China: Yuan Outflow Fears Versus Net Exports

Despite a still overvalued Yuan, China authorities are reluctant to accept too much Yuan weakness for fear of causing domestic capital outflows and discontent with China’s government. At some stage, if GDP growth surprises on the downside, China authorities could decide that a controlled Yuan decline could be more important from a net export viewpoint – especially as inflation fears are not a worry.

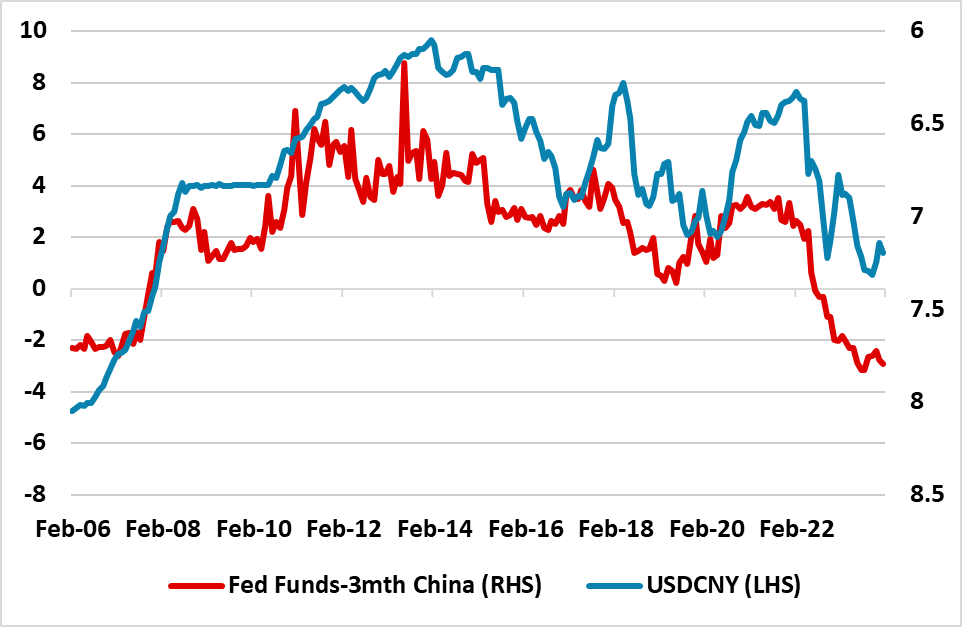

Figure 1: USDCNY and Fed Funds-3mth China Interbank Rate (%)

Source: PBOC/Continuum Economics

Source: PBOC/Continuum Economics

China authorities remain concerned that adverse interest rate differentials versus the U.S. could not only cause Yuan weakness but accelerate capital outflows. The decision to aggressively cut the 5yr loan prime rate by 25bps (here), despite no cut in the PBOC key 1yr medium-term facility rate is a balancing act to avoid fuelling Yuan weakness. One concern is that cuts in short-dates at the time of still high U.S. interest rates could prompt the Yuan to fall to 7.50. However, perhaps greater is concern that domestic residents could try to circumvent capital controls more aggressively, if they see too weak a Yuan.

