UK Gilt Vigilantes and Politics

• The Gilt market is sensitive to the prospect that Starmer/Reeves could be replaced, resulting in some changes to the fiscal rules in the scanario of a new PM/Chancellor. Further fiscal rule refinement could be possible, but a new PM would want a political reset and this would likely pressure for a small to modest change to the rules. This could cause short-term gilt market volatility, but 10yr gilt yields will likely be capped around 4.75%. Further BOE cuts will steepen the curve, but still help 10yr yields and the UK would still be on a much better 5 year fiscal trajectory than the U.S./France or Italy. Even so, a moderate softening of the fiscal rules is possible and would likely cause more lasting turbulence for gilts. Thus, UK politics need to be watched closely for the remainder of 2026.

Though UK PM Starmer survived Monday’s political crisis, the odds are that Labour could change Prime minister and Chancellor in 2026. What would be the impact on UK fiscal policy?

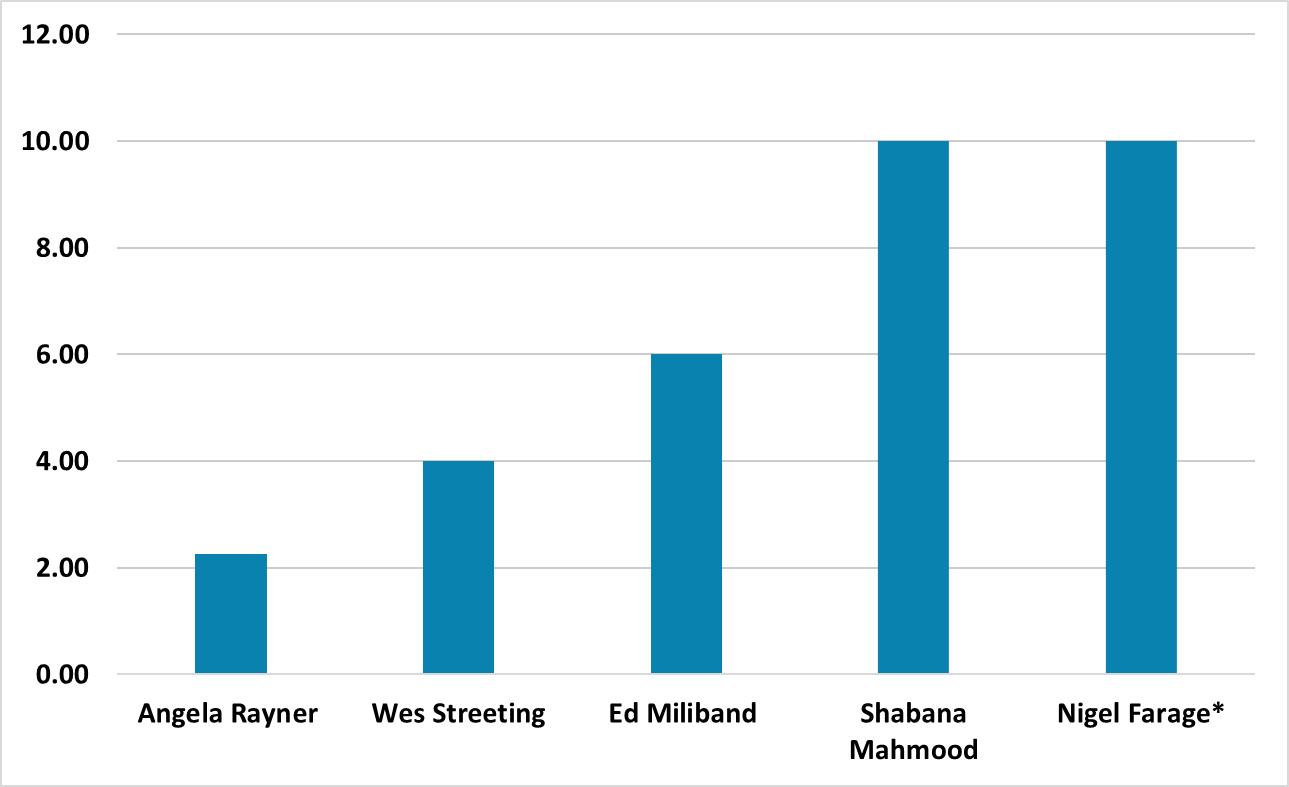

Figure 1: Betting Odds For Next UK PM After Kier Starmer  Source: Oddschecker (here) (Nigel Farage in the Reform leader and so his odds reflect expectation on a 2028/29 UK Election)

