Turkiye Inflation Review: CPI Decelerated to 49.4% YoY in September Indicating a Positive Real Interest Rate

Bottom line: As we envisaged, CPI cooled off to 49.4% y/y in September from 51.9% in August backed by the lagged impacts of the tightening cycle, relative slowdown in credit growth, and tighter fiscal stance but the deceleration pace was less-than expected. We continue to think the falling trend will continue in Q4 supported by moderate slowdown in domestic demand. Our end-year inflation remains as 43-44% while the extent of the decline will be determined by administrative price adjustments, TRY volatility and tax adjustments.

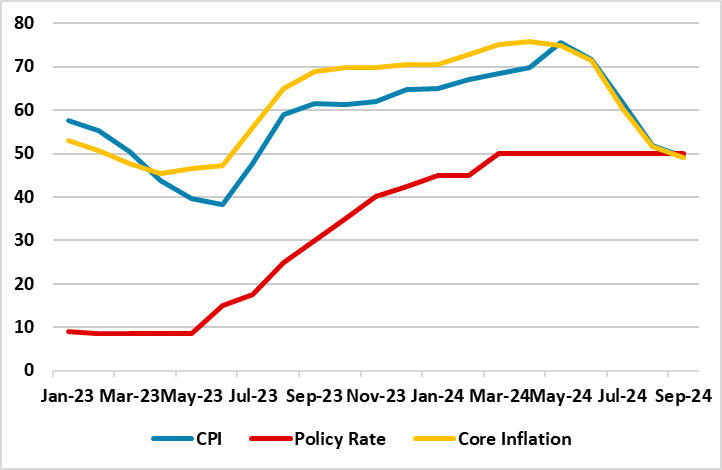

Figure 1: CPI, Core Inflation (YoY, % Change) and Policy Rate (%), January 2023 – September 2024

Source: Continuum Economics

As we expected the deceleration trend in inflation continued in September supported by moderate slowdown in domestic demand and relative TRY stability. (Note: TRY lost 0.4% of its value against the U.S. dollar in September.) CPI cooled off to 49.4% y/y in September from 51.9% in August but slowed less-than-expected, which will likely cause CBRT to delay cutting rates for the rest of 2024, as we predicted in September Outlook. The inflation reading in September indicate a positive real interest rate, the first time in the last three years, as inflation has now dropped below the nominal interest rate meaning that borrowing costs are above zero when adjusted for prices.

When annual rate of changes (%) in the CPI’s main groups are examined in September, transportation with 26.6% was the main group with the lowest annual increase while housing recorded the highest annual increase with 97.9%. It is worth mentioning that education (93.6%), hotels, cafes and restaurants (65.4%) also recorded remarkable YoY increases. Inflation rose by 2.97% MoM in September. Core inflation (CPI-C) recorded a 3.6% MoM increase, scaling up to 49.1% on an annual basis. The domestic PPI was up 1.4% MoM in September for an annual rise of 33.1%, the data showed.

Despite CBRT predicts inflation will to fall to 38% and 14% at end-2024 and end-2025, respectively, and the government sees end 2024 inflation of 41.5% in the updated medium-term program (MTP), we foresee end-year inflation will likely hit around 43-44% backed by moderate slowdown in domestic demand. We anticipate high inflation expectations, stickiness in services inflation, deteriorated pricing behavior, and geopolitical risks will keep inflation pressures alive.

We continue to think cautious and hawkish CBRT to delay cutting rates for the rest of 2024 and until there is a sustained decline in the underlying trend of monthly inflation and permanent improvement in annual CPI is observed, considering CBRT governor Karahan repeatedly stressed that CBRT would do whatever it takes to avoid any lasting deterioration in inflation as it maintains a tight monetary policy stance. We feel the first rate cut will happen in Q1 2025 given residual inflationary risks. Our end year key rate prediction is 50.0% for 2024, and 30.0% for 2025 and we believe 500bps cuts in every quarter in 2025.

As CPI softened in Q3 ignited by favourable base effects, lagged impacts of aggressive tightening and relative TRY stability underpinning the inflation relief, we envisage that inflation will continue decelerate in Q4, but the extent of the decline will be determined by administrative price adjustments, TRY volatility and tax adjustments.