BOE March Cut and Then More

· Six members of the MPC appear worried about the disinflationary impact from a weak economy and four of whom actually voted for a 25bps cut at the February meeting. BOE Bailey and Mann, looking at the MPC minutes, are very close to voting for a rate cut, which suggests high confidence that a 25bps cut will be delivered at the March MPC meeting and this is our forecast rather than April.

· Indeed, we have long argued that the weak economy/tight financial conditions would build the case for three 25bps cuts in 2026 to 3.00% and Mann’s conversion away from a hawk to a centrist only increases our confidence, alongside economic data and wage inflation that suggests CPI will come down. We pencil in these two extra cuts for the June or July and November and December (the timing of the Budget statement will impact the timing of a cut to 3.00%).

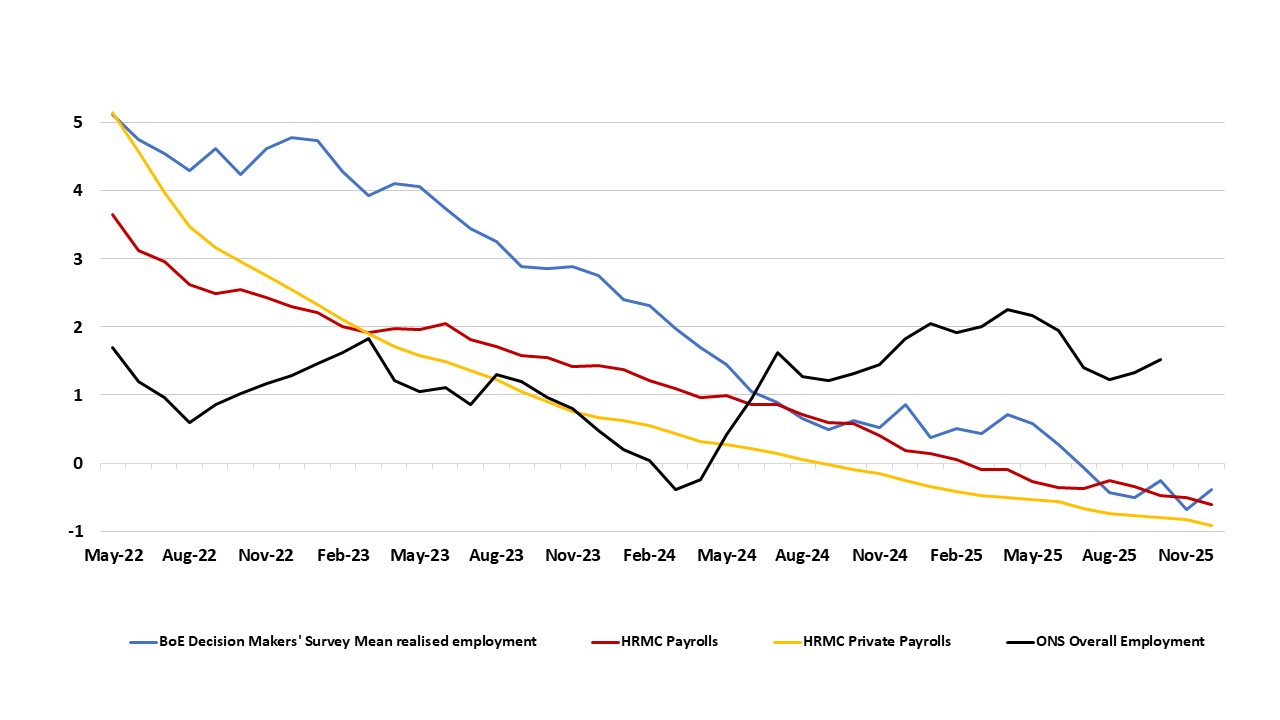

Figure 1: Marked Downgrade to Medium-Term Inflation Outlook

Source: BoE Monetary Policy Report, CE

With no change widely expected, the February close vote and MPC minutes provide some critical clues.

