FOMC Minutes: Shows Splits, But Rate Cuts Should Still Arrive

· The January FOMC minutes show a split Fed, with some sounding mildly hawkish. However, the district Fed presidents are on the mildly hawkish side, but most are non-voters and we feel that the FOMC voting consensus is more neutral. Additionally, we feel that Fed is too upbeat on the economy and as consumption slows towards income growth through 2026, and inflation continues to slow, that the Fed will still cut rates.

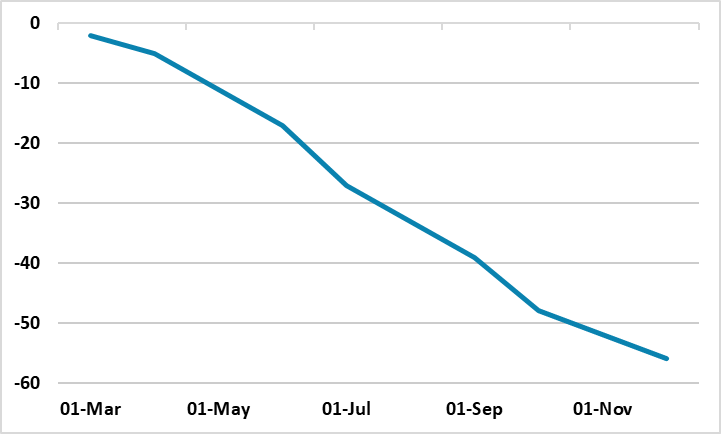

· We thus still pencil in 25bps cuts from the Fed for June and September to bring the Fed Funds rate down to 3.00-3.25%. However, even within the 12 FOMC members some dissent is likely and this could lead to a few disputing a June cut and more voting against a September cut.

Figure 1: Fed Rate Cuts Discounted (%)

Source: Bloomberg/Continuum Economics

The minutes from the January 28 FOMC meeting show a split Fed and some officials nervous that the next move could be towards tightening. Key points to note.

· FOMC Split, but. One camp felt that the Fed could consider rate cuts in the future; a 2nd camp felt that with the labor market is now not as weak as the autumn and that the Fed could go on hold and a 3rd camp saying that if inflation remains high that the Fed might have to consider raising rates. However, it is worth pointing out that the district Fed presidents have been more hawkish than the Fed governors or the FOMC voting decisions and some of the hawkish views could be non-voting members. For example, remember that 6 district Fed presidents did not want to cut the discount rate in December. Finally, some officials noted that cutting rates could sent the wrong signal that the Fed are less committed to the 2% inflation target, but this likely reflects an emotional backlash against Trump administration pressures on the Fed and non-voting members. Later in the year when it comes to data review, this emotion will likely be less important.

· Thus some hawkish noises may not be representative of the FOMC voting consensus. Additionally, the January CPI will have provided comfort that core PCE inflation should now get closer to the 2% target later in the year, with tariffs not impacting inflation as much as expected.

· Employment/consumption and inflation key. The Fed have the view that the economy is currently solid, which Friday Q4 GDP figures should show. However, consumption is outstripping income growth leading to a fall in the household savings ratio and this process is getting quite stretched. The tax rebates in Q1 could sustain this a little longer or could be partially saved. However, our baseline is that the consumption will slow through 2026 to reflect this lower absolute income growth. This income growth is also a reflection of lower trend employment growth, as the illegal crackdown slows labor force, employment then income and consumption growth. This is disinflationary and a contrast to sectoral inflation pressures from the AI boom, but on balance we feel core PCE will soften sufficiently through 2026.

June and September, but split votes. We thus still pencil in 25bps cuts from the Fed for June and September to bring the Fed Funds rate down to 3.00-3.25%. Fed chair designate Warsh will likely encourage this view (here). However, even within the 12 FOMC members some dissent is likely and this could led to a few disputing a June cut and more voting against a September cut. This split voting will make it more difficult for the market to believe in additional easing, unless the economy sees a hard landing. Additionally, the Fed is building towards a split of neutral rates. While Warsh takes the view that AI productivity boost is disinflationary and argues for lower rates (here) and potentially a lower neutral rate, not all FOMC officials agree. The January minutes show some fear a higher neutral rate from the AI boom pushing up inflation and demand for lending. In recent public comments Fed Barr and Jefferson appear to of this thinking.