H1 2025 Fiscal Stress or Crisis?

We see the U.S. facing fiscal stress in H1 2025. Either a re-elected President Biden would be restrained by Republicans over raising the debt ceiling or a president Trump would want to make the lapsing parts of the 2017 tax cuts permanent. Rating agencies would be unhappy with either scenario and we see a 30-40bps rise in 10yr U.S. Treasury yields. However, we see this as fiscal stress rather than a 2022 UK style fiscal crisis that prompts a jump to fiscal tightening.

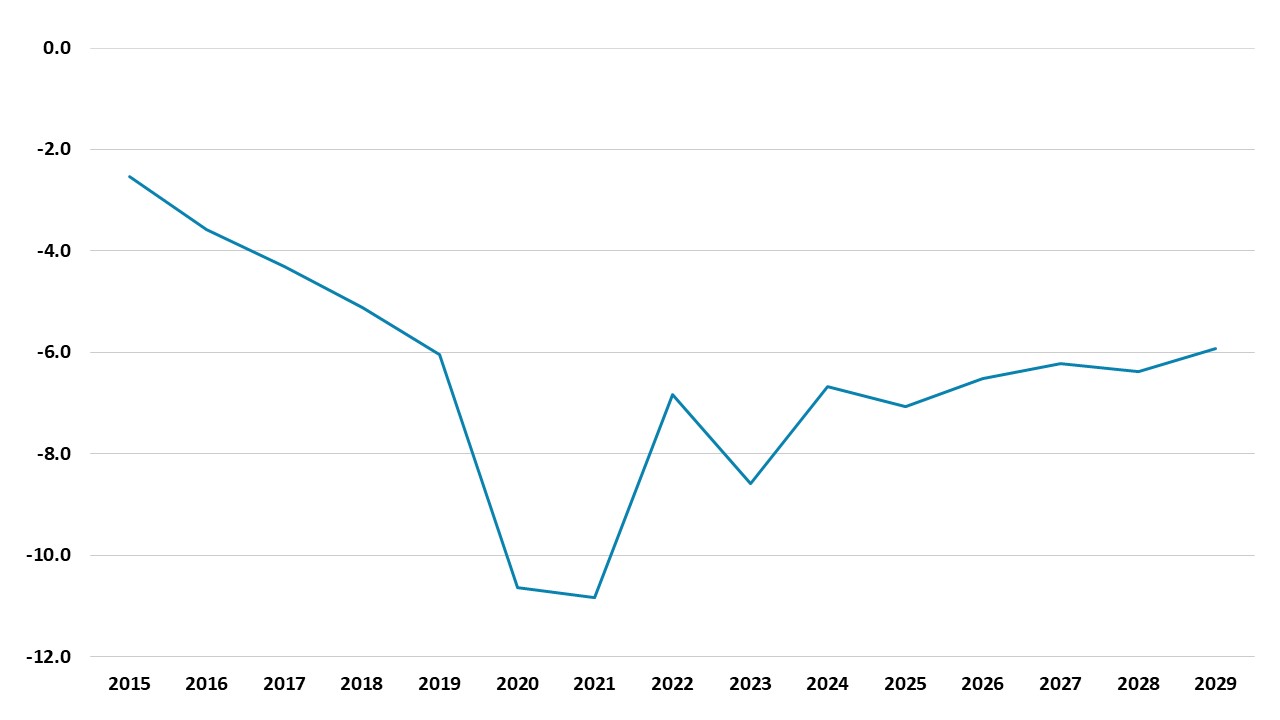

Figure 1: U.S. General Government Deficit to GDP (%)

Source: IMF Fiscal report April 2024

While the U.S. presidential election is a close race, we do feel that H1 2025 will see U.S. fiscal stress if either Joe Biden or Donald Trump is president. The U.S. already have an excessive budget deficit/GDP ratio (Figure 1) and is one of the reasons why 10yr real yields are now above 2% (here).

If Joe Biden is re-elected then he will face difficulties in quickly passing a higher debt ceiling. Our central scenario is for the Republicans to win the Senate but the Democrats to win the House in November. Senate Republicans would drag out an agreement and this could cause rating agencies to consider downgrading the U.S. (Moody’s have the U.S. on negative and the only agency still to have the U.S. at the top rating). However, Senate Republicans would likely do a deal in the end with a Biden adminstration. If the Republicans still controlled the House as well, then it could see a prolonged fight over the debt ceiling that could lift fiscal stress to crisis levels.

If Donald Trump were elected president, then one of his 2025 priorities would be extending or making permanent the 2017 tax cuts, where some are due to expire at the end of 2025. The CBO has estimated that making all the tax cuts permanent would cost around USD400bln per annum (here). Additionally, Trump would likely look to cutback the scale of the IRA climate change investment spending and credits to partially pay for making the tax cuts permanent. Making the tax cuts permanent with a Democrat House would be difficult, though less so in the case where the Republicans controlled both the House and Senate. A democratic House desire to protect IRA provisions would make it all the more complex. A compromise could be rolling over the tax cuts below $400k or roll off of some of the business tax cuts, but uncertainty over any outcome would be high and dependent on the size of any Democrat majority in the House. In the worst case this could still leave the budget deficit up to 1% higher than the current baseline (Figure 1) and risk a downgrade from one or more rating agencies – rating agency would also be unhappy if the Trump camp promise to replace top civil servants with Trump loyalists is implemented too aggressively and swiftly.

