China Housing Bailout: More Needed

Though China’s authorities have taken some action to help the residential construction sector, the negative drags from the huge excess completed housing and uncompleted projects continues to weigh directly on the construction/steel and cement sector and consumer confidence. Aggressive policy action is need to stabilize the housing market otherwise the effects will remain and could get larger. China authorities for now however are focused on incremental policy support.

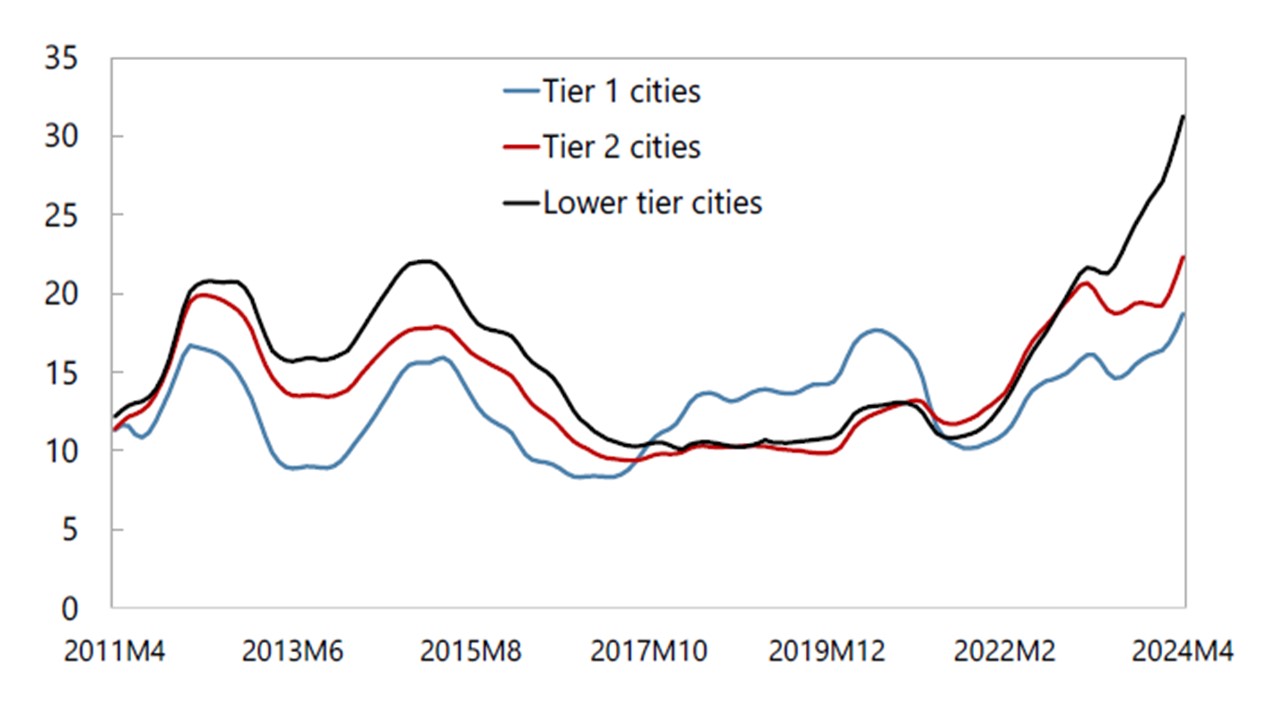

Figure 1: Inventory of Completed House (Number of Months)

Source IMF Article IV 2024 (here)

The epicenter of the growth drag on China economy is currently the residential property sector, where new construction remains a drag on GDP growth. China authorities have had a number of policy packages with some of the key highlights being Yuan500bln of PBOC pledged supplementary lending to support completing construction; Yuan300bln to buy excess completed inventory for affordable housing; mortgage rate cuts; lower deposits and recent a removal of new home price declines (new home sales have been depressed by second hand home prices falling more).

