India CPI Review: Easing Prices, but Monsoon Risks Loom

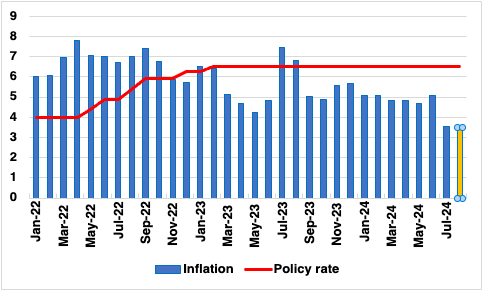

Bottom line: India’s August inflation level is expected to trend down to 3.5% yr/yr, from 3.53% y/y in July, reflecting higher base effects. Interest rate cut is unlikely though as the RBI perceives this as a temporary reprieve.

Figure 1: India Consumer Price Inflation and Policy Rate (%)

Source: MOSPI, Reserve Bank of India, Continuum Economics

India's upcoming Consumer Price Index (CPI) data is expected to show a continued moderation in inflation, with a forecast of 3.5% yr/yr in August, marginally lower than July’s 3.54%. This trend is primarily driven by the high base effect from last year and a recent easing in food prices, which account for nearly half of the inflation basket. However, this reprieve may be short-lived as erratic monsoon patterns pose a significant risk to the inflation outlook in the coming months.

Food inflation has softened considerably over the past two months, thanks in part to a recent recovery in monsoon rains that improved crop conditions in some regions. Vegetable prices, which surged by nearly 30% year-on-year earlier this year, eased to 6.83% in July, providing some much-needed relief to households and policymakers alike. However, this moderation comes against the backdrop of a high base effect from last year, which is expected to fade in the months ahead. The monsoon’s uneven distribution across key agricultural states remains a major concern. While recent rains have helped alleviate some of the pressure, overall rainfall deficits in critical crop-producing regions could still harm yields. This may push food prices higher in the coming months, particularly if the late-season rains are heavier than needed, disrupting harvesting and transportation.

Currency weakness is another factor likely to keep inflation elevated in the near term. A weak rupee could increase the cost of imports, particularly for essential commodities like oil, adding upward pressure on prices despite the current dip in food inflation. This dynamic suggests that while headline inflation may remain subdued in the immediate term, core inflation pressures could persist, driven by imported inflation.

In our view, the RBI will proceed cautiously on any potential rate cuts. Although a rate cut was initially expected in the next quarter, the likelihood of a December cut has grown, given the inflation outlook's temporary reprieve. We expect the RBI to keep a close eye on evolving weather patterns, currency movements, and global commodity prices as it navigates its policy decisions. The recent easing in inflation provides a window of opportunity, but the underlying risks indicate that this calm may be temporary, warranting careful monitoring in the months ahead.