China: 5yr LPR Cut But Not 1yr LPR

A larger than expected 25bps cut in the 5yr Loan Prime Rate (LPR) has been delivered, but the 1yr LPR rate was unchanged given that PBOC reluctance to cut the 1yr Medium-Term Facility rate (MTF) this month. The 5yr LPR rate is not a game changer for residential property, as bigger policy moves are required (e.g. nationalisation of property developers and large scale fiscal transfer to households).

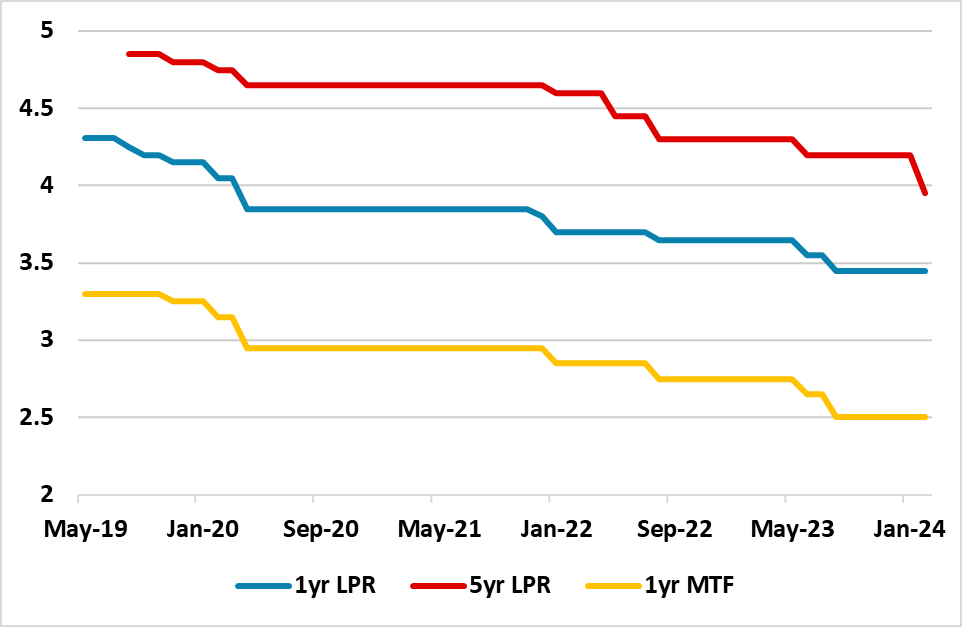

Figure 1: China 1yr MTF Rate and 1 and 5yr LPR Rate (%) Source: PBOC/Continuum Economics

Source: PBOC/Continuum Economics

The cut in the 5yr LPR rate is not a surprise after official hints, but the size is larger than expected at 25bps. This suggests that China authorities decided to push the banks into a larger cut to help trigger larger mortgage rate cuts, as they are priced off the 5yr LPR rate. This shows that the authorities are becoming more concerned by the continued negative impact of residential property on the economy.

However, the 25bps cut is not a game changer in itself. Home sales in the lunar New Year period are reported to have been very weak, with CRIC data suggesting a 40% Yr/Yr drop in metres sold. Sentiment towards residential property remain depressed and is unlikely to be lifted by cheaper finances for new properties alone. Tier 1 and 2 prices remain high relative to incomes, while households are concerned about instability among property developers. Additionally, households are suffering increased uncertainty post COVID from slow GDP and employment growth. A combination of nationalisation of property developers to underpin building confidence, plus a larger fiscal transfer to households, could be game changers. However, these are likely too aggressive for the authorities and this means that the multi-year hangover from the property sector will likely remain a negative drag via less housebuilding, cement and steel production/less construction employment and subdued spending among households for furniture and durable goods. This is one of the main reasons why we continue to forecast 4.2% growth in 2024.

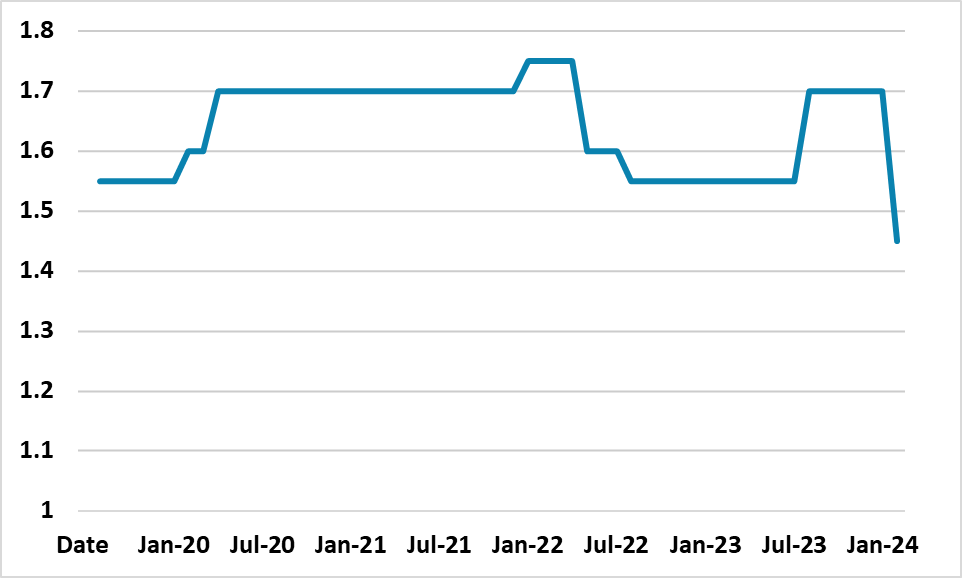

The reason that the 5yr was cut and the 1yr LPR rate was not is due to concerns for China authorities on the Yuan and the risk of capital outflows. With the Fed easing being delayed, China has been reluctant to cut the 1yr MTF and LPR rate in case it produces too much Yuan weakness. However, the spread between the 5yr LPR rate and 1yr MTF rate is now low (Figure 2). While we do forecast a March cut in the 1yr MTF rate, we only see 10bps reduction due to caution over the Yuan. We do see an additional 20bps of MTF cuts in H2 2024, but this will likely come once the Fed has started easing and thus reducing the risk of too much Yuan weakness.

Figure 2: China 5yr LPR- 1yr MTF Rate (%) Source: Continuum Economics

Source: Continuum Economics