U.S. March Employment - A healthy picture, but can it persist?

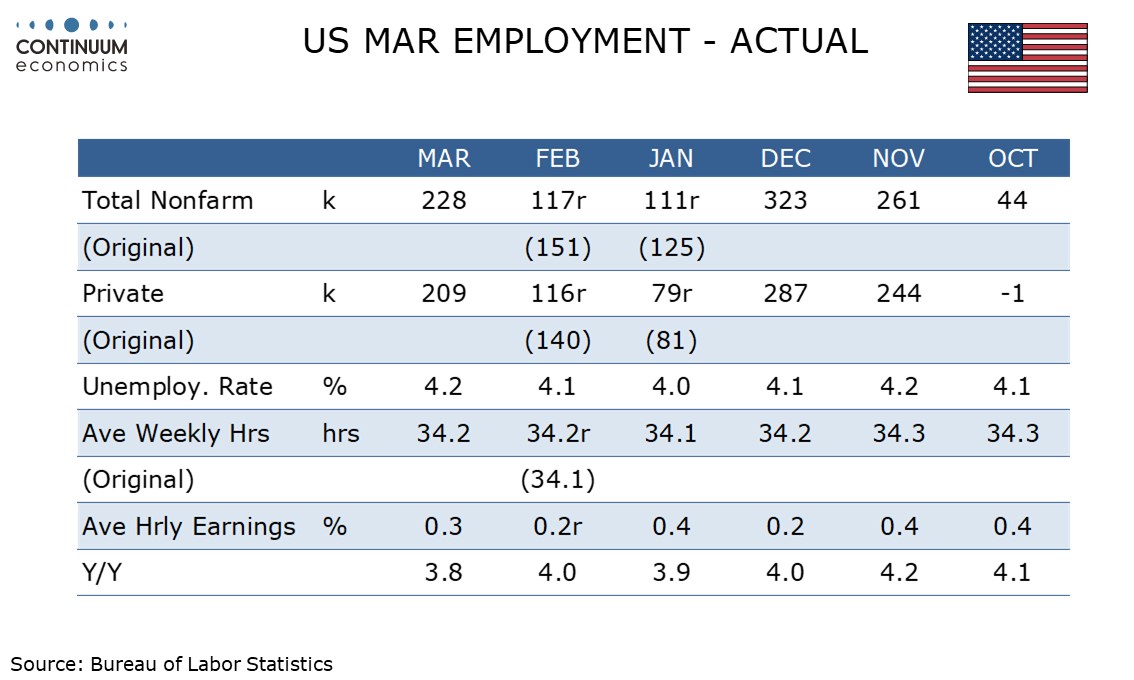

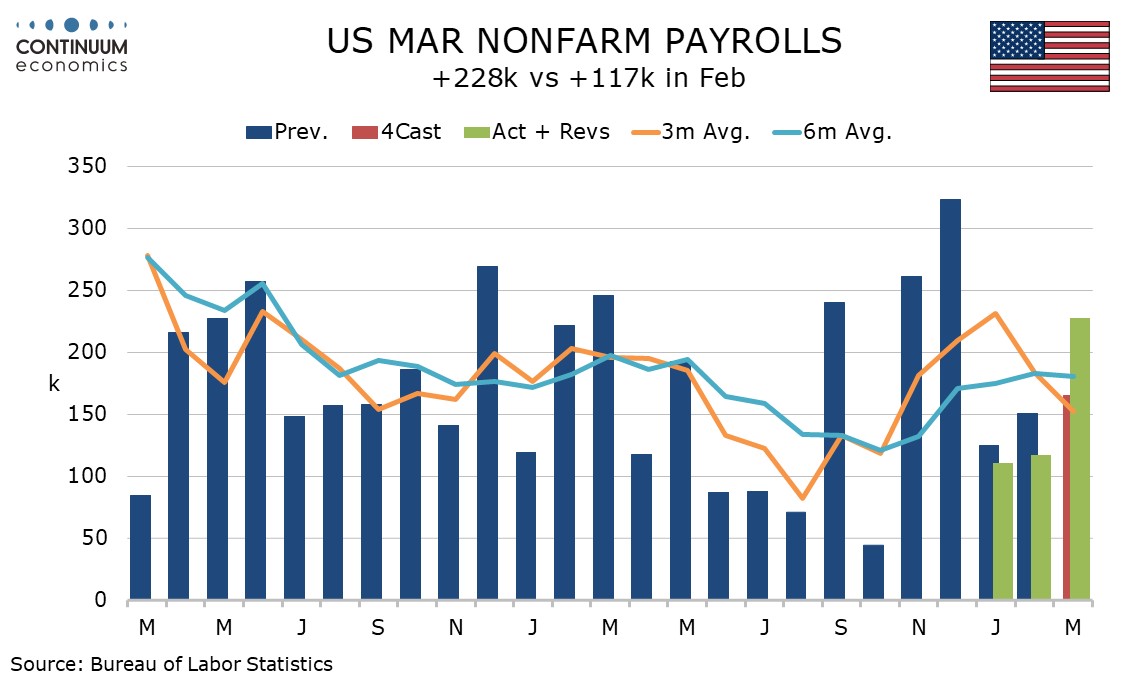

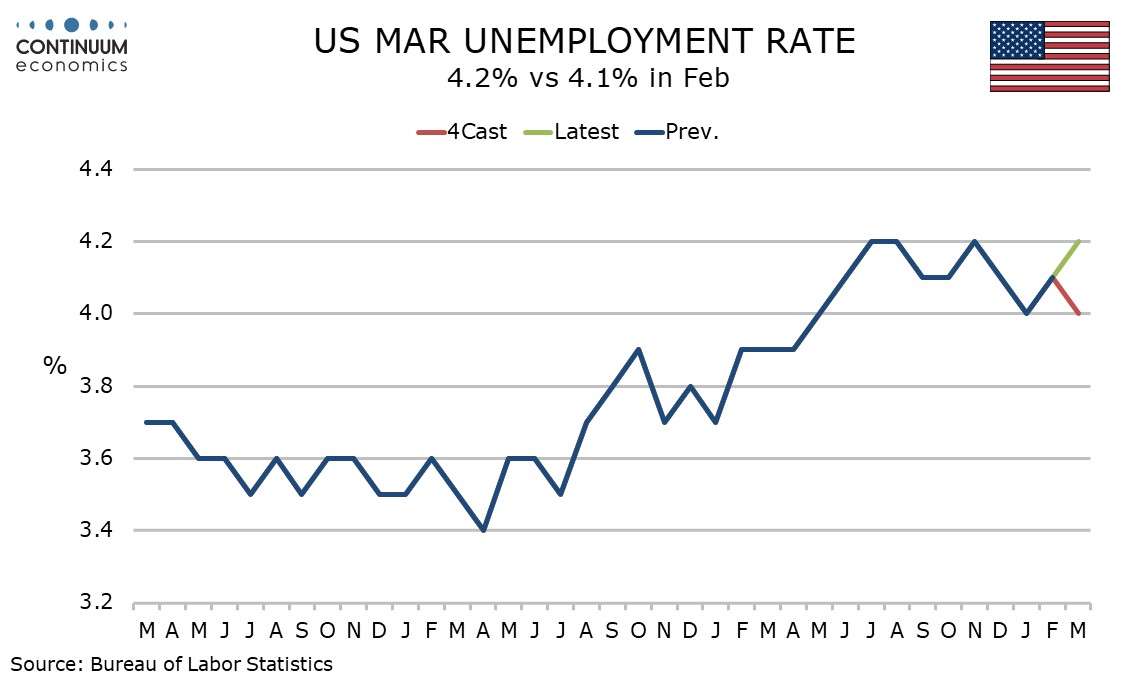

March’s non-farm payroll with a 228k increase is significantly higher than expected but less so net of 48k in downward revisions. The month looks like a bounce from two months restrained by bad weather, and shows a still strong labor market, though unemployment edged up to 4.2% from 4.1% and average earnings were moderate with a rise of 0.3%, also with negative revisions.

