Holding the Line: RBI Maintains Policy Rate Amid Economic Optimism

The Reserve Bank of India (RBI) has decided to maintain the policy repo rate at 6.50% and has shifted its stance to 'neutral' to balance the objectives of inflation management and economic growth. Although inflation has eased, the RBI remains cautious due to rising geopolitical tensions and increased commodity prices.

Commensurate with our view, the Reserve Bank of India (RBI) has opted to maintain the policy repo rate at 6.50% during its Monetary Policy Committee (MPC) meeting on October 9, 2024. This decision is accompanied by a significant shift in the monetary policy stance from "withdrawal of accommodation" to "neutral," reflecting a nuanced approach to navigating the complex interplay of growth and inflation dynamics.

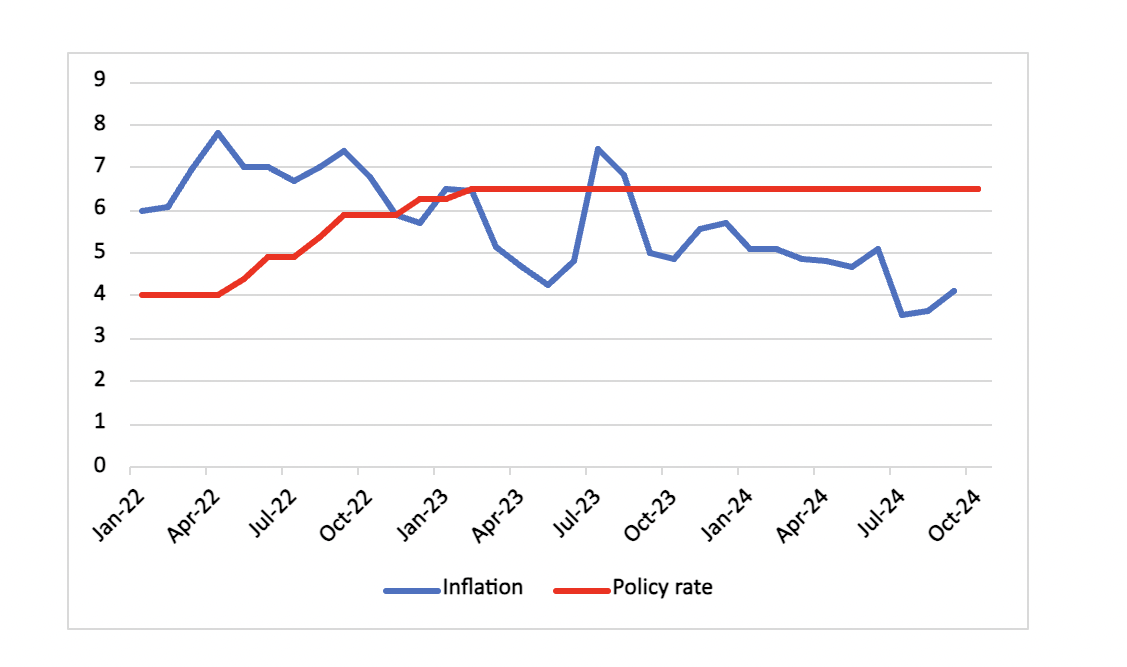

Figure 1: India CPI and Policy Rate (%)

Source: Continuum Economics

Economic Context and Growth Projections

The RBI's decision comes against a backdrop of robust economic indicators. India's real GDP grew by 6.7% yr/yr in Q1 FY25, propelled by a surge in private consumption and investment. This positive trajectory is expected to continue, with growth projections for the current fiscal year set at 7.2%. The MPC anticipates that strong kharif sowing and a buoyant consumer sentiment, particularly during the festive season, will further bolster private consumption. Notably, the agriculture sector is poised for a strong performance, thanks to favorable rainfall and reservoir levels, which should support both kharif and upcoming rabi crops.

Looking ahead, the RBI forecasts GDP growth rates of 7.0% for Q2, followed by 7.4% in both Q3 and Q4 of FY25.

Inflationary Trends and Projections

On the inflation front, the RBI has observed a notable decline, with headline inflation dropping to 3.6% and 3.7% in July and August, respectively, from 5.1% in June. However, concerns linger regarding a potential rebound in inflation rates due to adverse base effects and rising food prices in September. Despite these short-term pressures, the central bank anticipates that food inflation will ease by Q4 of 2024-25, driven by healthy kharif crop arrivals and substantial buffer stocks.

CPI inflation is projected at 4.5% for the fiscal year, with quarter-specific estimates of 4.1%, 4.8%, and 4.2% for Q2, Q3, and Q4, respectively. The MPC's analysis underscores that while the immediate inflation outlook presents challenges, the overall trajectory suggests a return to stability.

Rationale Behind the Policy Decision

The MPC emphasised the importance of balancing growth with price stability. The shift to a neutral stance reflects the RBI's commitment to fostering a sustainable economic environment while remaining vigilant to evolving inflation dynamics. Members of the MPC noted that enduring price stability is essential for sustaining high growth levels.

"With better prospects for both kharif and rabi crops and ample buffer stocks of foodgrains, there is now greater confidence on the disinflation path later in the financial year," the MPC stated. This reassured stakeholders that the central bank is prepared to manage inflationary pressures, especially in light of recent geopolitical tensions and fluctuating commodity prices. The decision to maintain the repo rate was supported by a majority of MPC members, including Governor Shaktikanta Das and other notable economists, while Dr. Nagesh Kumar voted for a modest rate cut of 25 basis points. This divergence in views highlights the ongoing debate about the optimal monetary policy framework in light of shifting economic conditions.

We anticipate that the RBI may implement a 25 basis points rate cut in December, driven by easing inflationary pressures. The RBI will look to strengthen consumer demand and private investment to maintain economic momentum.