· BOE Minutes and Bailey/Mann view. The February MPC minutes are perhaps the most interesting with Andrew Bailey and Catherine Mann having greater confidence that the inflation persistence risk would be mitigated by the lower near-term path for inflation and placed greater emphasis on the risks to inflation from weaker activity. It only needs one of these members to vote for a cut in March and a 25bps cut will be delivered (given that four voted to cut 25bps today) and we are now confident that a 25bps cut will be delivered. The BOE Monetary policy report forecasts have reduced Q1 2026 and 2027 GDP and Q1 2027 and Q1 2028 CPI inflation forecast (Figure 1) and Bailey noted in the press conference that most on the MPC agree with this changed picture, which also builds the case for BOE Bank rate cuts in March and beyond.

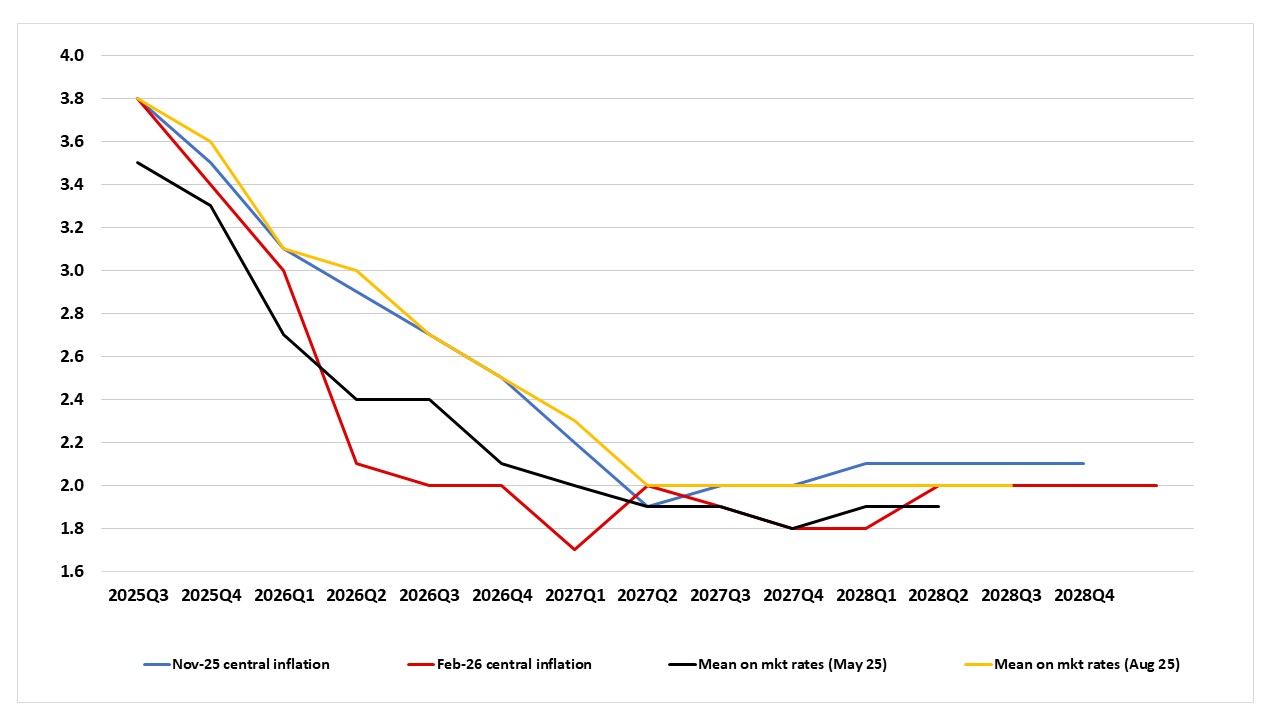

· Given the incoming weak economic data, plus poor political and economic mood, the significance of Mann switching away from a hawk to a pragmatist also increases our confidence that the two further cuts we forecast for 2026 to 3% will be delivered. We see a 2nd cut to 3.25% being delivered at the June or July BOE meeting, as the MPC now appears to be comfortable in reaching a decision at any meeting rather than with monetary policy reports. Though Bailey in the press conference noted the normal caveat that decisions will be close calls as we get close to the neutral rate, weak economic data will mean that the BOE will not automatically stop at Bailey or Mann view of neutral policy rate and could go modestly below their estimates. Bailey in the individual paragraph sees some further scope for easing, as the wage disinflation helps CPI towards the inflation target – he also emphasized this in the press conference. Meanwhile, Catherine Mann notes that new analysis and current developments have moved the appropriate time for a cut in Bank Rate closer. She is less worried about inflation persistence and more worried that private sector activity and employment continue to be soft. We have remained concerned that the underlying conditions in the labor market remain soft and can slow income and then consumption growth and curtail any economic rebound or hurt the economy. We place more weight on the HMRC employment data (-45k in December) and jobs survey numbers than ONS data, see Figure 2.

