Fed: Policy Easing Slowing

The FOMC statement, FOMC medians and Powell during the Q/A left the impression that Fed easing will slow down into H1 2025. We now see two 25bps cuts in March and June 2025 driven by a Fed’s desire to avoid too much labor market slack occurring, but then pausing for the remainder of 2025 at a 3.75-4.00% Fed Funds rate. In 2026, we see the Trump administration policy producing a higher core PCE inflation than the FOMC median and thus we feel that the Fed will hike by 75bps and actually increase the degree of restrictive policy.

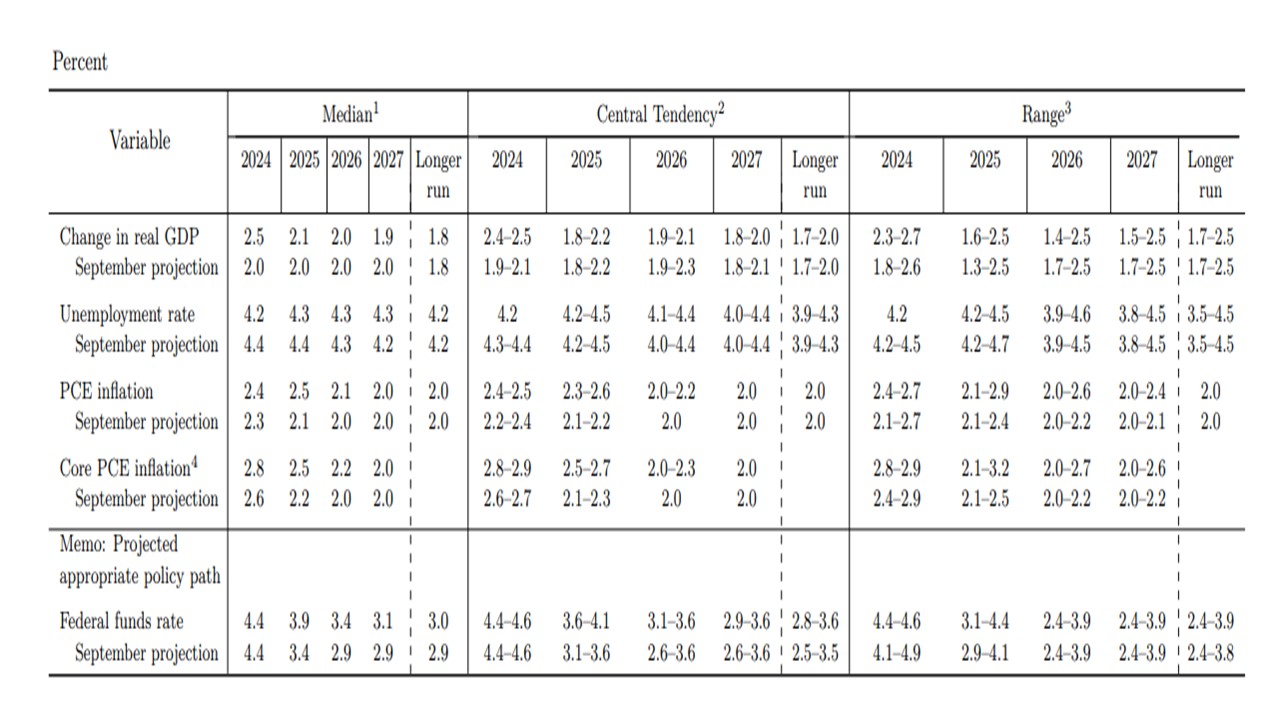

Figure 1: Fed December Summary of Economic Projections (SEP)

Source: Fed (December SEP)

Rate Cut Pace Slowing

The December FOMC statement and Fed Chair Powell Q/A provide a number of clues on prospective policy. Key points include

· Inflation revised. The median core PCE for 2025 and 2026 have been revised higher to 2.5% and 2.2% respectively, while the growth profile is consistent with the September view of 2.0%. However, in the Q/A Powell did note that the FOMC judgement was that the labor market now has more slack than 2019 and still cooling further – job finding rates/quits etc. Additionally, he appeared to feel that inflation progress to target was broadly on track, though acknowledged that central tendency for core PCE was skewed to the upside. The FOMC of course will need to take a view on the impact of economic policies from PresidentElect Trump, which we feel will likely boost the inflation profile in 2026 due to aggressive tax cuts and moderate tariffs with a neutral impact on GDP. Powell did acknowledge that the Fed had already started discussing the impact of tariffs, though without conclusions due to uncertainty over what will happen.

· Guidance on Interest rates. The FOMC statement guided that additional rate cuts will be dependent on the data; evolving outlook and balance of risks. Meanwhile, the median dots pencil in a further two 25bps in 2025, with the range being symmetric. A further 50bps is then penciled in for 2026, though the 2026 medians are more uncertain as they do not fully reflect how Trump’s policies will impact policymakers interest rate views in 2026 – though Powell indicated that some FOMC members inflation views were already being impacted. Additionally, Powell indicated that the FOMC decision was a close call, which tends to argue against a January move and a wait and see approach.

· 2025/26 rate prospects. Our read is that Fed easing will now slow with two 25bps cuts in the Fed Funds rate to 3.75-4.00%, which most likely will be delivered at the March and June FOMC meetings. Thereafter we see the Fed going on hold, both as it watches the lagged easing coming through but also as the Trump administration’s policy starts to cause concern that core PCE inflation will not come back down to 2.0%. We would pencil in three 25bps hikes Q1/Q2/Q3 2026.

· Terminal v Neutral Rate. The neutral rate median has now edged up to 3.0% and a risk exists that this could edge slightly higher in 2025. The median Fed Funds does get down to 3.1% in 2027, but the 2026 and 2027 cuts are likely fluid and uncertain – the distribution in the SEP are more dispersed than for 2025. We would suspect that the Fed visibility beyond H1 2025 is limited.