U.S. Financial Stress: Select Issues Not Widespread

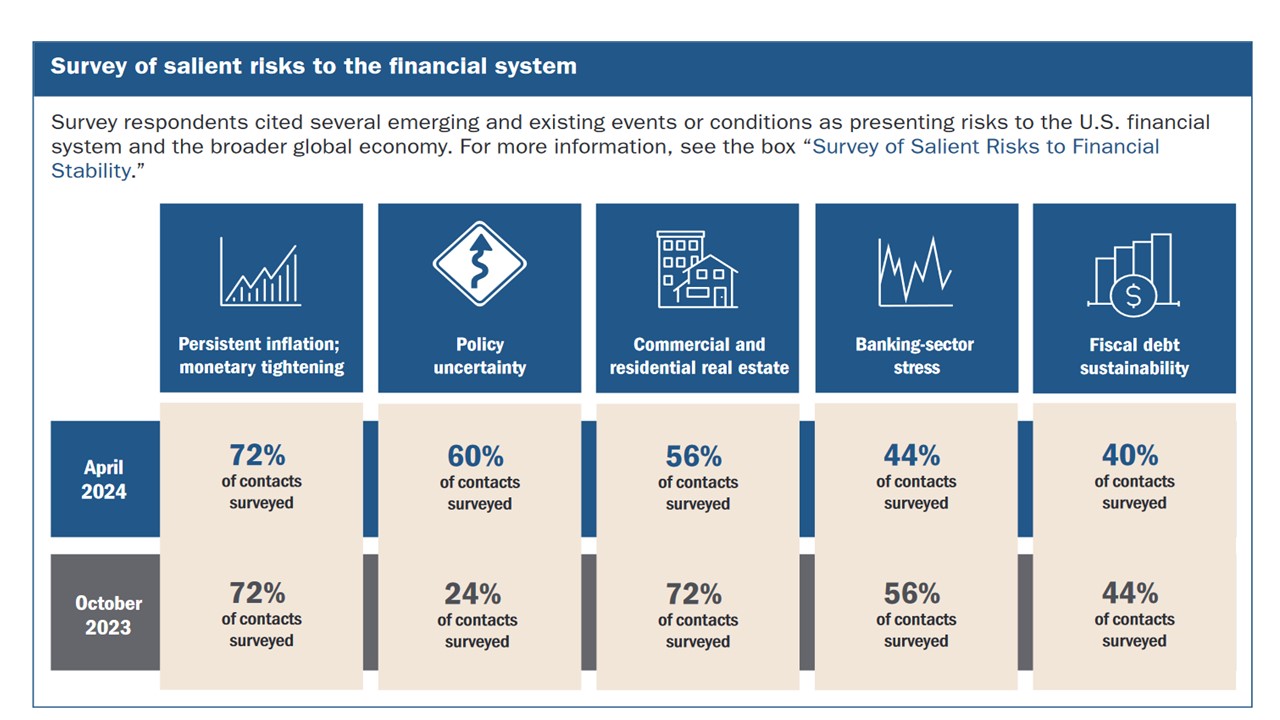

Higher U.S. interest rates are still feeding through with a lag, which can cause weaker corporates and households problems but point to divergence within consumption and investment rather than anything more serious. High leverage for hedge funds/issues for a small subset of banks and high holdings of illiquid assets for U.S. life insurance companies are fault lines that could amplify financial stress from any major unexpected macro shocks.

