Fed: 50bps Cut and 175bps More to Follow?

The 50bps cut in the Fed Funds rate to 4.75-5.00% will likely be followed with two 25bps cuts in November and December. For 2025, we now look for 125bps rather than 150bps, given our soft landing view and also the 50bps being delivered at the September meeting. This would be a 3.00-3.25% Fed Funds rate and just above the revised long run estimate of 2.9%. However, if a harder landing is seen then we feel that the Fed would consider cutting to 2.50% or 2.00% (here) depending on the scale of a slowdown i.e. stagnation versus mild recession.

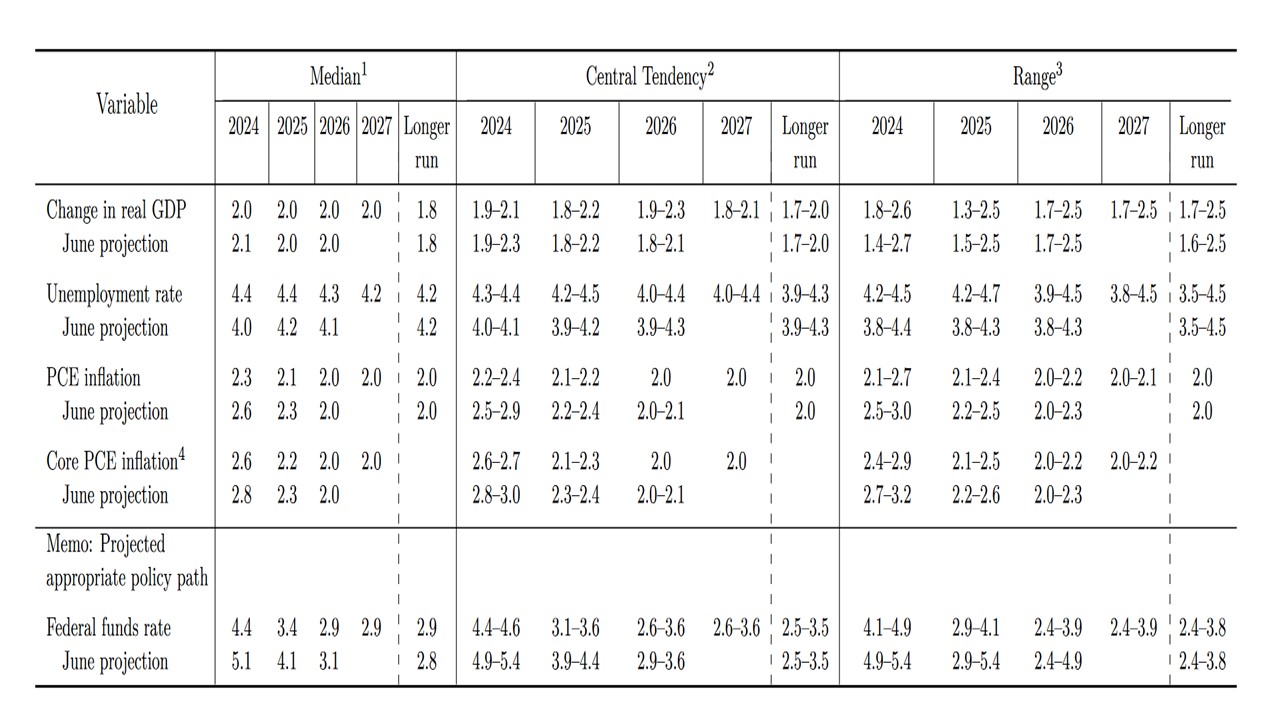

Figure 1: Fed September Summary of Economic Projections (SEP)

Source: Fed (September SEP)

Rate Cut Arrive The September FOMC statement and Fed Chair Powell Q/A provide a number of clues on prospective policy. Key points include

· Inflation/Unemployment rate Revised. The FOMC statement marked a shift of emphasis with greater confidence that inflation is sustainably moving towards 2%, but the Fed added that it is strongly committed to supporting maximum employment. Core PCE medians were trimmed in the SEP (Figure 1) and down to 2.2% in 2025, while the 2024 unemployment rate is the big change from June at 4.4% -- though then projected not to rise further. Though the Fed says inflation and employment risks are balanced, the Fed action suggest that they are more sensitive to employment. Meanwhile, Fed Powell also noted that Q3 GDP looks similar to Q2, which would be a solid pace of growth and not a harder landing. He also noted that though the labor market is slowing, that it currently remains close to maximum employment.

· Guidance on Interest rates. The median Fed dot of 4.4% by end 2024 is consistent with two 25bps at the November and December meeting or one 50bps cut. It is interesting that this is narrow majority of 10 out of 19, with 7 out of 19 only wanting one 25bps and 2 wanting no further cut. For end 2025, the median points to an additional 100bps to a 3.25-3.50% Fed Funds rate, but 6 out of 19 forecasting 3.00-3.25%. Though this provides some insight to the Fed policy reaction function, it is of course worth noting that the Fed has started with a 50bps cut. Though this may not be followed by 50bps if the economy sees a soft landing, the Fed could front load more of the 100bps in H1 2025 or add a further 25bps from 2026 – Fed Funds at 2.9% is seen in 2026, consistent with the new revised estimate of neutral policy by the FOMC. All of this is based on the central soft landing view. None of the FOMC officials forecast the unemployment rate above 4.7% by end 2025, whereas stagnation or a mild recession would likely increase it to 5%. Fed Powell noted a strong start has been made to the easing cycle, but the Fed is not in a rush and will go meeting by meeting.

· 2024/25 rate cut prospects. We had penciled in 25bps in November and December, which the Fed dots appear to back – especially with 9 of the 19 FOMC members seeing less than this. Fed Powell in the Q/A guided journalists towards the Fed Funds medians in the SEP and also noted the upward skew for end 2024 Fed Funds. Given our own economic forecasts of a soft landing, we thus maintain the view of 25bps cuts at the November and December meetings to 4.25-4.50% Fed Funds target. In 2025, we would see the Fed taking out insurance to avoid a harder landing and this means moving the Fed Funds rate towards neutral. We would now see 125bps of cuts in 2025 rather than 150bps, given the 50bps delivered in September. This would most likely be 25bps in each of the meeting through June, then 25bps to a 3.00-3.25% Fed Funds rate in September 2025 and then pause. This would be more easing than the median dot for 2025.

· Terminal v Neutral Rate. The Fed dots suggest that the Fed see the terminal policy rate at 2.9% and consistent with the median for the neutral policy rate. However, the range of opinions for 2026 and the neutral rate are wide with almost a 150bps spread. If we see a soft landing then this set of medians should be broadly correct. However, if a harder landing is seen then we feel that the Fed would consider cutting to 2.50% or 2.00% (here) depending on the scale of a slowdown i.e. stagnation versus mild recession. Powell also guided that the 50bps cut does not mean that the Fed is close to ending QT.