Warsh, AI and Lower Policy Rate?

· Warsh will find it tricky to convince FOMC members that AI is currently boosting productivity and acting as a disinflationary force. However, Warsh could also try to get the Fed to be more forward looking and less data dependent, which could add some proactivity into Fed debates. For now though, we stick with two 25bps cuts in June and September and then unchanged rates through 2027

Fed Chair Elect Kevin Warsh is arguing that AI is boosting productivity, which can lower inflation and potentially policy rates? Is this true and will other FOMC members agree?

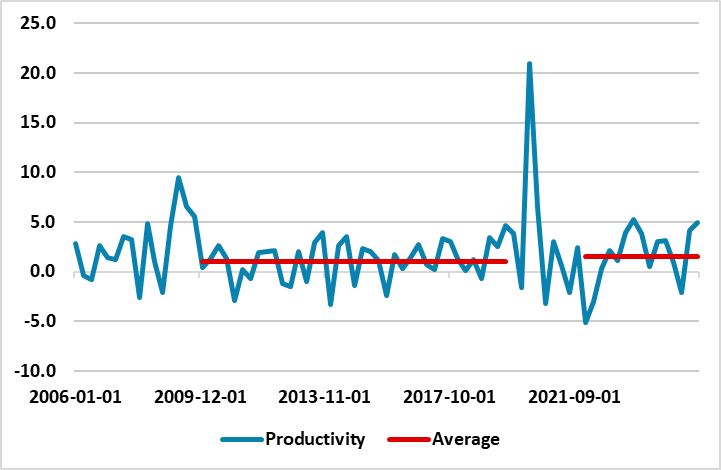

Figure 1: U.S. Productivity Pick-Up Versus Post GFC Years (%)

Source: Datastream/Continuum Economics

One debate at the Fed that will intensify from May is whether AI could produce lower policy rates via disinflation. A couple of points are worth noting.

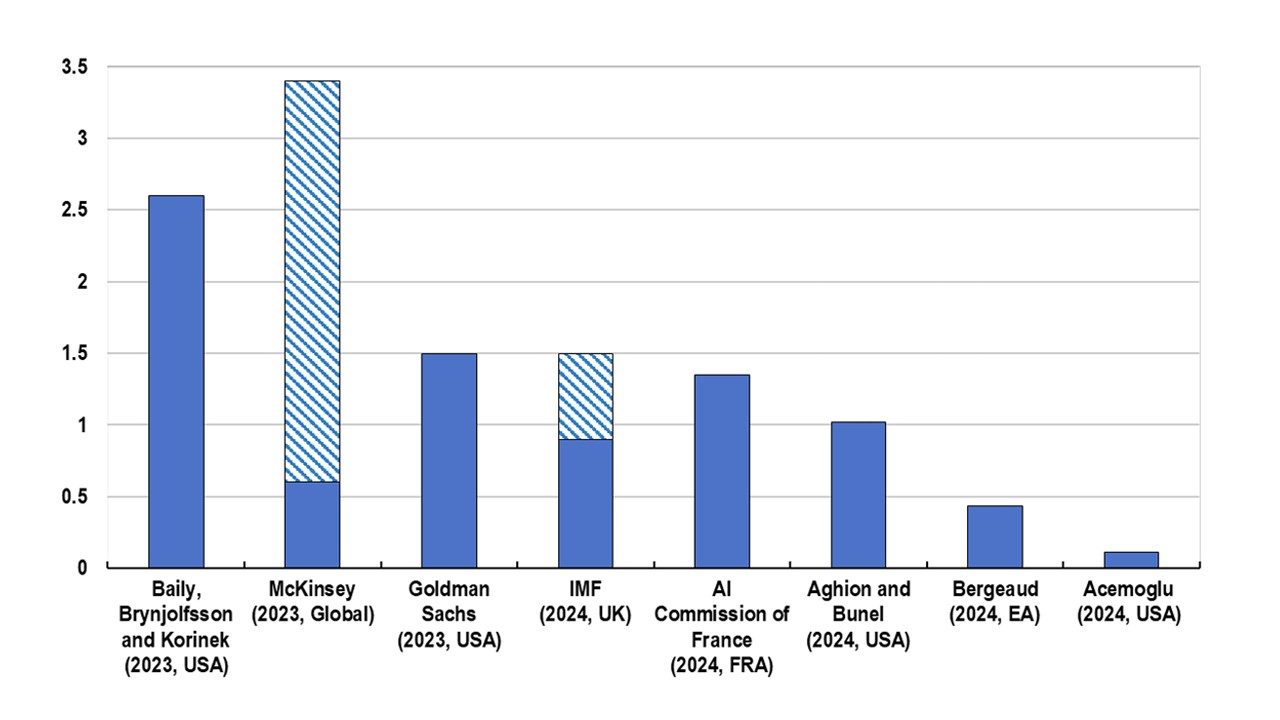

· AI and productivity. Kevin Warsh has argued that AI will enhance productivity and this could mean more disinflation and lower policy rates. This is part of the reason that he has sounded more dovish recently, but can he convince other FOMC members (here). Productivity has certainly picked up recently and 2022-25 average at 1.5% is above the 2010-19 average of 1.0% (Figure 1). However, AI adoption is narrow in technology/finance and professional services at the moment and the structural boost to whole economy productivity could take 3-10 years to see the full effects (Figure 2). Even so, cyclical productivity is likely being boosted by the AI data center and software boom (here), which combined with some early AI structural productivity, could be helping. It is uncertain whether existing FOMC voters will agree with AI currently boosting productivity, as Powell has indicated that the Fed feel that the productivity pick-up could be related to the more intense use of technology since the COVID crisis rather than AI.

Figure 2: Predicted Increase in Annual Labour Productivity Growth over a 10-year Horizon Due to AI (%)

Source: OECD 2024 (here)

· AI, CPI and weak Labor market. Thus other FOMC officials could argue that AI may not be materially boosting productivity yet, but could in the future and that the Fed should watch CPI and the labor market for signs that AI is having a greater impact. Employment growth is already being impacted by the sharp slowing of immigration, but if jobs growth in IT/finance and professional services falls noticeably then Warsh could point to evidence that AI is hurting jobs growth and this can cause disinflation via lower income/consumption. Additionally, Warsh could try to get the FOMC to be more forward looking and less data dependent, which could change the debate on the correct setting for policy rates and ease more in anticipation of lower inflation. We do feel slow jobs growth will mean lower overall income and consumption growth and slow the economy into 2026, which will warrant two 25bps cuts in June and September. However, to get still lower policy rates would require an FOMC consensus that disinflation means a risk of future inflation undershooting target or a lower neutral policy rate. The first depends on the data as well as a FOMC change of focus and the latter on an FOMC rethink.

· Neutral policy rate estimates. Warsh could argue that AI will boost trend growth and reduce inflation meaning a better GDP/inflation trade off and if GDP is not at new higher trend estimates then policy rates should be lower. However, it is difficult to see other FOMC members quickly agreeing to this line of think. Indeed, some (e.g. Jefferson and Miran have argued that higher productivity could lead to a higher neutral rate likely through increased investment demand. Alternatively, Warsh could try to convince FOMC members that current higher productivity is a fact and that neutral policy rate should thus be lower. Some make buy into this argument.