China September Data Rotates Higher, But

Q3 GDP and September monthly figures were slightly better than expected. Combined with a speed up of local government spending in Q4 and more completion of uncompleted homes, we change our 2024 GDP forecast to 4.8% v 4.6%. However, despite a further Yuan1.5-2.0trn of fiscal stimulus to come, we still see 4.5% 2025 GDP. Stimulus is not focused on the consumer, while the residential housing market has not bottomed in construction or sales terms.

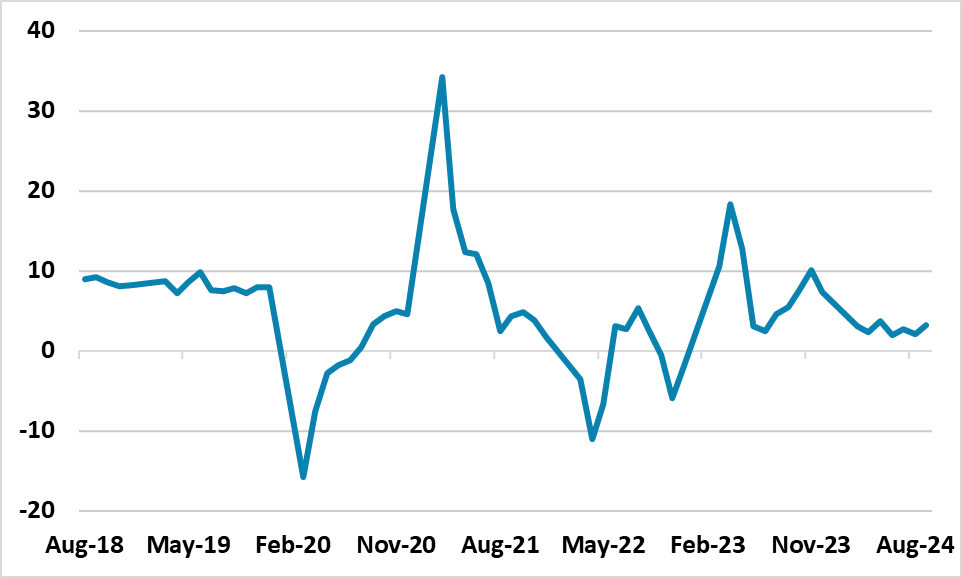

Figure 1: Retail Sales Yr/Yr (%)

Source: Datastream/Continuum Economics

Q3 GDP and September monthly data key points of note are

· Real GDP stabilizes, GDP Deflator Negative. The 4.6% Yr/Yr for Q3 was somewhat better than expected and stabilizes after the downward trend in recent quarters. However, Q/Q was +0.9%, while the GDP deflator was -0.6% Yr/Yr. We are revising our 2024 GDP forecast up from 4.8% to 4.6% for a number of reasons. Firstly, local authorities are expected to speed up spending in Q4, both as they have been slow so far this year and due to central government pressures. Secondly, the government is putting emphasis on finishing uncompleted homes, with reports that gross lending by banks will be boosted from Yuan2trn to Yuan4trn – the net figure is less clear however. Thirdly, government trade in funds for housing appliances had an impact in September retail sales (+20.5% Yr/Yr v +3.4% in August) and this will still have a modest help in Q4. It could be that GDP turns out at 5.0% for 2024, but this would likely be accompanied by more deflation – the disaggregation of nominal GDP into real GDP and GDP deflation is tricky.

· September data better, but. Industrial production Yr/Yr was higher than expected at 5.4% v 4.6% expected, with high tech manufacturing buoyant and auto production getting less worse at -1.0% Yr/Yr. However, cement and steel production still maintain substantive falls, due to the bust in residential property construction. Retail sales at 3.2% Yr/Yr was also better than expected v 2.5% expected. Home appliance surged helped, with good sales of communication devices. However, the post COVID surge in eating out appears over, with restaurant spending slowing further to +3.1% and jewelry remain weak – autos were less bad but still -0.4% Yr/Yr.

· 2025 4.5%. We are keeping out 2025 GDP forecast at 4.5%. The breakdown of the September data suggests that the economy remains unbalanced and signs of consumer weakness remain evident. Though fiscal stimulus will be announce late October by the National People Congress, we see this totaling Yuan1.5-2.0trn for 2025 (here). The lack of major fiscal stimulus for households will not lift the gloom for consumption. Meanwhile, we still see residential investment construction subtracting from GDP. Though more uncompleted homes will now likely be finished, this is likely to be at the cost of new starts. Meanwhile, despite the recent anecdotal bounce, most households will remain cautious about buying until the market is seen to have properly bottomed – which would likely require house prices to consistently rise.