Monetary Policy Reset: RBI’s Balancing Act Begins

The RBI has cut the repo rate by 25 basis points to 6.25%, marking its first reduction in five years. While aimed at supporting growth, the central bank maintains a neutral stance, signaling caution amid global uncertainties. Inflation is projected to ease, but risks from trade disruptions and financial volatility remain key concerns.

After nearly five years of holding its ground, the Reserve Bank of India has finally moved the needle. Commensurate with our view, the central bank, under Governor Sanjay Malhotra, has cut the policy repo rate by 25 basis points to 6.25%, marking its first rate reduction since May 2020. The decision, though widely anticipated, signals a cautious shift as the RBI navigates an evolving macroeconomic landscape, balancing growth aspirations with inflationary risks.

A Calculated Move Amid Growth Concerns

The decision to lower the repo rate follows a year of mounting pressure on the central bank to provide stimulus amid slowing economic momentum. With GDP growth for FY25 now projected at 6.4%, lower than earlier estimates, and FY26 expected to grow at 6.7%, the RBI’s move underscores its attempt to bolster domestic demand. Governor Malhotra framed the rate cut as a necessary step in ensuring the economy stays on track amidst external shocks, subdued private investment, and fragile global trade conditions.

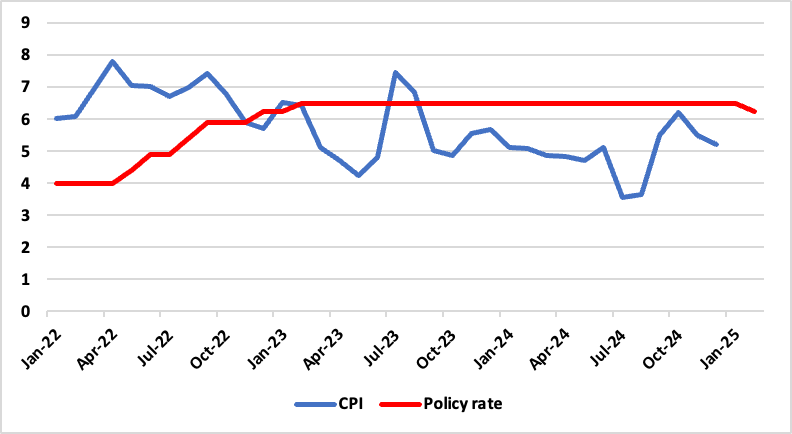

Figure 1: India CPI and Policy Rate (%)

Despite the rate cut, the Monetary Policy Committee (MPC) retained its neutral stance. This offers the RBI flexibility to assess further rate actions without committing to an extended easing cycle. The central bank’s measured approach is prudent, particularly given global uncertainties, including tightening liquidity conditions in the West and the potential spillover from Trump-era trade policies.

Inflation: A Manageable Threat?

Headline inflation has cooled from its peak, with FY25 inflation projected at 4.8% and FY26 at 4.2%. While this is a welcome sign, the RBI remains wary of upside risks. Softening food prices and stable core inflation have provided relief, yet global supply chain disruptions and climate-related shocks remain key concerns. The central bank’s expectation of sub-4% inflation by Q3 FY26 suggests confidence, but external risks remain a wildcard.

Alongside the rate cut, the RBI has reinforced its commitment to ensuring durable liquidity in the system. The unchanged Cash Reserve Ratio (CRR) at 4% and a calibrated approach to liquidity infusion indicate a preference for stability rather than aggressive monetary expansion. The assurance of proactive liquidity management is critical, as credit growth—while improving—remains uneven, with demand largely skewed towards services and urban consumption. A key subplot to the rate decision is the rupee’s recent depreciation. The central bank has reiterated its policy of forex market intervention aimed at smoothening volatility rather than defending any specific level. This comes at a time when global risk sentiment remains fragile, and capital outflows from emerging markets continue to challenge India’s external stability.

What Lies Ahead?

With FY26 growth expected at 6.7%—led by consumption and investment—the central bank will have to tread carefully. Further rate cuts remain on the table, but much will depend on inflation trends, global policy shifts, and the resilience of domestic demand. For investors and businesses, the rate cut is a positive signal, but it stops short of being a game-changer. The RBI has chosen prudence over exuberance, leaving room for future course corrections. We anticipate another 25bps rate cut in April to support domestic growth.