What does this mean for U.S. Treasuries? Our baseline involves a 30-40bps jump in 10yr Treasury yields, which we would call fiscal stress rather than a crisis. We would see this being controlled by a sense that the U.S. would eventually muddle through and would not face a multi notch downgrade due to the USD reserve currency status. The actual outcome under a Biden or Trump presidency would vary depending on the congressional election results and decision by the president and his team. Fiscal stress could become a crisis, if either the economy is slowing down sharply towards recession (with risks of a cyclical fiscal widening) or bond market stress becomes extreme but politicians fail to find a solution. This is possible in certain situations, but is not our baseline and hence we look for H1 period of fiscal stress rather than crisis.

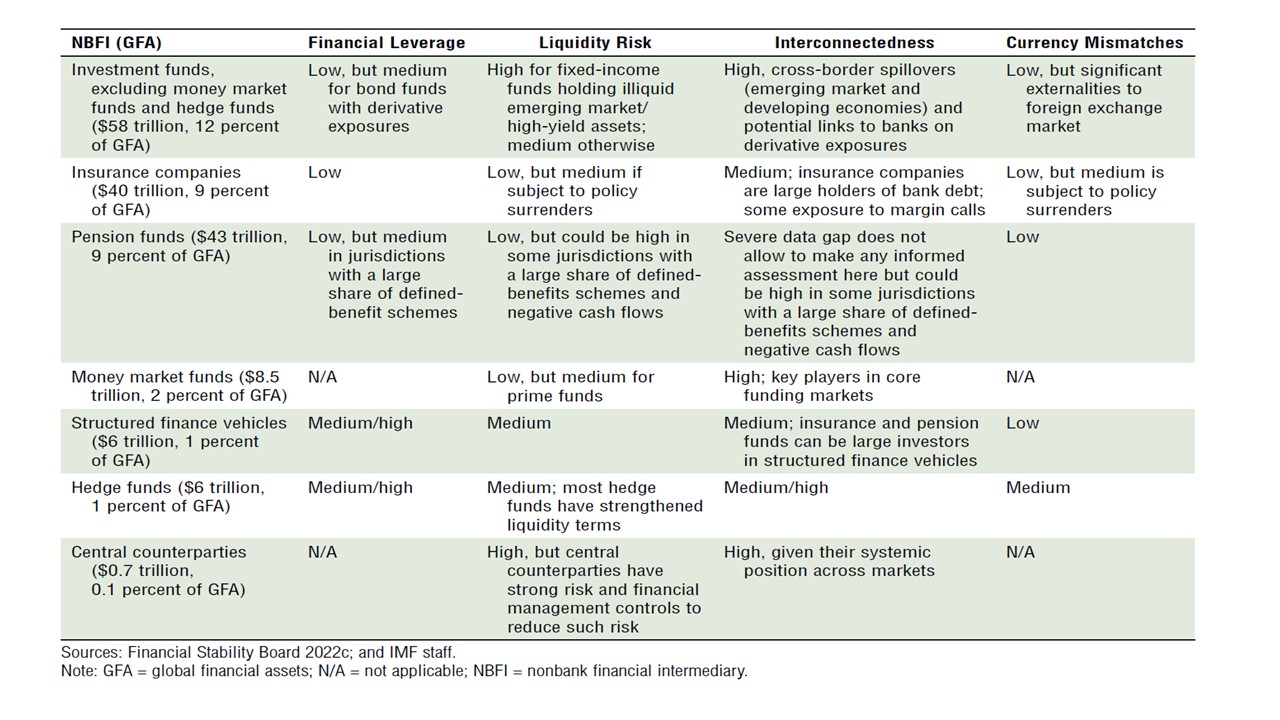

A question also exists of the spill over of fiscal stress on the wider U.S. economy and financial system, given the central role of U.S. Treasuries. A 30-40bps jump in 10yr U.S. Treasury yields would be manageable, especially as we would expect 2yr yields to show limited impact (we look for Fed easing to start September 2024 and to be at a gradual quarterly pace through 2025). The U.S. financial system is complex but dispersed and it could take say a 100bps rise in 10yr yields to cause a broader financial shock and tightening of financial conditions. Unlike the September 2022 UK fiscal crisis, the U.S. has a smaller proportion of pension liability driven investment (LDI)/GDP and in absolute size is similar to the UK US1.7trn (FSB here). Instead, in the U.S. the impact of a sharp fiscal shock driven yield rise could come through quick deleveraging (e.g. hedge funds) that amplifies financial market reaction or attempt to sell or hedge less liquidity assets (Figure 2 and our recent overview of U.S. financial stress (here)). This is not our baseline, but just some blue sky thinking in a worst case scenario.

Figure 2: Preliminary Assessment of Vulnerabilities of Major NBFIs (Global)

Source: IMF GSFR April 2024