Source: Oddschecker (here) (Nigel Farage in the Reform leader and so his odds reflect expectation on a 2028/29 UK Election)

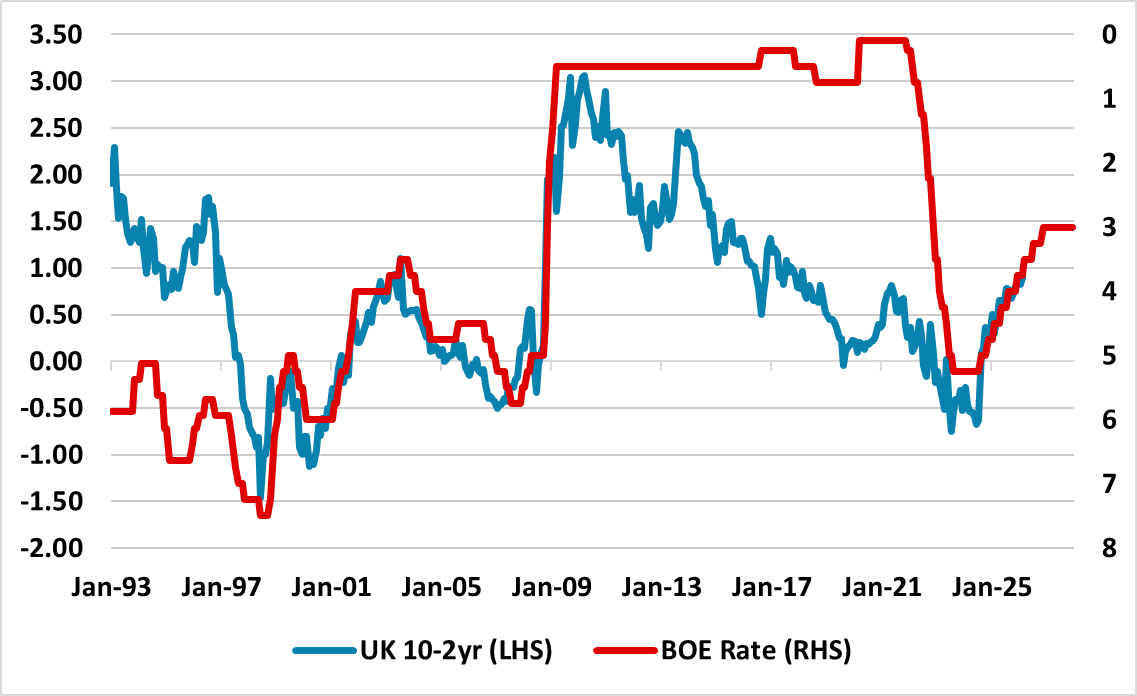

Consolidated support from Labour cabinet members and the parliamentary party appears to have sustained UK PM Kier Starmer through Monday’s political crisis. However, the betting odds remain that Starmer will likely be replaced in 2026 as Labour leader and PM. The next major hurdles are the Denton by election (Feb 26) and, more crucially, the May local and Scottish elections (May 7), with widespread expectations that Starmer will likely face a challenge after the May elections with 81 of 404 Labour MP’s needing to support each individual candidates – which suggests a small field. The betting odds suggest three main potential candidates (Figure 1), with Rayner and Miliband from the soft left side of the Labour party. This has caused some nervousness in the Gilt market. One of the best ways to look at this risk premia in the coming weeks and months is the 10yr spread between the UK and U.S. (Figure 2) and in the 2022 Truss crisis the spread went from -0.80% to +0.50%, though multi-year this is also influenced by relative policy rates.