Figure 2: Employment Trends (Yr/Yr %)

Source: HMRC/ONS

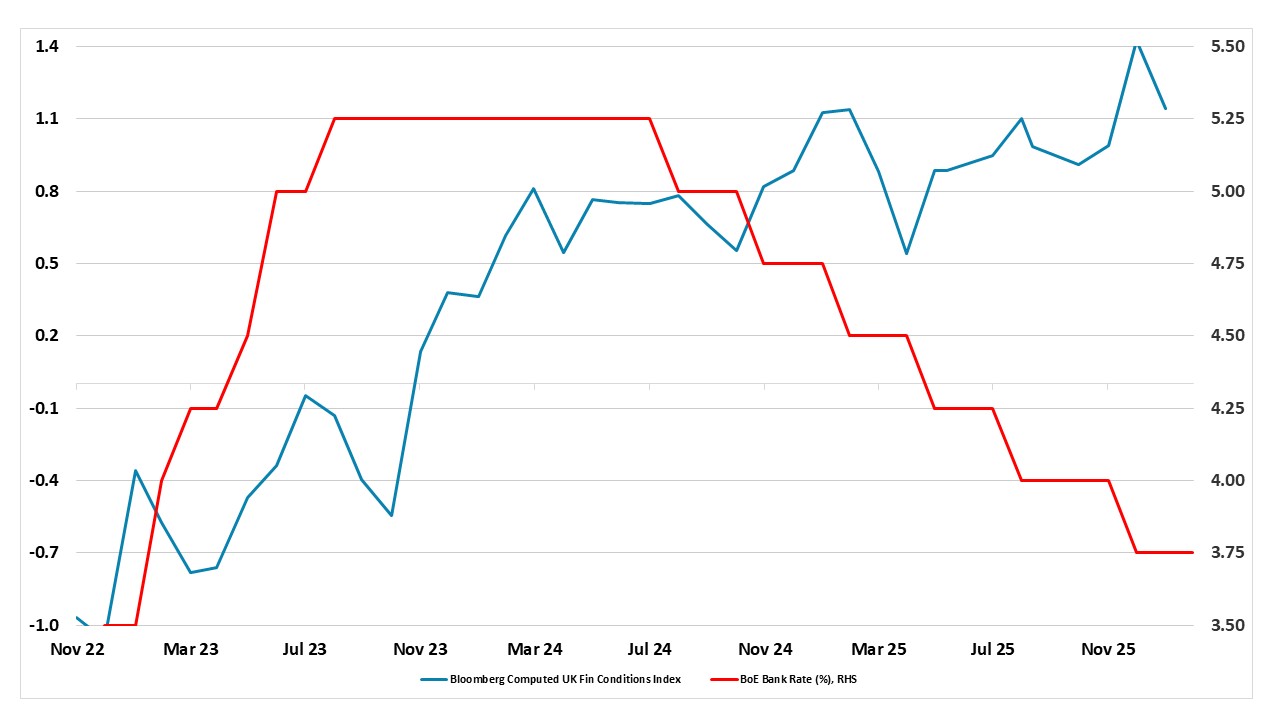

· Tighter Financial Conditions than BOE Bank Rate. Once again the MPC suggest that it has reduced the restrictiveness of policy has fallen as Bank Rate has been reduced by 150 basis points since August 2024. We think this is a complacent, if not misplaced, analysis, given that the monetary policy’s impact encompasses more than just the official policy rate, instead taking in bond rate, spreads and the exchange rate. Indeed, a barometer of financial condition actually suggest a more restrictive backdrop is still unfolding even given the drop in Bank Rate (Figure 3). This is partly backed up by the BoE Agents survey (released alongside this policy decision) in which small firms still report that ‘high street bank credit is not available’.

Figure 3: BOE Bank Rate and Financial Conditions (% and level)

Source: Bloomberg, BOE Continuum Economics