January’s rise now stands at 111k and February at 117k meaning that March matched the total of January and February. The weather effect is most visible in leisure and hospitality, up 43k after declines totaling 31k in January and February.

Health care and social assistance with a 78k rise remains the strongest sector while retail had a strong month at 24k. Manufacturing at 1k failed to impress. Government at 19k continues to rise, with gains at the state and local level offsetting a loss at the Federal, but even the latter drop was modest at 4k.

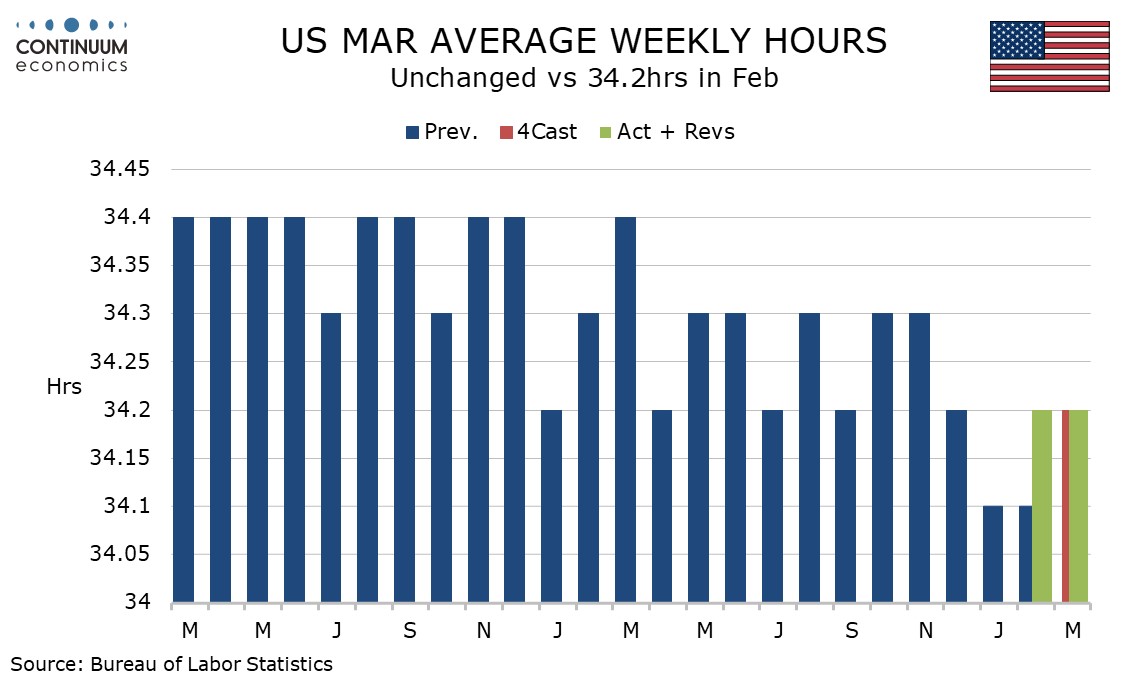

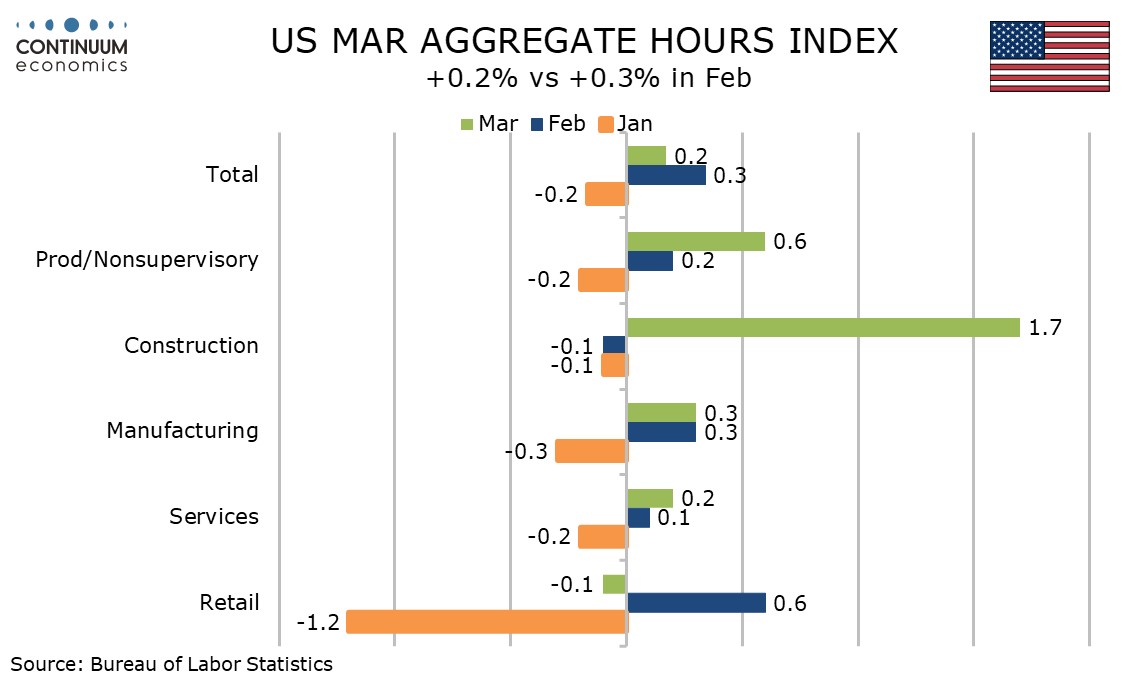

The workweek was unchanged at 34.2 hours though February was revised up from 34.1 which is where January was. Aggregate hours worked increased by 0.2% on the month and 0.5% annualized in Q1, which does not tell us much about GDP, which could be strong or weak depending on productivity.

Construction, despite a modest 13k gain in employment, led the rise in aggregate hours worked, again hinting at a weather impact.

