RBI to stand pat in April

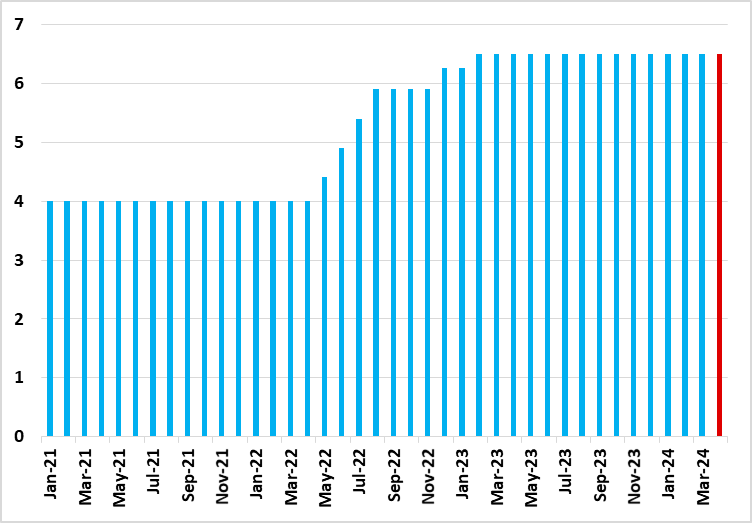

The Reserve Bank of India (RBI) is gearing up to announce its first monetary policy decision for FY25 (April-March) on April 5. For the upcoming meeting, we anticipate that the RBI will likely keep the repo rate unchanged at 6.5%, given the optimistic outlook for economic growth and still elevated inflationary pressures.

A convergence of factors, spanning from the trajectories of inflation and economic growth to the global macroeconomic environment, is poised to shape the repo rate decision of the Reserve Bank of India's (RBI's) Monetary Policy Committee (MPC) during its initial meeting for the financial year 2025, scheduled from April 3 to 5.

Figure 1: India Main Policy Rate (%)

Source: Continuum Economics

India's economy recorded robust growth of 8.4% yr/yr in the fourth quarter of 2023, outpacing most major economies. This growth was driven by sustained private consumption, government spending and an investment uptick. All of these factors are expected to persist in the upcoming two quarters. Therefore, this optimistic outlook may lead the RBI to adopt a cautious approach towards rate adjustments to prevent overheating the economy.

Furthermore, global economic conditions, particularly in the US, are expected to influence the RBI's decision. The US Federal Reserve's stance on interest rates and global macroeconomic trends will be closely monitored by the MPC. Despite potential rate cuts by the US Federal Reserve by June, the RBI is likely to maintain higher rates for a longer duration. We anticipate the first rate cut only in August. Additionally, the RBI will be concerned with the volatile nature of crude oil prices, exacerbated by geopolitical tensions. This presents an external sector challenge for India's economy. With crude oil prices expected to remain elevated, the RBI will take into account the impact of higher energy costs on inflation and the current account deficit. Although for now, the current account deficit remains manageable at 1.2% of GDP.

Meanwhile, inflation control remains a key priority for the RBI, with current projections indicating a manageable scenario. In our view inflation trends will remain choppy, which will ensure a hawkish approach by the RBI. A forecast of an intense heatwave in India in the upcoming month will affect harvests and this will be another factor considered by the RBI. Further, the agricultural sector's outlook, dependent on monsoon patterns, will factor into the RBI's decision-making process. While inflation is expected to decline in the third quarter, it is likely to remain within the target range between April and June.

Overall, the MPC's cautious approach to monetary policy is expected to continue, with a focus on supporting economic growth while maintaining price stability. No rate cut is likely ahead of the elections and given the strong growth numbers for FY24, the RBI has sufficient room to hold rates. We continue to forecast a 6.5% repo rate in H1-2024, followed by a 25bps rate cut in Q3 and another similar cut in Q4 to end 2024 at 6%.