RBI Holds Rates Firm, Citing Room for Economic Growth

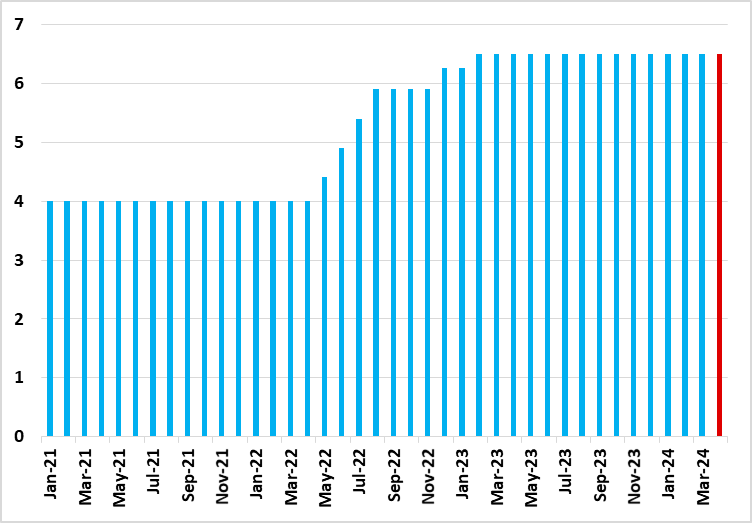

In line with our expectations, the Monetary Policy Committee (MPC) of the Reserve Bank of India (RBI) chose to maintain the policy repo rate at 6.5% in its latest meeting. The decision reflects their aim to gradually scale back stimulus measures while still supporting economic growth. It also underscores the RBI's hawkish stance given the choppy trends observed in inflation.

In its latest meeting, the Reserve Bank of India's Monetary Policy Committee (MPC) decided to keep the policy repo rate steady at 6.5%, with a majority vote of 5 to 1. This decision also maintains the standing deposit facility (SDF) rate at 6.25%, as well as the marginal standing facility (MSF) rate and the Bank Rate at 6.75%. Furthermore, by a majority vote of 5 out of 6 members, the MPC reaffirmed its dedication to gradually withdrawing accommodation to aid in aligning inflation towards the target while supporting economic growth.

Figure 1: India Main Policy Rate (%)

Source: Continuum Economics

These determinations are grounded in positive developments observed in growth and inflation indicators since the previous policy review. Economic growth has sustained its momentum, exceeding earlier projections. From January to March 2024, headline inflation eased to 5.1% yr/yr from December 2023's 5.7% yr/yr, with core inflation consistently decreasing over the past nine months to its lowest level recorded. Notably, the fuel component of the Consumer Price Index (CPI) has remained in deflation for six consecutive months. However, inflationary pressures in food prices intensified in February. Lending more credence to our view that the RBI remains hawkish were the RBI governor, Shaktikanta Das' words that the MPC would prefer the elephant (inflation) to return to its abode (within 4%). In our view, the RBI members would prefer to see inflation durably reduced (on a sustained basis) to its medium term target.

Looking ahead, the robust growth outlook provides leeway for the policy to maintain a vigilant approach towards inflation, aiming to guide it towards the 4% target. Amid ongoing uncertainties in food prices, the MPC remains attentive to potential upside risks to inflation that could disrupt the disinflationary trend. Therefore, in our view, the MPC is unlikely to cut rates in H1 2024. Regarding growth prospects, the central bank forecasts a 7% yr/yr GDP growth for FY25. While indicating continued strong performance for the Indian economy, Governor Das also stressed that risks are evenly balanced. The RBI's projections for real GDP growth in specific quarters of the fiscal year were also addressed. For Q1-FY25, the RBI anticipates a growth rate of 7.1% year-on-year, slightly adjusting from the previous estimate of 7.2% provided in February. Looking forward, the RBI foresees a growth rate of 6.9% year-on-year in Q2, followed by 7% for both Q3 and Q4.

We expect the first rate cut to come about in Q3 2024. A small rate cut of 25bps is anticipated, followed by another 25 bps in Q4 2024.