UK Budget Preview (Oct 30): More Tax and More Spend

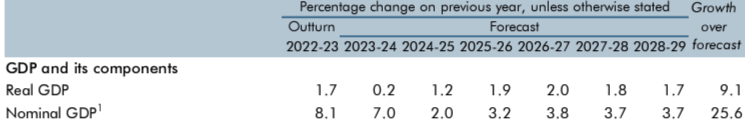

With speculation that the Chancellor faces a £ 40 bln funding gap which will be addressed largely through tax rises, it seems as if the UK economy faces a larger fiscal tightening than was planned under the previous government. However, with promoting growth the policy priority, the Chancellor is hardly going to create economic added headwinds. Instead, that funding gap has emerged as a means to pay for added government spending that will be partly set out in the Spending Review published alongside he Budget. Thus it seems likely that the Budget measures will actually be less restrictive and should therefore reinforce the Office for Budget Responsibility’s already relatively upbeat growth outlook (Figure 1).

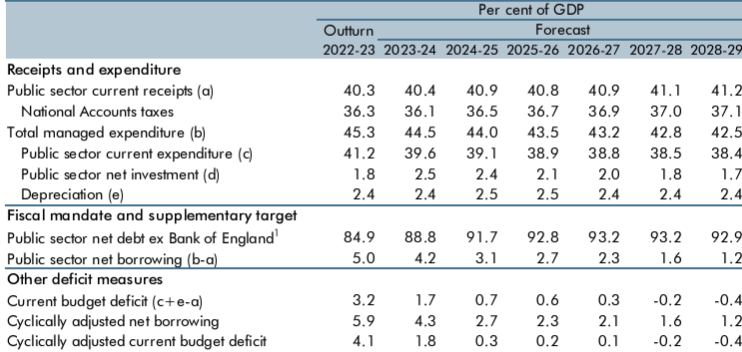

In some ways the Chancellor is pinned down by her new fiscal rule, this stating that the current budget must be brought to balance. But with existing fiscal plans (Figure 2) actually pointing to a current budget surplus from 2027, the Chancellor has no option other than to finance increased current (day-to-day) spending via taxes. However, by amending the other fiscal rule regarding debt falling by year five of the forecast, this will give her much more fiscal headroom in which she can significantly upgrades planned government capital spending. But, partly to reassure investors, only some of this scope will be used! As with other recent Budgets, the event will be as much political as economic and may have little bearing on the BoE policy outlook.

Figure 1: The Existing Official Economic Outlook

Source: OBR March 24

Some Key Measures

This Budget will also see the publication of a one-year Spending Review, which will finalise departmental budgets for 2024–25 (in light of what seem to be increasing overspends). It will also set the overall level and allocations of departmental spending for 2025–26 and set spending totals beyond 2025–26. Next spring, there is planned to be a multi-year Spending Review, allocating spending totals from 2026–27 onwards between departments. As for actual measures, the Chancellor seems likely to announce changes to capital gains tax, inheritance tax and (employer) national insurance and would thus meet a time-honoured tradition that taxes were raised in the first budget after an election and may be framed as much as part of reforms by making the system more efficient, ensuring the tax rises hit the better off, and not breaking Labour’s 2024 manifesto commitments. There may also be pointers to looming longer-term tax reforms to business rates, council tax and road pricing.

Figure 2: The Existing Official Fiscal Outlook

Source: OBR March 24

Creating Fiscal leeway

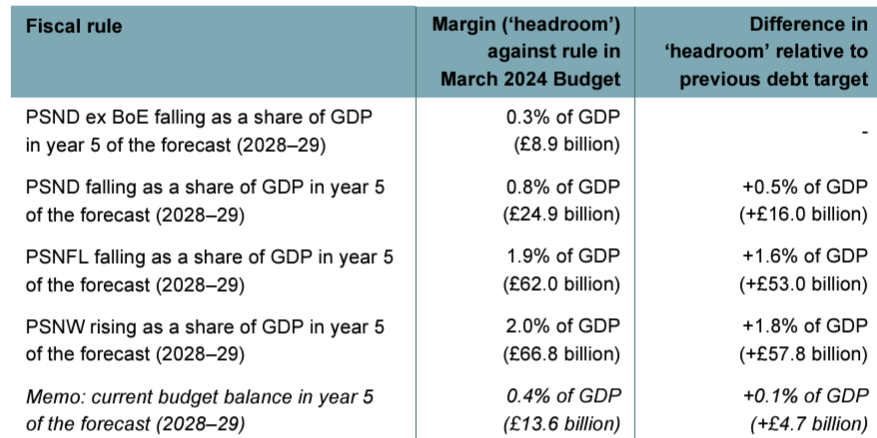

Over recent years and different government there have been an array of various fiscal rules. So there is a precedent for further change. This has already been announced. The Labour manifesto commits this new government to two ‘non-negotiable’ fiscal rules, ie to get debt falling as a share of national income by year five of the forecast (the debt rule); and to bring the current budget into balance (the borrowing rule). And it seems as if the debt rule will be amended formally from the existing one based around Public Sector Net Debt (ex BoE) and possibly justifiably given its current arbitrariness and predispostion to the vagaries of the BoE QT program. As for the latter, losses that the BoE faces from QT are far from smooth and could be particularly concentrated in the fifth year of the forecast (due to the timing of actual or projected Bank of England quantitative tightening) then this would lead to a temporary overstatement of the need for a fiscal tightening.

Of course, such a shift is also fiscally expedient as it will create somewhere up to £66bn of fiscal headroom depending on the new measure (Figure 3). Given the new borrowing rule, this added fiscal leeway can only be used to finance investment, but this of course is the Chancellor’ new priority. To reassure the bond markets about a possible ensuing marked increase in gilt supply and an increase in debt interest that would compromise the borrowing rule, only some of the added fiscal leeway will be used. In addition, the hope is that added capital spending will persuade the OBR (ultimately) to upgrade its estimate of the economy’s potential growth rate, which would reduce both inflation risks and possibly increase net revenue growth. Indeed, the Office for Budget Responsibility estimate that every 0.1 ppt increase in productivity growth reduces the long-term rise in the debt-to-GDP ratio by 25 ppt, something that underlines that the greatest risk to long-term fiscal sustainability is low growth.

Figure 3: Policy Scope Under various fiscal rules, as of March 2024 Budget

Source: OBR & Institute for Fiscal Studies, PSNW = public sector net wealth and PSNFL= public sector net financial liabilities