China: Lopsided Growth and New Housing Measures

Overall, the April industrial production suggests Q2 GDP should be reasonable, but weak retail sales suggests H2 2024 can be disappointing. We stick with a 4.6% forecast for 2024 GDP growth.

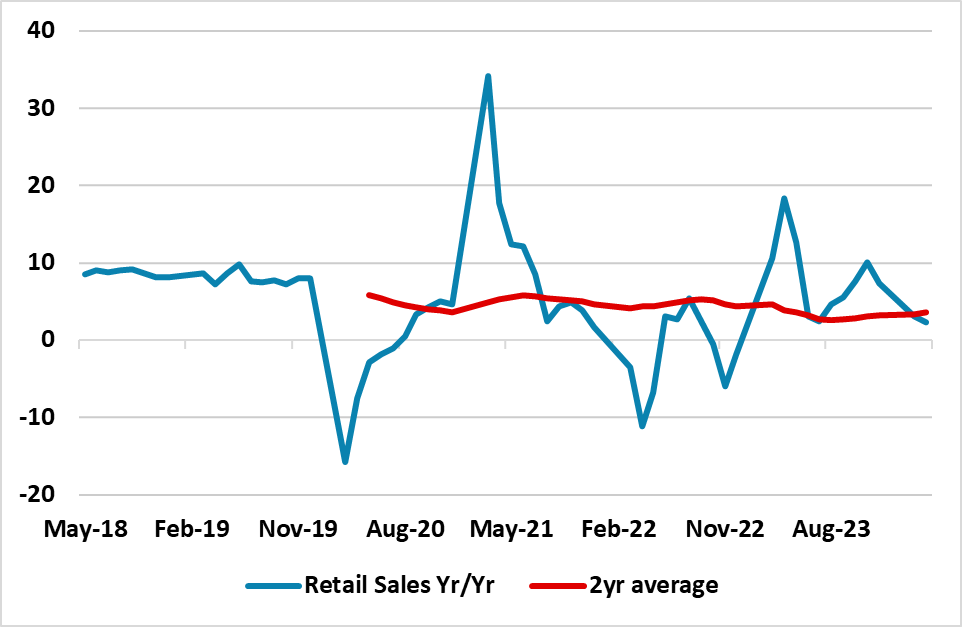

Figure 1: Retail Sales and 2yr average (Yr/Yr %)

Source: Datastream

The latest monthly figures show lopsided growth into April. Industrial production rose a larger than expected 6.7% Yr/Yr, with a 1.0% jump on the month. In contrast, retail sales was poor at a below consensus 2.3% Yr/Yr and after the soft 3.1% in March. The flat profile on the month shows a worrying trend, as the breakdown of the retail sales data shows that weakness was not concentrated but in a number of sub categories. The 4.5% contraction in construction material is to be expected given the weakness in residential housing investment. However, catering slowed to +4.4% Yr/Yr suggesting that the post COVID boom in eating out is slowing. The contrast between good industrial production and weak retail sales is most evident in cars. Car production surged to +16.3% Yr/Yr, but car purchases in the retail sales numbers were -5.6% Yr/Yr. Now export of cars can account for some of the difference, but the U.S. and soon the EU are increasing tariffs on electric vehicles from China. Some car production could soon be going into inventories, which cuts future car production growth plans!

The production surge helps to keep momentum towards hitting the 5% growth target for 2024, with high tech production up 11.3% Yr/Yr. However, underlying momentum in H2 depends on domestic demand and exports. The retail sales and residential investment numbers point to weak demand outside of public consumption and investment. Meanwhile, though exports are improving Yr/Yr, exports and net exports are still likely to be a flat contribution to GDP in 2024.

China authorities also announced extra housing measures today. The most important is the instruction to local government to purchase excess housing inventory and turn it into affordable housing, after a pilot in Hangzhou. This is an important move if it is large scale across the country, as it could be key signal to stabilize household and developers attitudes towards property and lessen the drag from housing construction. However, we need more details, with some estimate in the property sector that up to 5mln unsold apartments need to be bought (circa Yuan2trn, but the sum would go down through time if some were sold at a later date as occurred with NAMA in Ireland). See Figure 2 for the IMF estimate. For now we are not going to revise up our negative outlook on housing, as population aging means less demand for housing and property developers are weak (the authorities should nationalization most of the sector). The authorities also reduced the deposit for 1 time buyers to 15% and removed the floor on mortgage rates, which are helpful but not as important as removing excess inventory.

Figure 2: IMF Estimate of Developers Excess Inventory (Mln SQM)

Source: IMF Article IV 2024, selected issues

Overall, the April industrial production suggests Q2 GDP should be reasonable, but weak retail sales suggests H2 2024 can be disappointing. We stick with a 4.6% forecast for 2024 GDP growth.