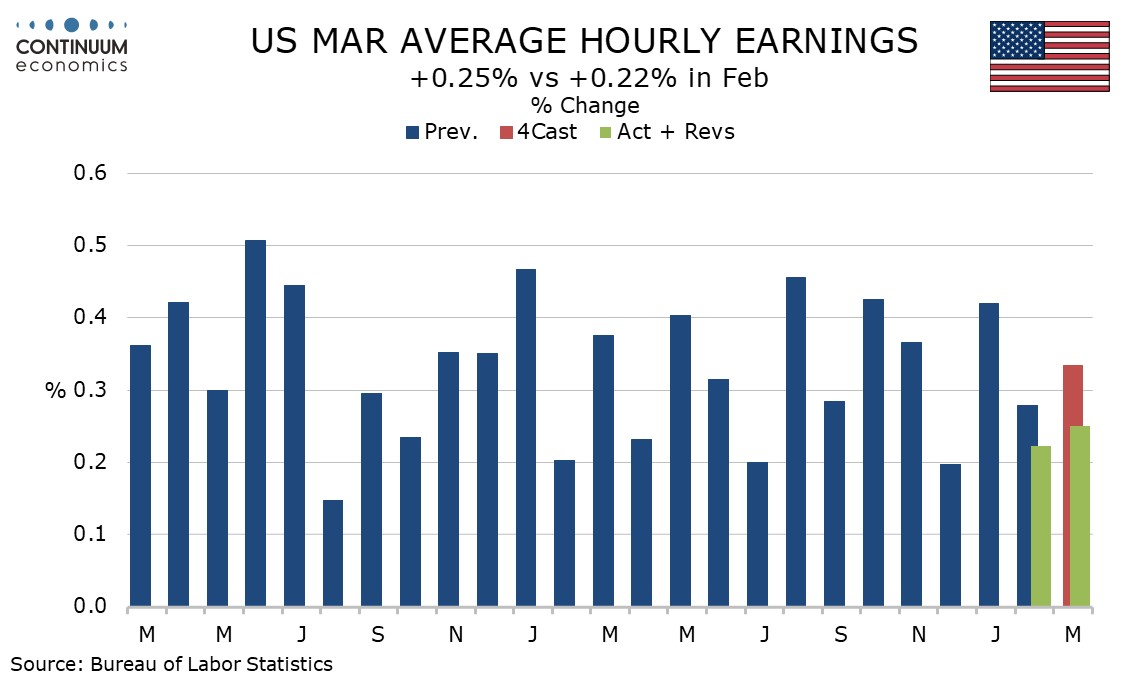

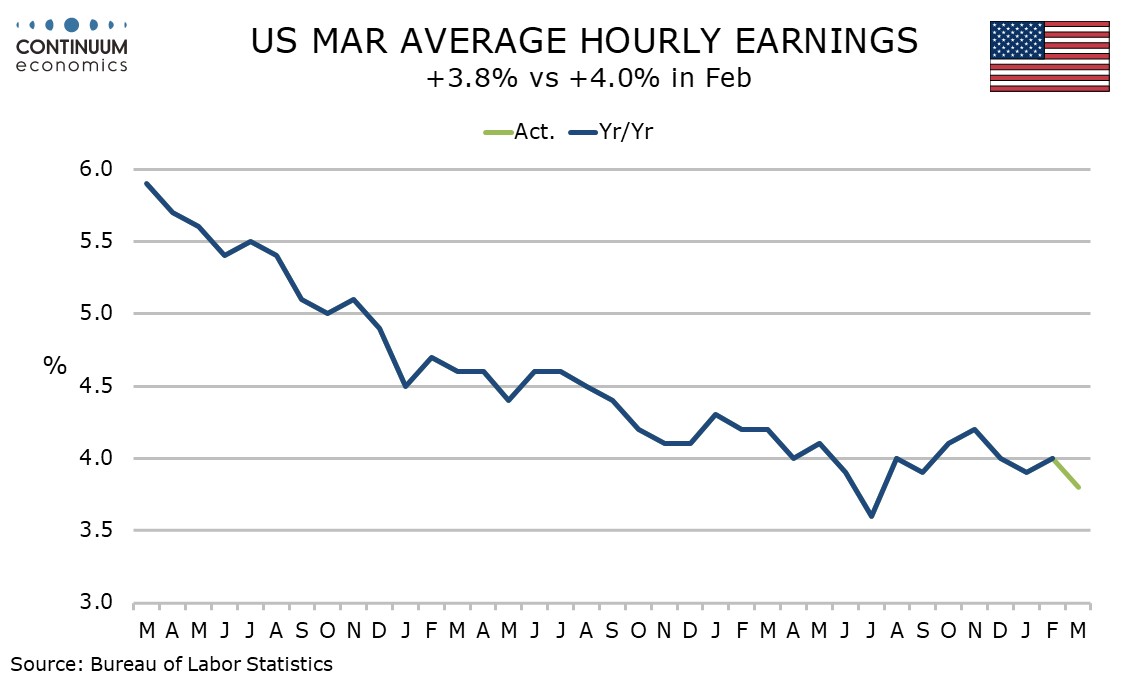

Average hourly earnings rose by 0.251% before rounding while February was revised to 0.223% from 0.279%. Yr/yr growth fell to 3.8%, the lowest since a far from distant July 2024, from 4.0%.

With the labor force raising by 232k and the household survey’s estate of employment rising by a payroll-consistent 201k the rise in unemployment was marginal, to 4.152% before rounding from 4.139%.

This is a healthy report that can provide some comfort to the Fed, with solid employment growth with limited inflationary pressure from wages. However the upside inflationary and downside growth risks from tariffs mean the healthy picture may not last for very long, though wages do not appear to be adding to inflationary risks.