China: Surprise 7 Day Reverse Repo Rate Cut

China 10bps cut in the 7 day reverse repo rate and 1 and 5yr Loan Prime Rate (LPR) was sooner than expected, as a move had not been anticipated until the Fed cuts rates. However, this is not the start of a new aggressive policy phase, but rather a tactical move given the targeted nature of easing.

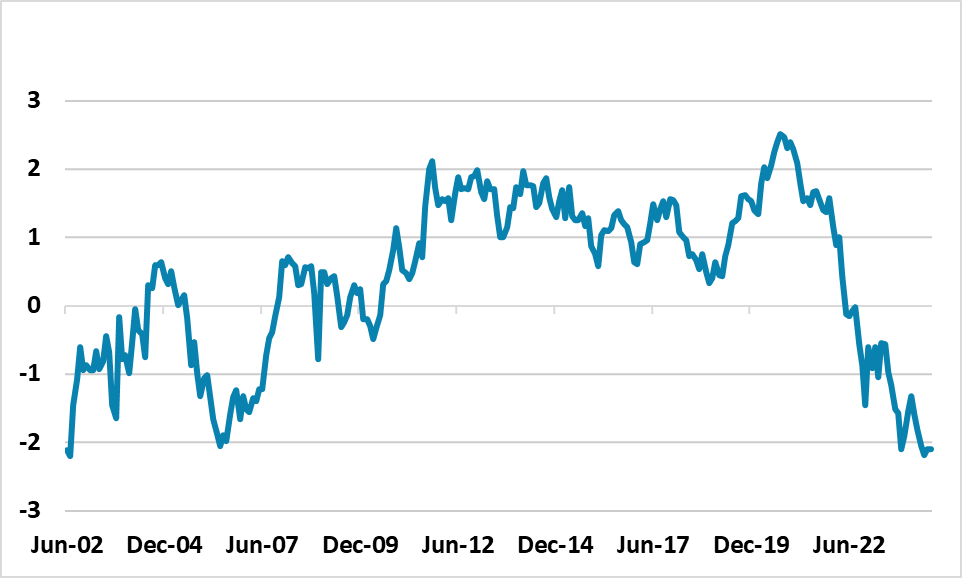

Figure 1: 10yr China- U.S. Treasury Government Bond Spread)

Source Datastream/Continuum Economics

China decision to ease the 7 day reverse repo rate from 1.80% to 1.70% reflects a shift away from the 1yr medium-term lending facility rate as the key policy tool, as it allows more flexibility in timing. A 10bps cut in the 1 and 5 yr LPR rate then also occurred today. A move had not been anticipated until September or October after the 1 cut from the Fed to avoid excessive weakening in the Yuan.

However, the move is likely tactical within the framework of targeted easing, rather than signaling a shift towards aggressive easing. Firstly, the 10bps scale of the move is modest rather than large, while officials have also maintain communications in the wake of the 3 plenum last week that suggests targeted policy action. Secondly, the monetary policy move could be a political signal to actually deliver something from the plenum, given the lack of major announcements. We would expect that the next monetary policy easing will be a 25bps cut in the RRR rate in August or September and then a further 10bps in the 7 day reverse repo rate in Q4.

One alternative is that the rate cut is designed to soften the Yuan before the U.S. election. If Donald Trump is elected then he is likely put pressure on the USD to decline and for the Yuan to appreciate from weak levels. In 2018, China reacted to Trump’s tariff hikes by allowing a weaker Yuan, but China authorities may feel that some Yuan adjustment could be warranted before the U.S. election. We think this could be a consideration and we still look for 7.40 on USD/CNY by end 2024, though we do feel that China authorities would be reluctant to see a quick Yuan depreciation as it could cause domestic capital flight.