Figure 2: 10 UK-U.S. Treasury Spread and BOE-Fed Policy Rate Spread (%)  Source: Datastream/Continuum Economics

Source: Datastream/Continuum Economics

Any new PM would need to walk a tightrope between changing the political narrative and gilt market vigilantes. While some voices in the Labour party would like to ignore the gilt market and deemphasize the OBR, any of the three main candidates know they have to keep the gilt market on board after the brutal political lesson Liz Truss learned with her failed government in 2022. However, to try and rebuild support before a 2028-29 general election (current opinion polls suggesting going early would be a disaster and 2028-29 is the best chance for Labour to try and build a post-election centre-left coalition to stop Reform getting power), a new Labour leader could likely need extra spending/tax cuts for low to median income groups alongside better communications and less frequent U turns. Though this would likely also see Chancellor Reeves replaced, the betting is towards gilt market friendly candidates e.g. Pat Mac Fadden and Torsten Bell. Two options exist.

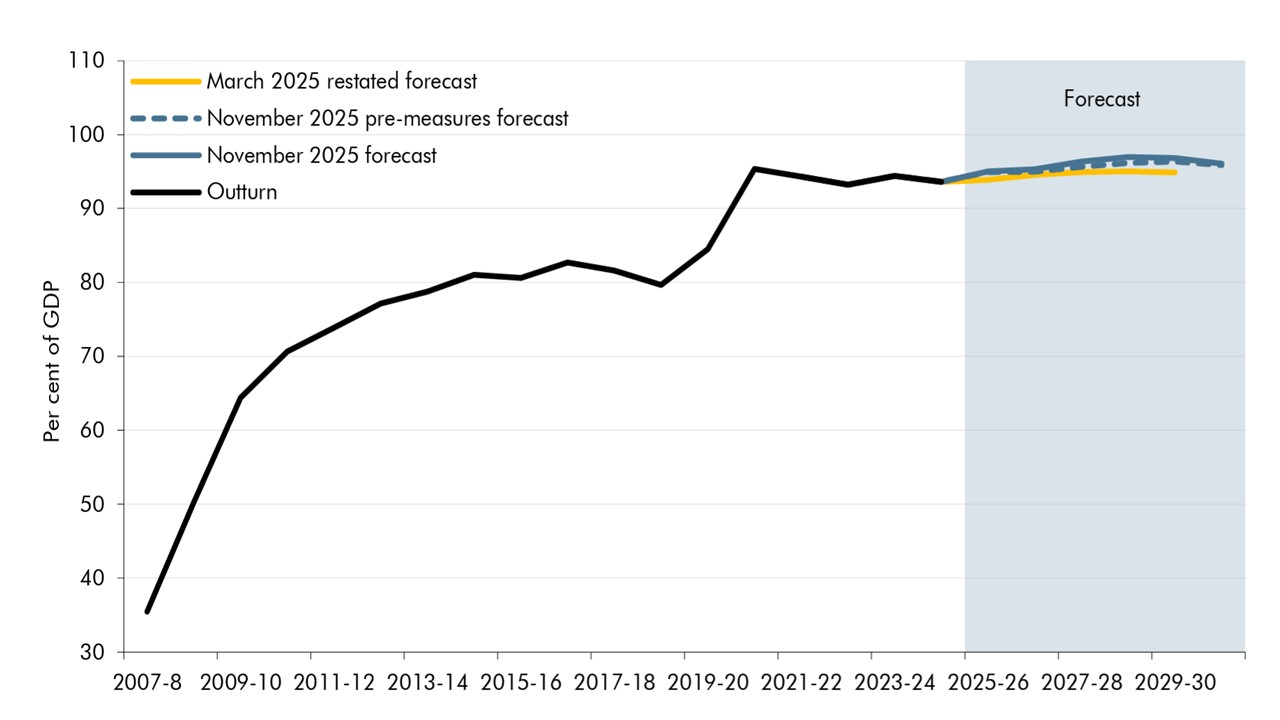

• Fiscal rule refinements. The IMF July 2025 article IV suggests a number of refinements (here p18) to make the existing fiscal rules more flexible, which would likely get acceptance from the rating agencies and the gilt market. The IMF suggested de-emphasizing headroom from Blns to pct of GDP or targeting a range for headroom rather than a pinpoint target. With the November OBR projection (Figure 3) suggesting only limited room, the gilt market would prefer this option.

