India CPI Preview: A Cautiously Optimistic Outlook

Bottom line: India's inflation rate for October is projected to ease to 5.2% y/y due to base effects and domestic food prices. Moderating food pressures and global commodity prices will see inflationary pressures ease in the coming months.

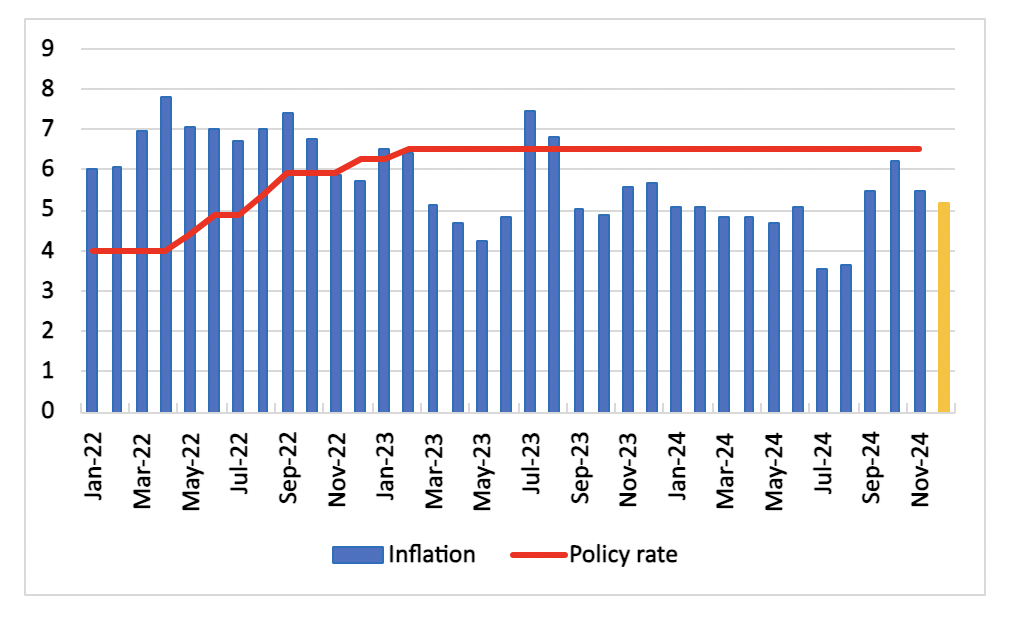

Figure 1: India Consumer Price Inflation and Policy Rate (%)

Source: MOSPI, Reserve Bank of India, Continuum Economics

India's inflation outlook appears to be stabilising as December 2024 inflation is set to moderate to 5.2% from 5.5% in November. This anticipated decline offers a welcome shift from the persistent price pressures that have plagued the economy over the past year, particularly in food prices. The sharp correction in vegetable prices, notably tomatoes, onions, and potatoes, has significantly eased inflationary pressures. These vegetable prices, which have witnessed substantial drops in early January, are expected to continue their downward trend thanks to improved marketplace arrivals and favourable weather conditions.

The easing in food inflation is a critical development, as food prices make up nearly half of India's CPI basket. After months of sharp rises in vegetable costs—often double-digit increases—moderation has come as a result of the summer crop harvest, bolstered by favourable monsoons. This has brought some relief to the overall inflation picture, which has been exacerbated by global commodity prices, such as those for edible oils, which have also stabilised.

Looking forward, the inflation trajectory remains cautiously optimistic, although external risks persist. The depreciation of the rupee could trigger higher imported inflation, potentially dampening the positive domestic trends. Nonetheless, domestic factors, including the ample supply of cereals and pulses, are expected to keep inflation in these segments under control.

This moderation in CPI inflation provides a critical respite for policymakers, who may now find themselves in a position to support the economy with an interest rate cut. The Reserve Bank of India (RBI) is likely to reduce its key policy rate by 25 basis points to 6.25% in its February meeting, as the economy struggles to maintain growth momentum. Yet, inflation is unlikely to return to the RBI’s medium-term target of 4% until at least the second half of 2026. While price pressures are easing, global and domestic factors suggest inflation will remain a key issue for the foreseeable future.