Eurozone Services Risks Clearer?

It is clear that PMI data are a key component of the data analysis of the ECB. We are somewhat sceptical of the data, at least in its ability to track GDP growth coincidently and accurately. But the data does offer a wide-ranging insight into private sector economic momentum. With this in mind the October PMI data will be reverberating within the confines of the ECB Council even though it is clear (and justified) that policy will be shaped by an array of data rather than any particular data points! The PMI data offer a several key messages, not least weak momentum, albeit where the continued marginal drop below the apparently key 50 reading is probably indicative of sluggish growth than recession. But the risks of the latter are growing and possibly materializing if the weakness in orders and now employment are anything to go by. However, what is clear at present is that a) services are weakening, possibly heralding the end of the only part of the economy that has been growing and b) partly as a consequence, price and costs pressures are receding clearly, thereby adding to the ever-clearer disinflation picture.

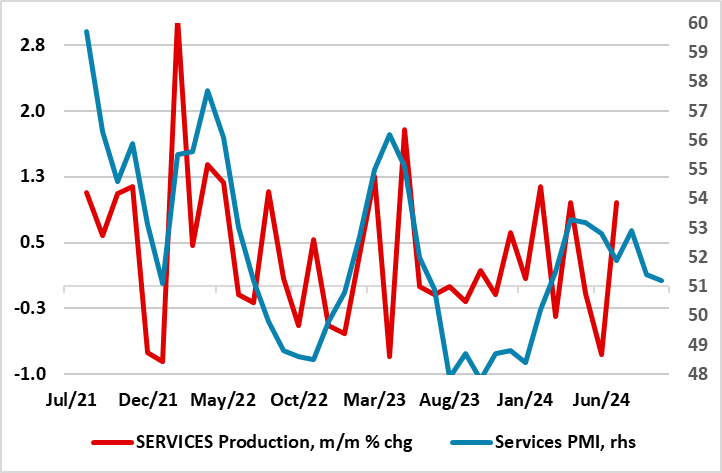

Figure 1: Services Sector Growth Slowing Clearly

Source: Eurostat, Markit

Divergences Persist?

Flash PMI numbers for October showed that the composite measure edged up 0.1 point to 49.7, but staying below the apparently key 50 mark for a second successive month. This reflected output being scaled back in response to a weakening demand environment, with new orders down for the fifth consecutive month. This resulting lower workloads led firms to reduce employment by the largest degree in almost four years, while business confidence dropped to an 11-month low.

The marginal reduction in overall business activity masked a continued divergence between the manufacturing and services sectors, albeit by the smallest margin since February. Even so, manufacturing production fell markedly again while the service sector managed to continue expanding but at an eight-month low. However, the very unusual divergence seen between services and EZ manufacturing may be coming to an end – the factory sector has contracted for six and probably seven successive quarters while services have risen alongside. But services are slowing with official data for the sector having fallen for three out of the last five months of data and where business survey data (both the PMI and European Commission data suggest near-stagnation looms (Figure 1).

Notably, outside of Germany and France, the rest of the EZ actually saw output increase at the fastest pace in four months. This contrast reflects the varying size of the industrial sectors in these economies with those with the larger services sectors as % of GDP (eg Spain) prospering more than those more reliant on recession-bound manufacturing (eg Germany).

Price and Cost Pressures Receding

This backdrop is taking a clear but understandable toll on inflation. Although input costs increased again in October, the pace was the lowest in just under four years. As was the case with business activity, there were marked differences in price changes between the two monitored sectors. Manufacturing input costs decreased for the second month running, and at the fastest pace since March. Meanwhile, services input prices continued to increase but at a rate that was softer than the series average.

While there is talk of whether the EZ will see a soft landing or not, perhaps the more relevant question is whether there has actually been a take-off! Meanwhile, it does seem as if the last mile for inflation is not the hardest, after all. This is not surprising, as for middle distance runners and most other experienced athletes the last mile is often the quickest as it sees a sprint finish!