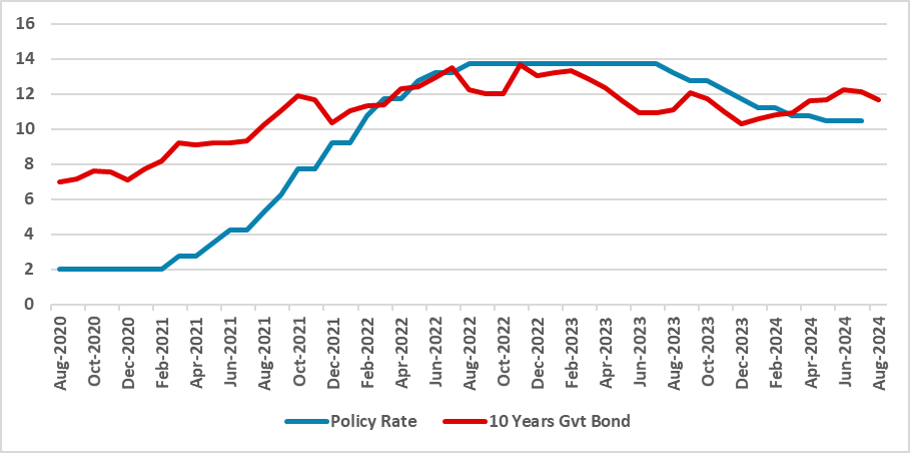

Brazil: The Case for a Hike?

August 28, 2024 1:42 PM UTC

Despite the market's push for a rate hike by the Brazilian Central Bank (BCB), we believe the current policy rate of 10.5% is sufficiently restrictive to ensure inflation converges. However, de-anchored inflation expectations, fiscal concerns, strong economic activity, and a new BCB president desiri

China Consumer Volatility

August 28, 2024 1:30 PM UTC

China consumption patterns are divergent; slowing and becoming more volatile at a sub sector level. Less certainty over new employment and wage growth, plus wealth worries over housing are some of the causes. We forecast GDP to slow in H2 and be 4.0% in 2025.

August 27, 2024

Ukraine War Update: Surprising Ukraine Incursion in Russia Continues

August 27, 2024 10:51 AM UTC

Bottom Line: Ukraine’s surprise cross-border offensive inside Russia's western Kursk region continues with pace as Ukrainians recently advanced near Sudzha. In response, Russian military deploys forces from lower priority sectors of the frontline in Ukraine to the frontline in Kursk Oblast. We for

August 23, 2024

Banxico Minutes: Cuts on the Table, Divided Board

August 23, 2024 1:02 PM UTC

Banxico has resumed its rate-cutting cycle, reducing the policy rate from 11% to 10.75%, with a split board decision. Most members noted weakening domestic activity and external volatility impacting the exchange rate. While some view the rise in non-core inflation as transitory, others see it, along

August 22, 2024

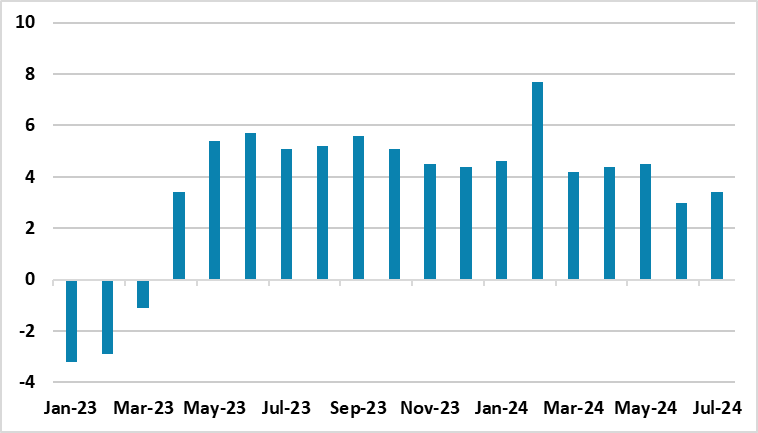

Argentina: Economy Continues to Shrink

August 22, 2024 2:08 PM UTC

Argentina’s economy contracted by 0.3% in June (m/m), according to INDEC’s monthly activity indicator and, in quarterly terms, it will accumulate three consecutive quarter of contraction. Despite an 80% annual rise in agricultural activity due to base effects, other sectors like construction and

August 19, 2024

Brazil: Activity Surprises Again in Q2

August 19, 2024 1:24 PM UTC

The Brazilian economy outperformed expectations in Q2, with a 1.1% growth (according to monthly data) driven by industrial production and strong household demand. This strength likely stems from the fiscal push in late 2023, though a slight deceleration is anticipated in the second half of 2024. Wit

July 26, 2024

CBR Hiked Key Rate to 18% as Inflation Soars

July 26, 2024 2:16 PM UTC

Bottom Line: As we predicted, Central Bank of Russia (CBR) announced on July 26 that it increased its policy rate by 200 bps to 18% after four consecutive rate holds, and first time in 2024, to tame the stubborn price pressures stemming from high military spending, tight labour market and fiscal pol

May 17, 2024

April 11, 2024

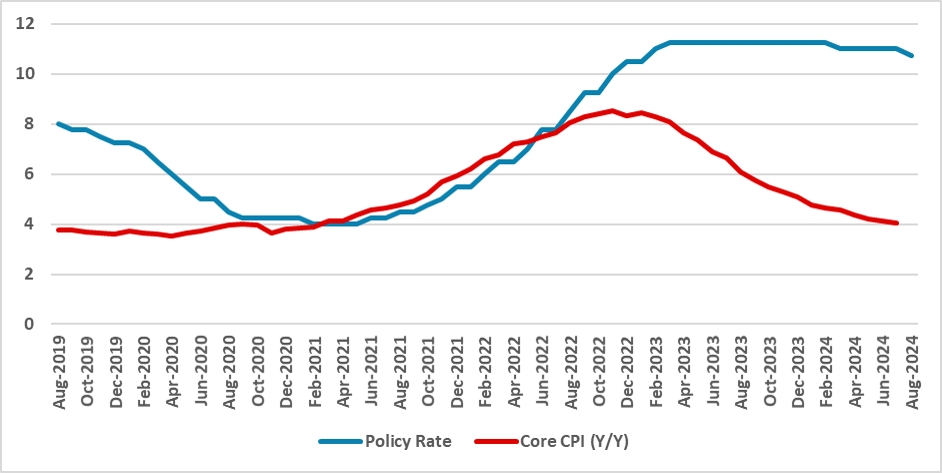

RBI Holds Rates Firm, Citing Room for Economic Growth

April 11, 2024 5:44 AM UTC

In line with our expectations, the Monetary Policy Committee (MPC) of the Reserve Bank of India (RBI) chose to maintain the policy repo rate at 6.5% in its latest meeting. The decision reflects their aim to gradually scale back stimulus measures while still supporting economic growth. It also unders

April 04, 2024

RBI to stand pat in April

April 4, 2024 7:25 AM UTC

The Reserve Bank of India (RBI) is gearing up to announce its first monetary policy decision for FY25 (April-March) on April 5. For the upcoming meeting, we anticipate that the RBI will likely keep the repo rate unchanged at 6.5%, given the optimistic outlook for economic growth and still elevated i