Brazil: Activity Surprises Again in Q2

The Brazilian economy outperformed expectations in Q2, with a 1.1% growth (according to monthly data) driven by industrial production and strong household demand. This strength likely stems from the fiscal push in late 2023, though a slight deceleration is anticipated in the second half of 2024. With the economy heating up, the Central Bank of Brazil (BCB) is likely to maintain the policy rate at 10.5%, while adopting a hawkish stance to manage potential inflation risks.

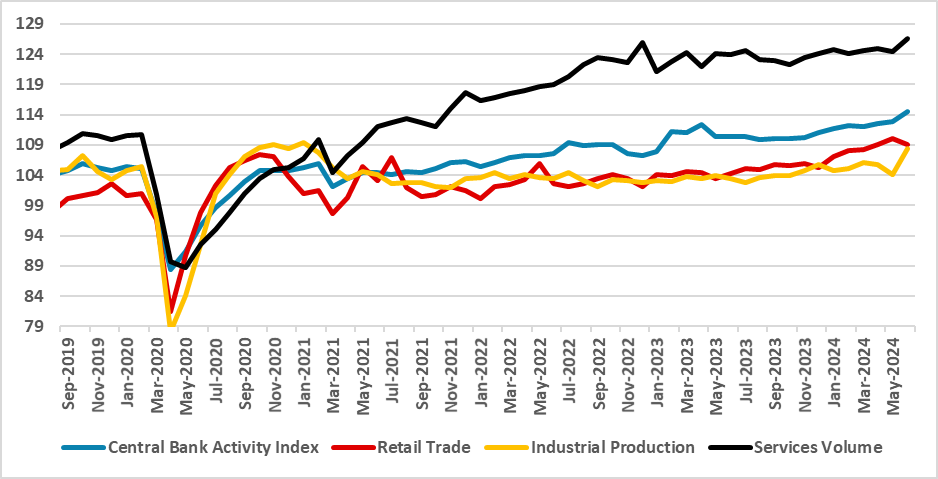

Figure 1: Monthly Activity Data (2020 = 100, Seasonally Adjusted)

Source: IBGE and BCB

Most of the monthly activity data has already come out, giving us a good picture of how the Brazilian economy performed during Q2. Contrary to most expectations, the Brazilian economy performed strongly in the second quarter. The Central Bank Activity Index shows that the Brazilian economy grew by 1.1% compared to the first quarter. Most analysts were predicting a deceleration during the second quarter, with forecasts pointing to q/q growth below 0.5%.

Industrial production grew solidly, with a 1.5% increase during the quarter, driven particularly by growth in June. While we still await the official GDP data, we believe this growth was especially driven by the mining and extractive industries. The services volume grew by 0.7% in the second quarter, which we believe was driven by household demand. In the same vein, retail trade sales also grew by 0.7%.

With half of the year behind us, it is clear that the Brazilian economy will once again surprise in terms of growth. We still believe this is a lagged effect of the strong fiscal push at the end of 2023, coupled with increases in social transfers and a higher minimum wage. Moreover, the unemployment rate is approaching its historical minimums. All in all, this points to an economy that is heating up.

What remains to be seen is whether the Brazilian economy will follow a similar pattern to 2023, where a strong first half was followed by a weaker second half. We expect a slight deceleration as the impacts of the fiscal push diminish. However, our estimates suggest that the Brazilian economy will grow around 2.4% in 2024, with some upside risks.

As the economy heats up, questions arise about how the BCB should respond. So far, the BCB has adjusted its messaging from considering cuts to considering hikes. At 10.5%, we still believe the policy rate remains at contractionary levels, and there would be no need to raise it, although some market participants may differ. We still believe the BCB will keep the policy rate unchanged at 10.5%, but they will maintain a hawkish tone in their communiqué and minutes.