China Data: Soft Start to Q3

Overall, the July data is consistent with our forecast of a weaker H2 and we still look for 4.7% GDP growth for 2024. The data is also consistent with our forecast of 4.0% in 2025 GDP growth. Consumption behavior could stall further and cause more of a drag than we anticipate and we now see a 30% probability that 2025 growth could be below 4%.

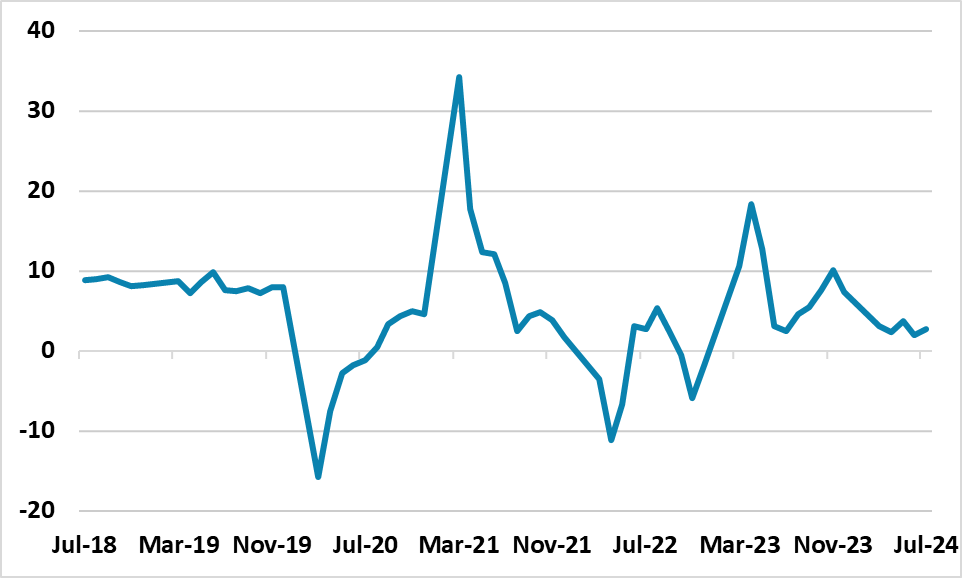

Figure 1: China Retail Sales Yr/Yr (%)

Source Datastream/Continuum Economics

The July economic numbers from China make disappointing reading. The output side of the economy disappointed versus expectations, with industrial production at 5.1% Yr/Yr (unchanged on the month). Though high tech manufacturing held up well, other areas were soft. This is not a surprise given the weakness in retail sales in H1 2024. Meanwhile, fixed investment slowed to 3.6% YTD Yr/Yr, with the breakdown pointing to slowing state investment – though this could be weather related and the Yuan 1trn central government expenditure program should kick in over the course of H2.

Retail sales was marginally better than expected at 2.7% Yr/Yr, helped by summer travel. Even so, the breakdown suggests that the trend remains soft, with furniture and households weak and luxury goods soft. Households are suffering from a hit to wealth from the house downturn, with the NBS reporting that existing home prices are down -8.8% Yr/Yr – questions have been raised whether this fully captures the decline in transacted prices. Additionally, employment growth in the private sector has been weak, due to restrained sentiment among private businesses and flat business investment. This saps income growth and hence consumption prospects.

Overall, the data is consistent with our forecast of a weaker H2 and we still look for 4.7% for 2024. The data is also consistent with our forecast of 4.0% in 2025 GDP growth. Though some further easing will be evident this is likely to be incremental in nature. We look for a 25bps cut in the RRR rate in September and 10bps in key policy rates in October (the PBOC is moving from the MLF rate to the 7 day reverse repo rate for more control – the August MLF decision has been delayed until Aug 26). However, downside risks exist to our baseline forecasts, if the consumer slowdown is greater than expected. Retail sales trends are already soft by China standards given the structural headwinds from property, slowing employment growth and population aging. It can be argued that China is showing signs of a major hangover from the residential property bust and staling of private employment, which some says as echoes of Japan balance sheet recession in the 1990’s. Consumption behavior could stall further and cause more of a drag than we anticipate and we now see a 30% probability that 2025 growth could be below 4% -- most likely in the 3-4% region, which would feel like a recession by China’s standards!