UK GDP Preview (Oct 11): Moderating Momentum?

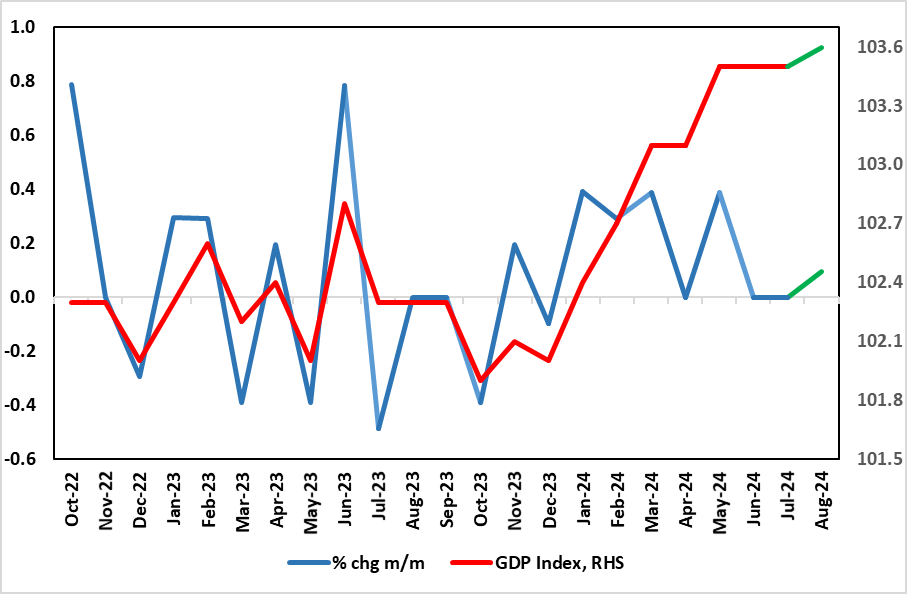

Much has been made of the UK’s economy’s apparent solidity, if not strength, so far this year given sizeable q/q gains in the first two quarters of the year of 0.7% and 0.5% respectively. But this may be something of a flash in the pan, not least as GDP growth has been positive in only one of the last four months of data with flat readings in both June and July (Figure 1). We see a better outcome in August but only a below consensus 0.1% m/m rise, despite a clear and already reported rise in retail sales, helped by more normal seasonal weather. Instead, we think still softening housing market transactions and weak manufacturing (particularly for vehicles) will hold back recorded August activity. In addition, it will be interesting to see how the revised down Q2 GDP reading is attributed amid the relevant months, possibly adding to the actual weak recent pattern alluded to above.

Figure 1: Momentum Ebbing??

Source: ONS

Surprising to the downside, the economy failed to show more positive signs with the July GDP data. Indeed, GDP was flat in m/m terms for the second successive month, compared to a 0.2% m/m rise wisely envisaged. Thus the data still show showing volatility, as GDP growth has been positive in only one of the last four months of the last quarter (Figure 1) with the latest softness large due to a divergence between (solid) services and fresh goods output declines. Regardless, the lack of growth in Jun/Jul has created a soft base effect for Q3 growth which we see advancing just 0.1%, a quarter of the BoE estimate. This weaker immediate GDP backdrop is something that chimes more with labor market and public borrowing data and where HMRC payrolls paint a much softer backdrop and possible outlook that also conflicts very much with PMI survey numbers. Indeed, it could be argued that the labor market data (probably alongside growing fiscal considerations) may have had more impact on BoE thinking, this possibly one factor that persuaded Governor Bailey to hint at more aggressive rate cuts despite the resistance of his Chief Economist.