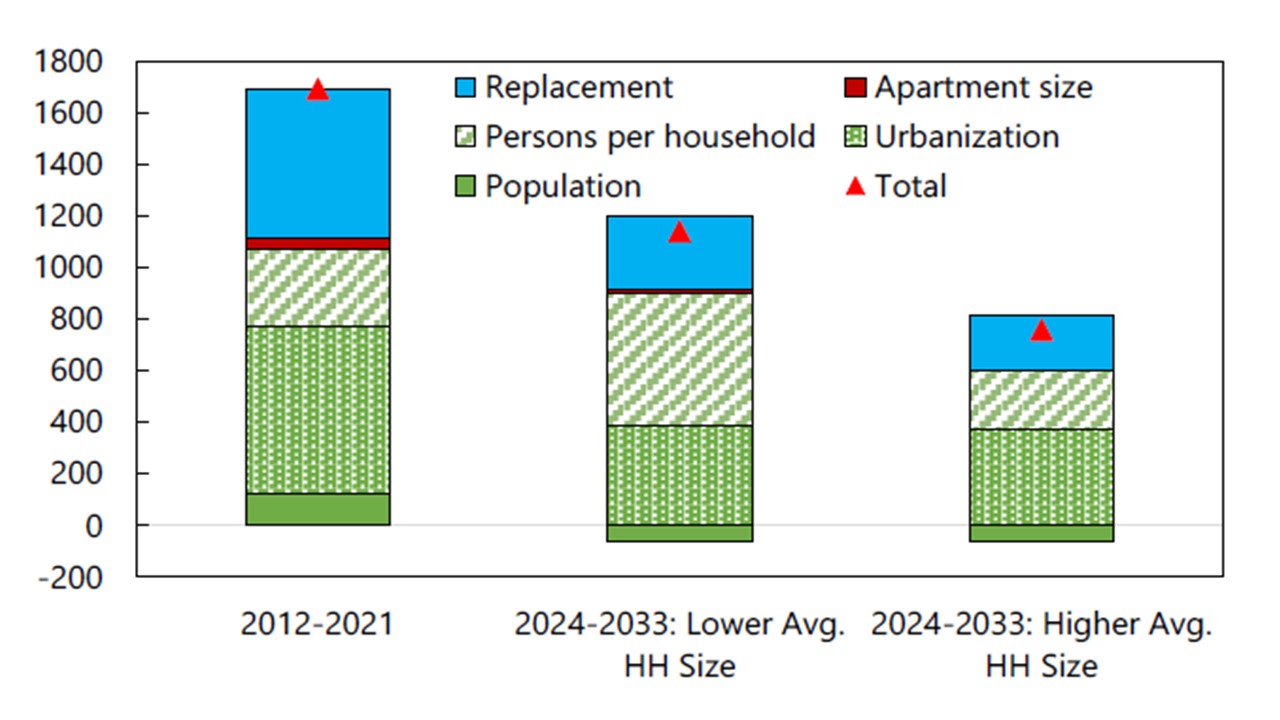

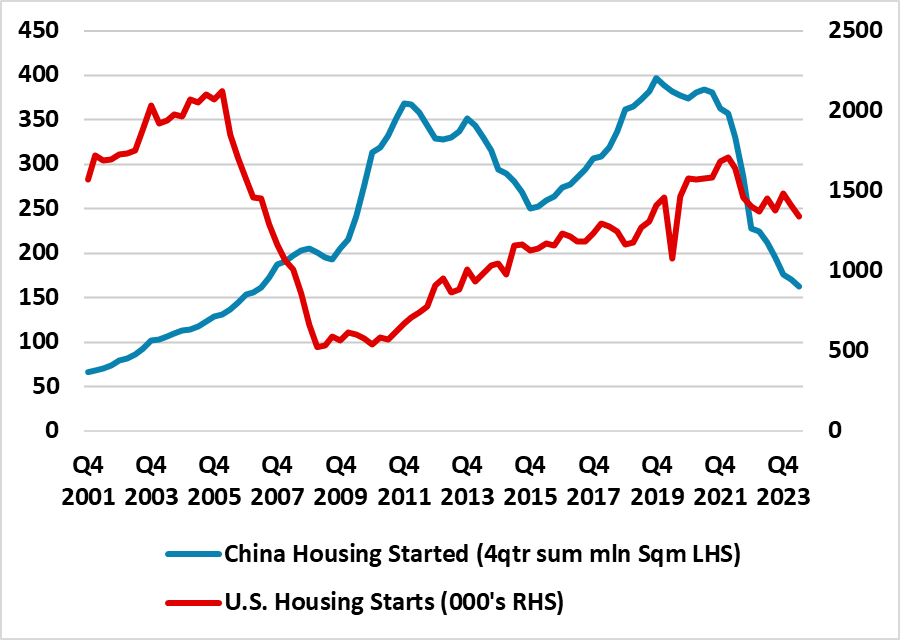

While the measures are welcome, they are not enough given the scale of the problem. Firstly, a large excess of completed inventory exists, which is restraining the market (Figure 1). Secondly, an even larger overhang of uncompleted housing is still in the pipeline, with delay spreading financial distress among more developers and some households that pre-paid for properties. Thirdly, population aging means that demand for housing is slowing sharply this decade (Figure 2). In some ways this is as bad as the 2006-10 U.S. housing market crash in construction investment terms (Figure 3). Though house prices have fallen by less than the U.S., China’s recent willingness to allow greater new house price declines has seen price falls of 20% plus in Beijing and Shenzhen in some new projects recently – which will initially hurt perceptions of housing wealth and produce a further adverse feedback lo7op (here).

Figure 2: 35-55% Decline in Housing Demand (Annual Ave Housing Demand Mln Sqm)

Source IMF Select Issues Feb 2024 (here)

Figure 3: U.S. Housing Construction Peak 2006/China 2021

Source: Datastream/Continuum Economics

The IMF has recommended in the August Article IV (here) a more comprehensive housing package including wider state support to complete pre-sold homes; converting unviable part completed projects into affordable housing; accelerating resolution of insolvent developers and lower new home prices to help clear the completed inventory backlog. This should also be accompanied by a faster resolution of weak rural banks and more downward flexibility in the Yuan to help make monetary policy easing more effective. The problem is that the fiscal cost of such a program is estimated at 5.5% of GDP or around Yuan 7trn (a mix of spending and guarantees). China central government has the balance sheet to undertake such a program, given that it would then get tax benefit eventually through a stabilization and slow recovery of the housing market. However, China authorities have only been willing to undertake incremental support for residential investment, both due to a desire to focus on other areas of the economy and also concerns over the total debt/GDP in China (government/corporate and households) – which now higher that the U.S. or EZ.

Our growth forecast of 4.7% and 4.0% for 2024 and 2025 reflects the drag from residential housing alongside slow private sector employment growth that is restraining income and consumption growth. However, we could be underestimating the adverse direct effects of declining investment in residential property and the spillover on other industries and employment (e.g. steel and cement). Additionally, consumer confidence is weak and necessary falls in house prices to clear the market could intensify concerns about wealth and consumption patterns. We currently see a 30% probability of a harder landing in China economy of sub 4% growth in 2025. China policymakers could surprise and become aggressive, but we will have to see policy announcements in the coming months.