Russia’s Inflation Continued Its Rally in June: 8.6% YoY

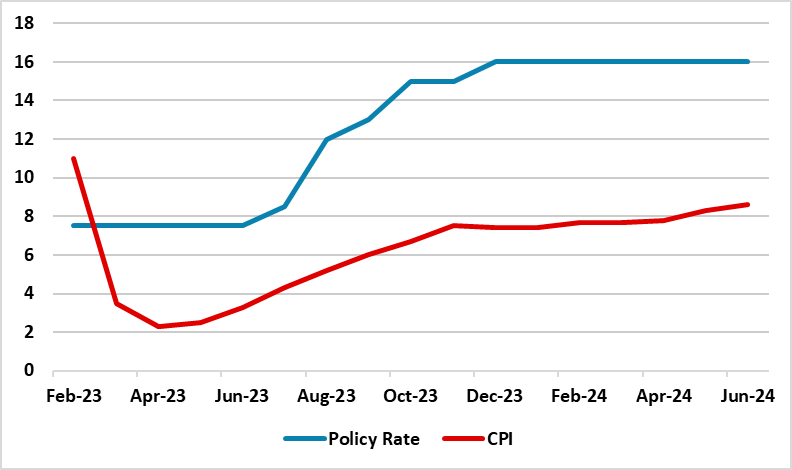

Bottom Line: According to Russian Federal Statistics Service data released on July 10, inflation jumped to 8.6% YoY in June after hitting 8.3% YoY in May, the highest reading since February 2023, due to strong military spending, tight labour market, and fiscal policy igniting domestic demand. The new set of sanctions by the U.S. Department of Treasury targeting the country’s financial system on June 13 likely started to lift the cost of doing business, coupled with higher costs for both food and services which further stoked inflation in June. Given inflationary risks and Central Bank of Russia’s (CBR) hawkish forward guidance, we expect the CBR to increase the key rate by 100 bps to 17% at the next policy rate meeting on July 26, as strongly signaled by CBR Governor Nabiullina last week.

Figure 1: CPI (YoY, % Change) and Policy Rate (%), February 2023 – June 2024

Source: Continuum Economics

According to Rosstat figures, the inflation rate continued its upward trend and hit 8.6% YoY in June. Despite price growth slowed to 0.64% from 0.74% in May, it still remains elevated, driven by the food and services prices which rose by 0.63% and 1.06% MoM, respectively. Core CPI recorded an 8.73% YoY increase in June while it was 8.64% YoY in May. We think the inflationary pressures remain strong basically due high military spending, strong fiscal policy, demand-cost pressures stemming from high demand, and tight labor market.

In addition to the war in Ukraine overheating the economy, the new set of sanctions by the U.S. Treasury Department targeting the country’s financial system on June 13, has prompted the Moscow exchange to hold trading of dollars and euros, and likely started to ignite the cost of doing business contributing to inflation.

Taking into account restrictive monetary policy partly suppresses prices with lagged impacts, we feel cooling off inflation will not be straightforward as it is likely that the inflation would remain higher than CBR’s expectations in H2 2024 as we envisage annual average inflation to record 6.9% in 2024 partly due to adverse base effects, and surges in food and services prices.

It is worth noting that June’s 8.6% YoY inflation remained far above the CBR’s 2024 forecast range of 4% - 4.5%, and CBR’s medium term target of 4%. CBR highlighted in its statement on June 7 that "Returning inflation to the target will require a significantly longer period of maintaining tight monetary conditions in the economy," and added it holds open the prospect of increasing the key rate at a future meeting.

As CBR Governor Elvira Nabiullina also signaled last week that a rate hike is likely on July 26 and indicated that "I think the main subject of discussions will be the step of the rate hike," we foresee CBR will hike the rate by 100 bps to 17% due to surge in inflation, increase in cost of borrowing, and negative impacts of new sanctions. CBR can also decide to impose a higher rate hike, and will likely not start cutting the rates until the end of 2024 under current circumstances.

As mentioned, the risks to the outlook remain strong as the fiscal policy making a big contribution to domestic demand coupled with military spending due to ongoing war in Ukraine. The risk is even higher as a larger Russian offensive operation already started in Kharkiv and Donetsk which continue to pump up the military expenses.