• Small to modest changes to fiscal rules and broad tax hikes. To provide a new PM/Chancellor with more budget flexibility for a political reset and attempt to rebuild voter support, a small to modest change to the fiscal rule could be required – moderate or aggressive Truss style changes could quickly backfire. For example extending the target to balance day to day spending to 5 years rather than 3 years. This could end up lifting the debt/GDP ratio 1-3% cause short-term gilt market turbulence but not lasting damage. Additionally, a new PM/Chancellor could decide on broader tax hikes or wealth redistribution to fund expenditure/tax breaks for working people. This could generate turbulence for the gilt market, unless it is measured and fiscally credible, but also does not hurt growth expectations – for example Reeves employer NI backfired on growth. One wild card is that Rayner/Streeting and Milband seems more open to a EU custom deal to boost growth, which if it occurred would need to be factored in by the OBR.

Figure 3: OBR Net Debt/GDP Projections (%)

Source: November OBR

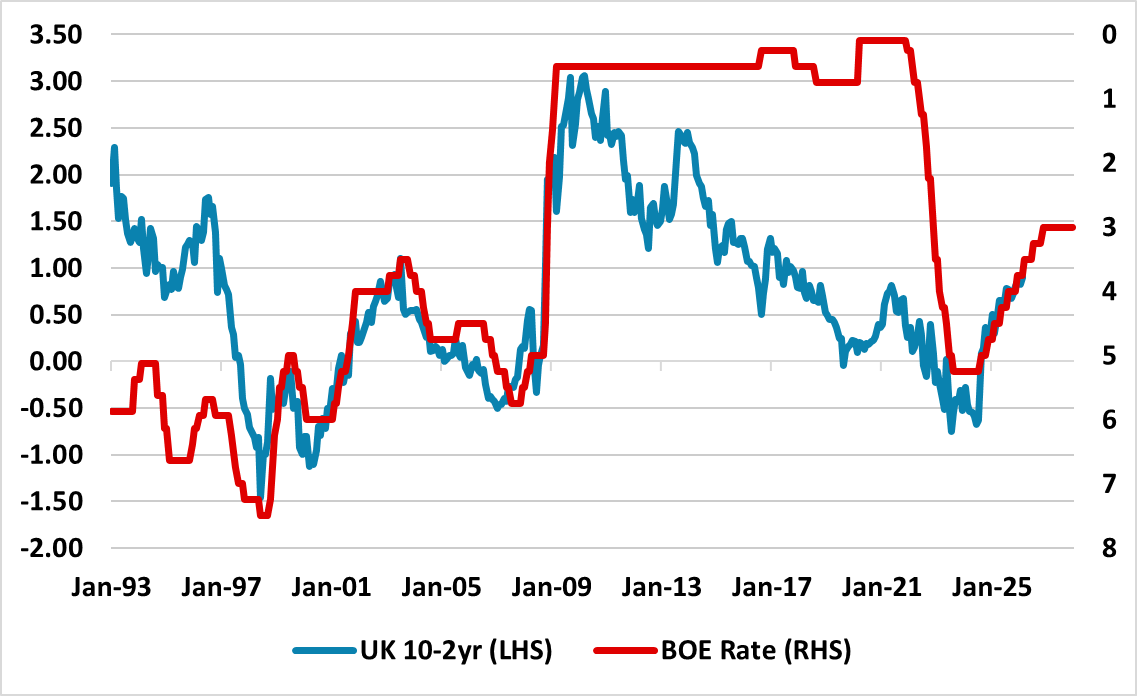

What a new PM and Chancellor can pencil in is more BOE rate cuts, as a weak jobs market and disinflation will likely deliver a 25bps cut in March (here) and two further cuts to 3.00% most likely in July and November/December. This should drag 2yr down to 3.30-40%. While the 10-2yr normally see a bull steepener during rate cutting cycles (Figure 4), declining BOE Bank rates and 2yr yields could at a minimum provide a cap on outright 10yr gilt yields just above current levels and provide any new PM/Chancellor with more room to maneuver. Additionally, we see the BOE slowing the rundown of the gilt portfolio to £50bln per annum from September 2026 and £30bln per annum from September 2027. One of the reasons for current 10yr gilt yields is fiscal woes, but another is the scale of BOE QT at over 2% of GDP.

Figure 4: 10-2yr UK Gilt Curve and BOE Bank Rate Actual and Forecast (%)

Source: Datastream/Continuum Economics

Source: Datastream/Continuum Economics