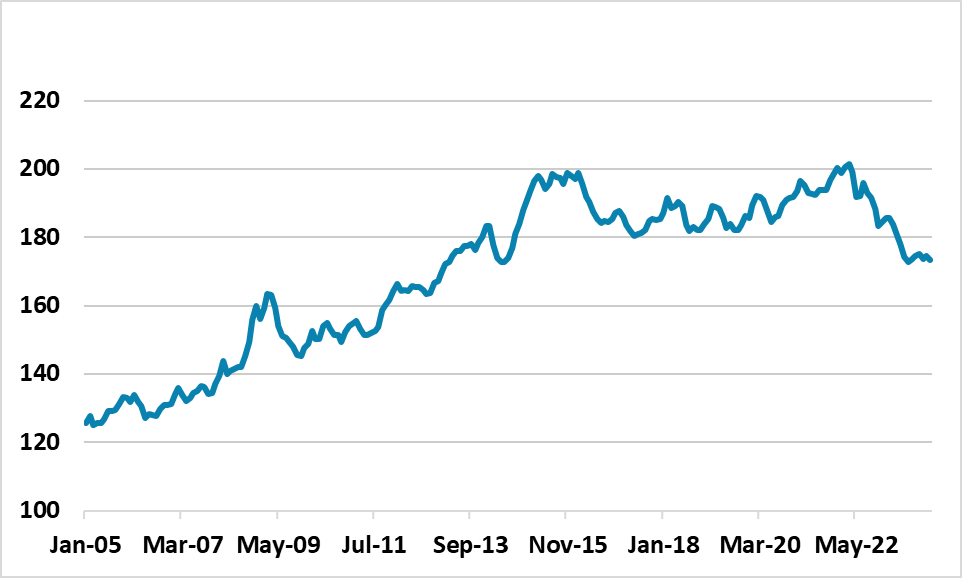

Though China authorities are avoiding too large a decline in the Yuan for now, this policy means that China competitiveness is not the best. Looking at the real effective exchange rate (Figure 2) shows that the Yuan is overvalued, despite falling from the 2022 peak. Negative inflation in China versus moderate inflation elsewhere also mean that the real exchange appreciates if the nominal value of the Yuan is steady.

Figure 2: China Real Effective Exchange Rate  Source: Continuum Economics

Source: Continuum Economics

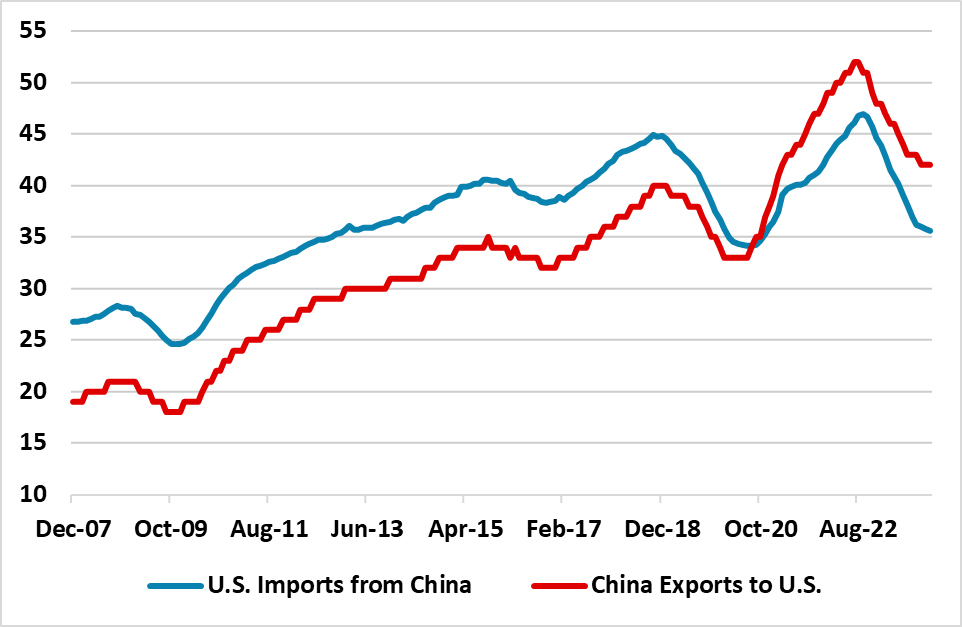

Worse still the Yuan lack of competitiveness is just one problem that China faces externally. Net exports are not adding to China growth, as an offset to the negative drag from the residential property sector. Indeed, against the U.S. (Figure 3) and EU, China’s exports are losing market share over the past couple of years. The shift post COVID towards on shoring some sectors and friendly shoring post Russia invasion of Ukraine has helped to shift supply chains. Additionally, China centric supply chains are also suffering from fears of a China-Taiwan war and U.S./China strategic competition and this is prompt some production chains to be switched out of China. This trend is sufficient that net exports will likely be a small drag on GDP growth again in 2024. At some stage, if GDP growth surprises on the downside, China authorities could decide that a controlled Yuan decline could be more important from a net export viewpoint – especially as inflation fears are not a worry.

Figure 3: U.S. Imports From China (U.S. data) and China Exports to U.S. (China Data) (USD Blns 12mth MMA) Source: Datastream/Continuum Economics

Source: Datastream/Continuum Economics