China Steps Up Support, But Not a Game changer

China has surprised and cut the 7 day reverse repo rate by 20bps to 1.5%, with a 50bps cuts in the RRR rate. Combined with other measures this is a step-up in support and could help GDP on the margin, but the measures are not game changers as monetary policy is currently ineffective. While further fiscal easing will likely arrive in the next few weeks, we still maintain our forecast of 4.0% GDP growth for 2025 (here).

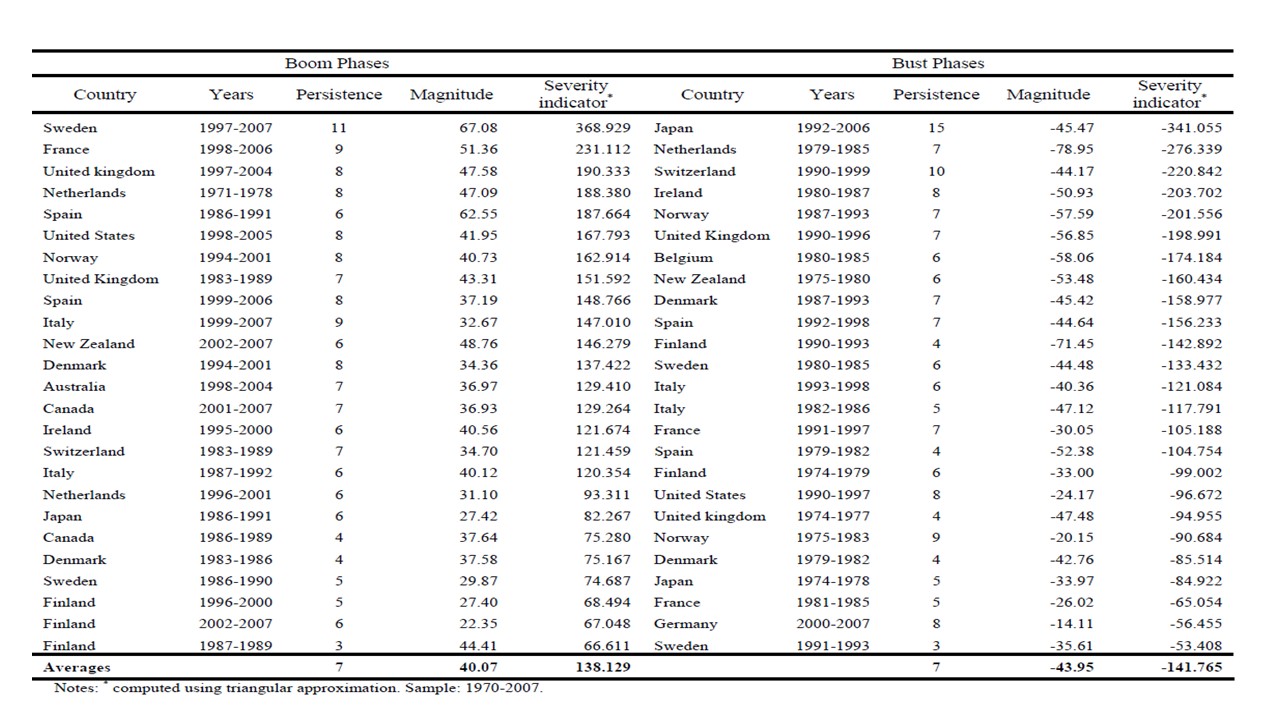

Figure 1: DM Housing Boom and Busts Prior to 2007

Source: ECB (here)

China has announced a package of measures to support the economy, which is helpful but are not game changers. Key points to note.

· Rate cuts but Household borrowing caution. The 20bps cut in the 7 day reverse repo rate (the new key benchmark rate) from 1.70% to 1.50% had not been expected until Q4/Q1 2025. Meanwhile, the 50bps RRR cut was larger than the 25bps anticipated. The PBOC also signalled that remortgage to lower lending rates could occur 3-6 months early, though it has yet to be clarified whether this is first time buyers or all existing remortgages – this process normally occurs in Q1 every year. The deposit on 2 properties has also been reduced from 25% to 15%. This can have some benefit to households cash flow with mortgages, but this may not translate into extra borrowing and spending. China households are paying down debt due to the ongoing property crisis. Also deposit rates are expected to be cut to protect bank margins and this will hurt households!

· No game changer for residential investment or buying. The package include an ability for state banks to increase principal funds to 100% from 60% for state banks to use for lending to buy unsold homes. However, the take-up has been modest so far. Additionally, no extra funds were added to the Yuan300bln to buy completed homes for affordable housing, whereas we estimate Yuan3-4trn would be required to be a real game changer. Property purchases are unlikely to pick up either until house prices have fallen enough to find a bottom, which we feel would be around 30% for real national house prices given excessive house price/income ratio in an environment of slowing wage growth. Nominal national house prices could fall 20-25% peak to trough. The experience from DM and EM economies is that the housing bust takes a long time and has averaged 7 years in DM countries (Figure 1).

· More monetary easing 2025 but no QE. We had expected a 10bps 7 day reverse repo rate cut in Q4, but this has now arrived. We look for two further 10bps cut in Q1/Q2 2025 to take the 7 day rate down to 1.3%. Additionally, we now look for the next RRR cut in Q1/Q2 also for a cumulative 50-100bps to help banks sustain profitability in an environment of squeezed net interest margins. We do not see QE or zero interest rate in China however. Such a policy would hurt banks too much and reduce the effectiveness of monetary policy still further. Instead, we would expect pressure for the banks to increase lending. However, recent M2 growth shows that small and mid-sized banks are reducing credit supply (here), while private businesses and households have very low credit demand – effectively balance sheet recession for these borrowers. The extra support for the equity market meanwhile has also helped sentiment, but the economy needs to be fixed to sustain a rally (here). While further fiscal easing will likely arrive in the next few weeks, we still maintain our forecast of 4.0% GDP growth for 2025.