UK GDP Preview (Nov 15): Momentum Slowing?

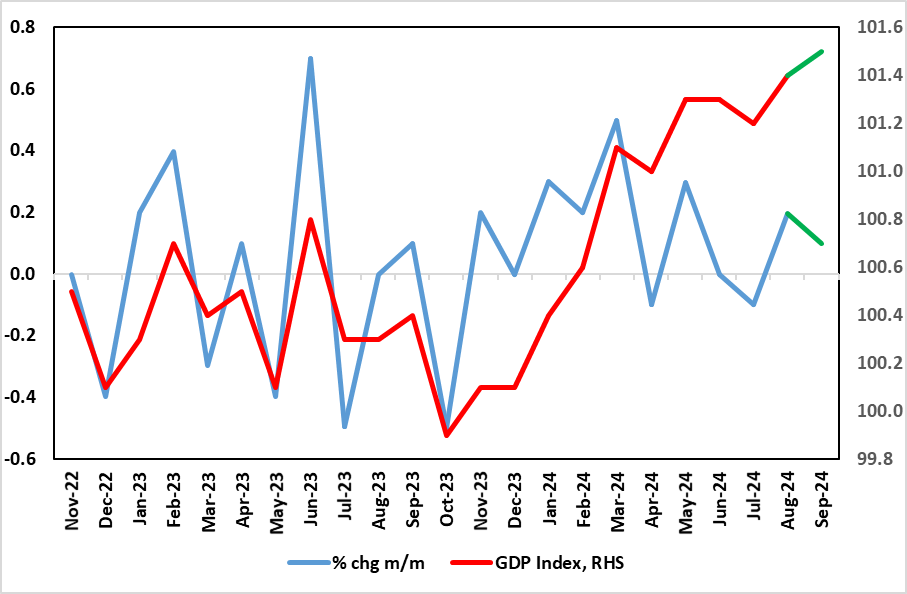

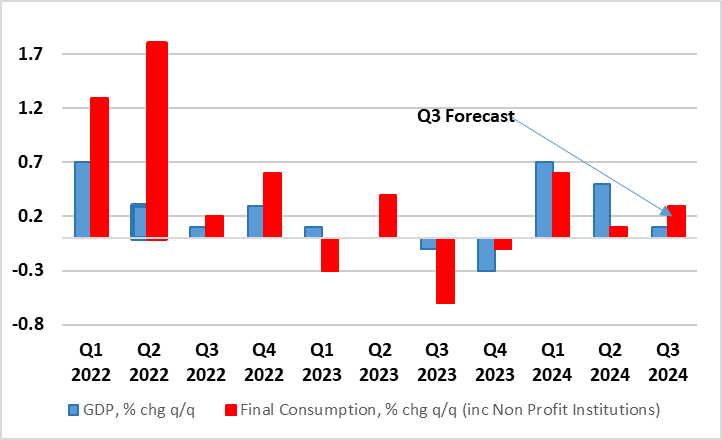

Much has been made of the UK’s economy’s apparent solidity, if not strength, so far this year given sizeable q/q gains in the first two quarters of the year of 0.7% and 0.5% respectively. But this may have been something of a flash in the pan, not least as GDP growth has been positive in only two of the last five months of data with flat and pared-back readings in both June and July before a better August outcome. Even with a further small rise likely to September of 0.1% m/m, we see Q3 GDP rising by no more than 0.1-0.2% q/q, albeit with consumer spending perking up a little (Figure 2). The GDP projection is just below the BoE projection for the quarter and the BoE estimate of an underlying pace – and with downside risks also to the 0.2% Q4 projection we have – this being flagged by business survey data and also more consistent with employment now contracting.

Figure 1: Momentum Ebbing?

Source: ONS

Monthly real gross domestic product is estimated to have grown by 0.2% in August 2024, after showing no growth in July 2024. Real GDP is estimated to have grown by 0.2% in the three months to August 2024 compared with the three months to May 2024. Services output grew by 0.1% in August 2024, following an unrevised increase of 0.1% in July 2024, and grew by 0.1% in the three months to August 2024. Production output grew by 0.5% in August 2024, following a revised fall of 0.7% in July 2024 but showed no growth in the three months to August 2024. Construction output grew by 0.4% in August 2024, following an unrevised fall of 0.4% in July.

As for September, we see mild weather curbing utility and manufacturing falling afresh, something already hinted at by car production numbers. There may be small boost from real estate, but with something of an imponderable being the public sector which had been clearly boosting activity in H1, but may now be flattening out, if not reversing.

Figure 2: Domestic Weakness?

Source: ONS