Fed: Cautious Policy Due To Uncertainty

The Fed do not appear to be in a hurry to cut interest rates, both as economic momentum remains reasonable and as the Fed waits to see how Trump administration policy feedthrough – especially tariffs to inflation. This suggests that the Fed will need to see a weaker economy and we pencil in one 25bps cut for Q4 and two 25bps cuts in 2026. However, uncertainty is high on policy versus this baseline and we feel that the main alternative scenario is a harder landing and a more aggressive easing that could bring Fed Funds down to 3% or lower.

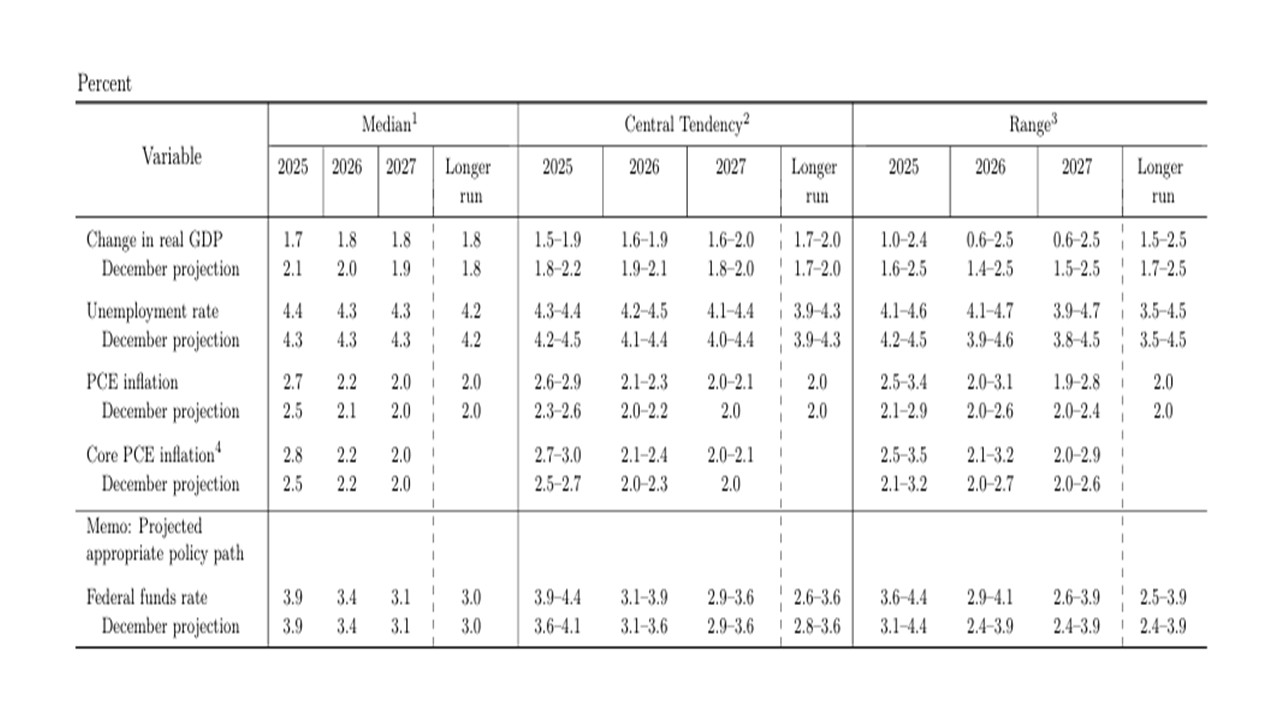

Figure 1: Fed March Summary of Economic Projections (SEP)

Rate Cut Pace Cautious

The March FOMC statement and Fed Chair Powell Q/A provide a number of clues on prospective policy. Key points include

· Inflation and growth uncertainties. The median from the SEP showed a downward revision to 1.7% for 2025 GDP growth from 2.1%, but an upward revision to core PCE inflation from 2.5% to 2.8%. However, 2026 core PCE inflation stays at 2.2%, which shows a leaning towards progress on inflation being maintained into next year. Powell also noted that most long-term market and survey measures of inflation expectations were controlled suggesting that the Fed is not overreacting to the UoM 5-10yr inflation expectations. However, Powell noted that some of the increase in goods inflation in the first two months of the year could be due to tariffs and that this needed to be watched carefully. Nevertheless, the press conference left the impression that the baseline into 2026 is that tariff inflation will likely be transitory. Meanwhile, the FOMC statement notes that uncertainty around growth has increased, which was also emphasized repeatedly by Powell due to the policy changes being undertaken by the Trump administration.

· Guidance on Interest rates. The medians from the SEP showed two 25bps cuts for 2025 and two more for 2026. This shows that the FOMC bias remains towards easing and they currently expect to undertake some easing. However, the top of the 2025 and 2026 central tendency was higher than before showing that the FOMC is cautious. Powell also noted in the opening remark that the Fed was not in a hurry, which suggests that the economy and labor market would have to deteriorate further to trigger early cuts.

· 2025/26 rate prospects. Powell noted that the costs of waiting for clarity was low with the economy still doing well and this argues against cuts in the near-term, unless the real sector data deteriorates quickly. We look for tariffs to slow the economy in H2, which should be enough for the Fed to ease by 25bps. However, the Fed will want to see that a pick-up in inflation from tariffs does not come through on a 2 round basis. This argues more for 2026 rate cuts, as core inflation comes down and we look for two 25bps in 2026. However, uncertainty is high on policy as well versus this baseline and we feel that the main alternative scenario is a harder landing and a more aggressive easing that could bring Fed Funds down to 3% or lower. Meanwhile, the reduction in the U.S. Treasury QT cap from USD25bln per month to USD5bln was cited as a technical decision by the FOMC, with the MBS cap kept unchanged at USD35bln. Powell noted that some tensions had started to be seen in the money market.