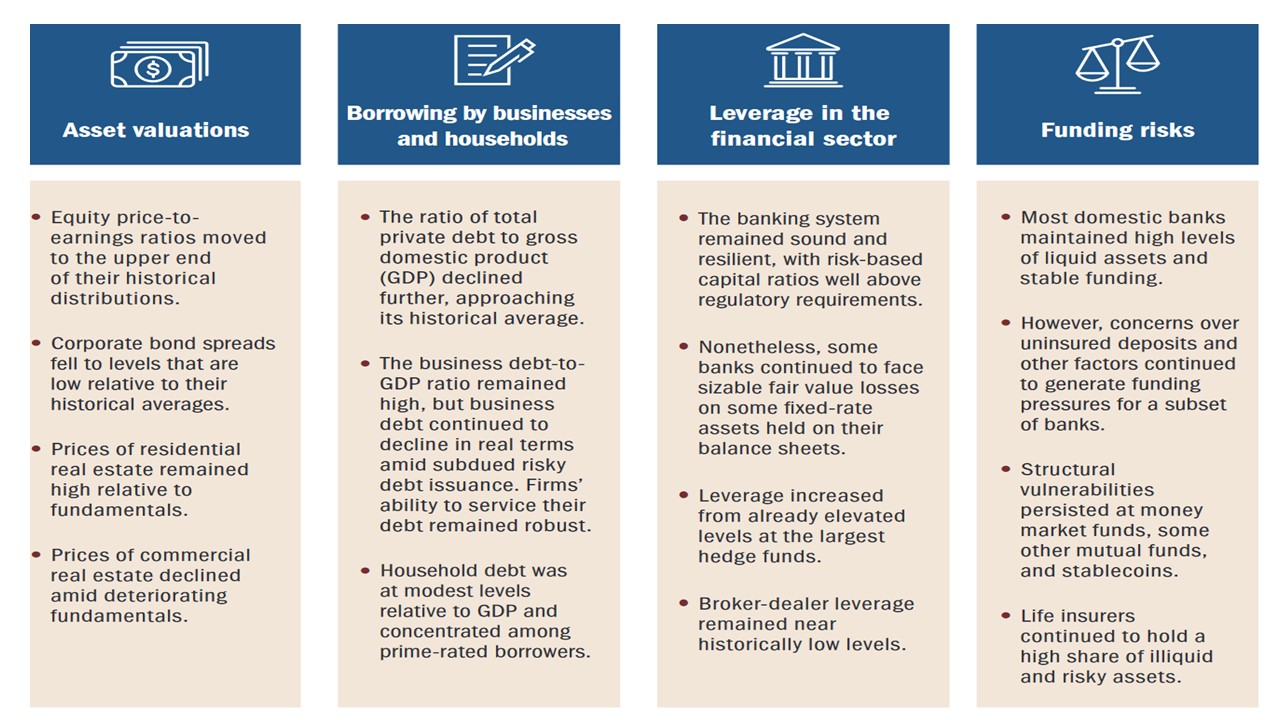

Figure 1: Overview of Financial System Vulnerabilities

Source: Fed Financial Stability Review April 2024 (here)

The U.S. financial system is not immune from higher interest, it just that the lags are longer as some borrowers’ fixed rate agreements (e.g. mortgages) mean that the impact is spread over many years. Nevertheless, the impact on certain borrowers is still feeding through and a number of issues are worth mentioning.

· Weaker borrowers’ rising delinquency rates. Households with low credit scores are starting to struggle as higher interest payment bites in consumer credit (USD5trn) with higher than average delinquency rates for autos and credit cards. With excess pandemic household savings having been run down, this suggests that a robust consumer could become more divergent with prime households supported by large wealth, but low income households becoming more cautious. Meanwhile, some small businesses are starting to struggle, though large businesses are managing debt servicing more comfortably according to the April Fed financial stability review (here). CRE in the office sector also remains a difficult area for new financing, despite the adjustment of office prices lower. This could cause a problem (e.g. default/repricing) that cause a snowball effect and a moderate scare still. The BOE in December (here) highlighted concerns about highly leveraged corporates in the U.S. (private equity and leveraged loans), but the Fed are less worried after looking at leveraged loan delinquency rates and lower average leverage for this type of corporate.

· Overvalued U.S. equities/tight corporate bond spreads. The Fed are concerned that the U.S. equity market is overvalued and corporate bond spreads are too tight (Figure 1). Our forecasting of a slowing of U.S. growth into H2 would certainly be a headwind to these valuations, but a quick surprise slowing towards recession would have to be seen to cause a major reset of asset values and cause market risk related problems (Figure 2). This is currently a low probability scenario.

· High hedge fund leverage/select bank issues and life insurance illiquidity. Three issues are worth highlighting from the Fed review. Firstly, though the bulk of the banking system is seen as robust, a selection of banks still face problems due to fixed income portfolio losses and dependence on uninsured deposits. After the SVB triggered shakeout, this is still one to watch but would likely be a transitory issue for the wider market and be more institution specific. Secondly, hedge funds’ leverage measures were judged by the Fed to be historically high, partially due to cash-futures basis trades in U.S. Treasuries. However, leverage for hedge fund strategies and size varies and it would take a large unexpected macro shock to produce quick and widespread deleveraging. Thirdly, the Fed remains worried that U.S. life insurance companies hold too many illiquid assets (e.g. CRE loans and illiquid corporate bonds). This is one to watch. Money market risks from a major financial crisis are also still highlighted, but modest/moderate crises do not appear to cause problems (March 2020 was a major temporary crisis).

No immediate broad candidates for major U.S. financial stability risks, but a few themes that need to be watched.

Figure 2: Fed Survey of Key Risks To The Financial System

Source: Continuum Economics