U.S. February CPI - Renewed progress, but threatened by tariffs

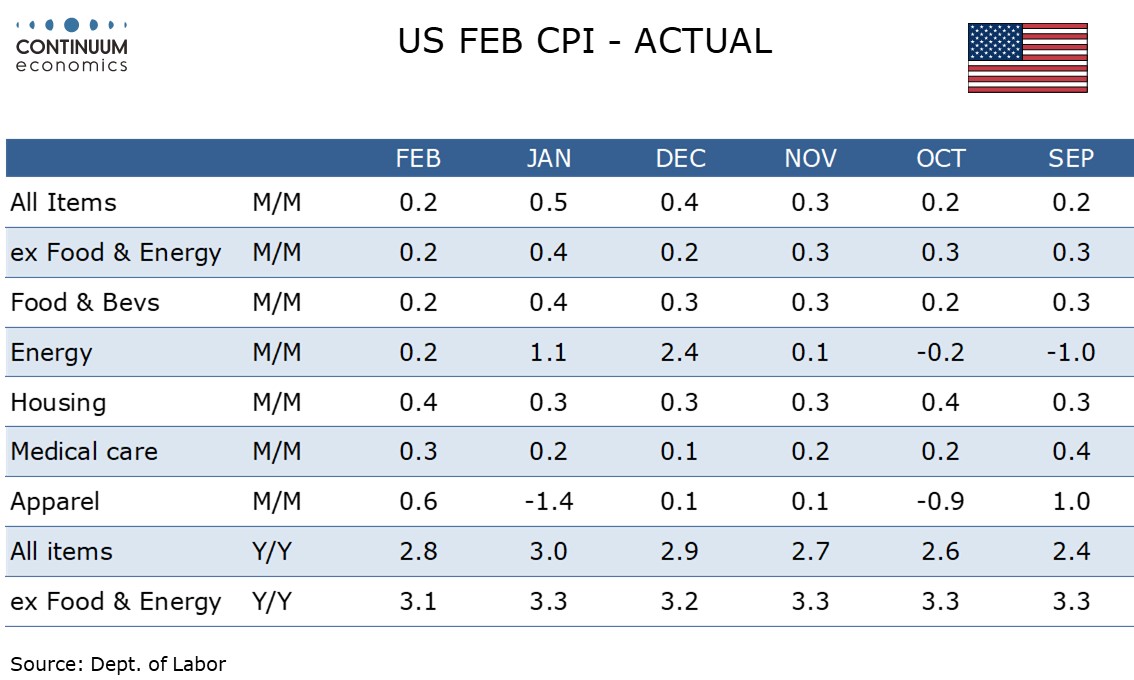

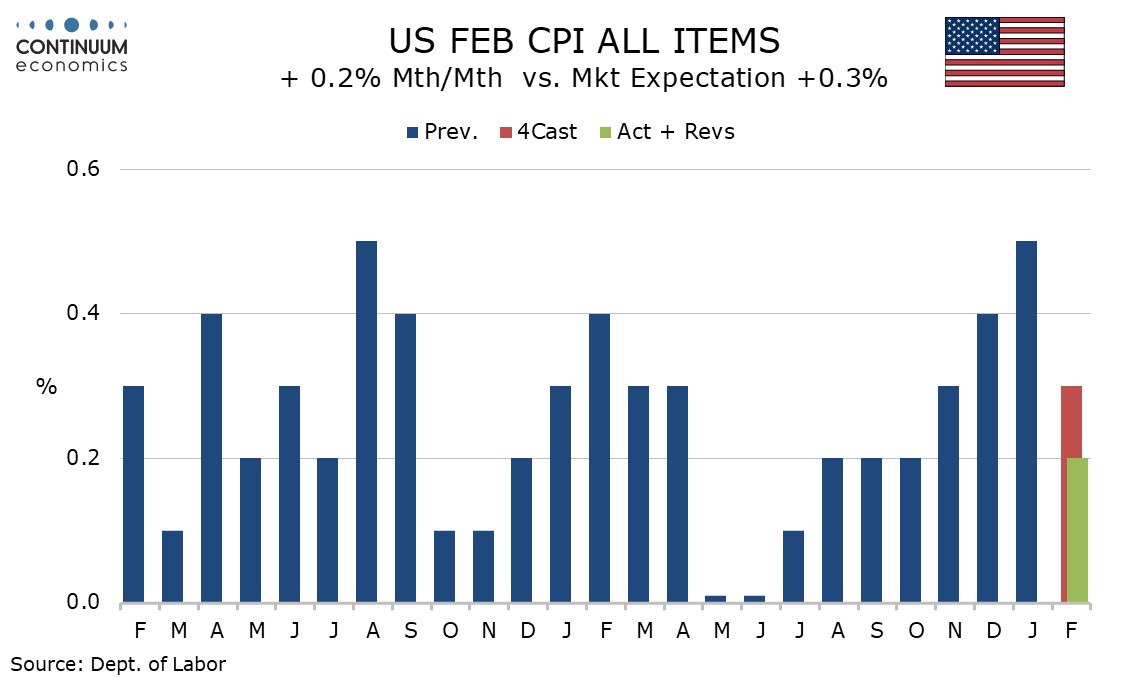

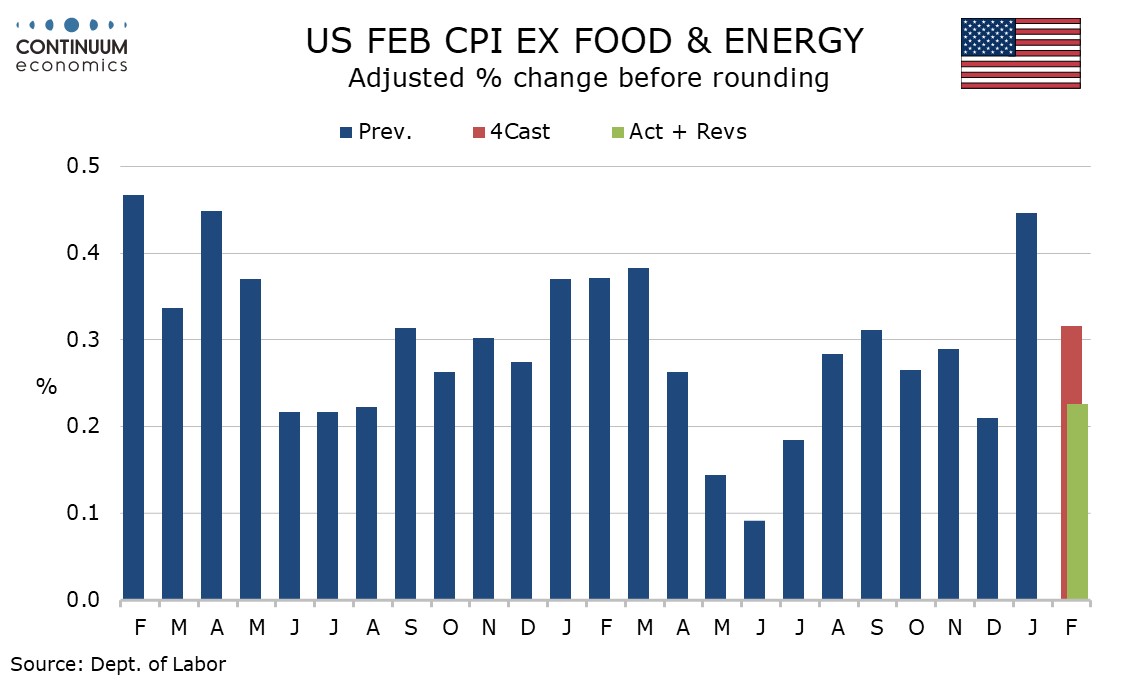

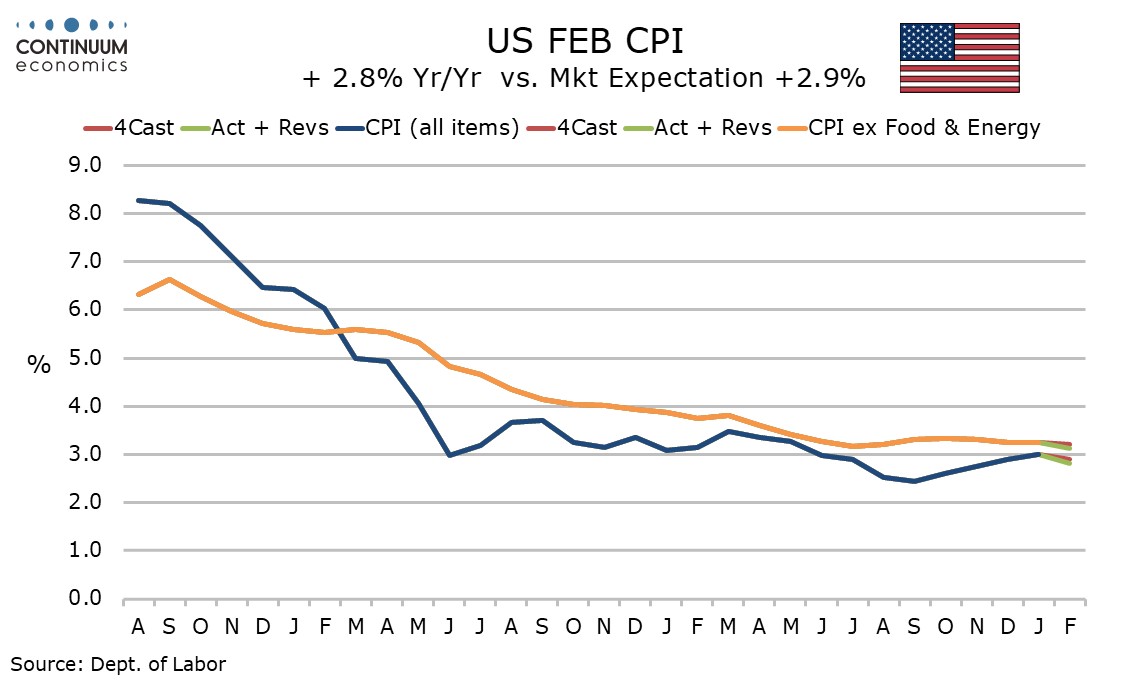

February CPI is softer than expected with gains of 0.2% both overall and ex food and energy, with the ex food and energy rate up by 0.227% before rounding. Coming after a strong January conclusions should be cautious, while upcoming months may be lifted by tariffs. However, the data will come as a relief to the Fed.

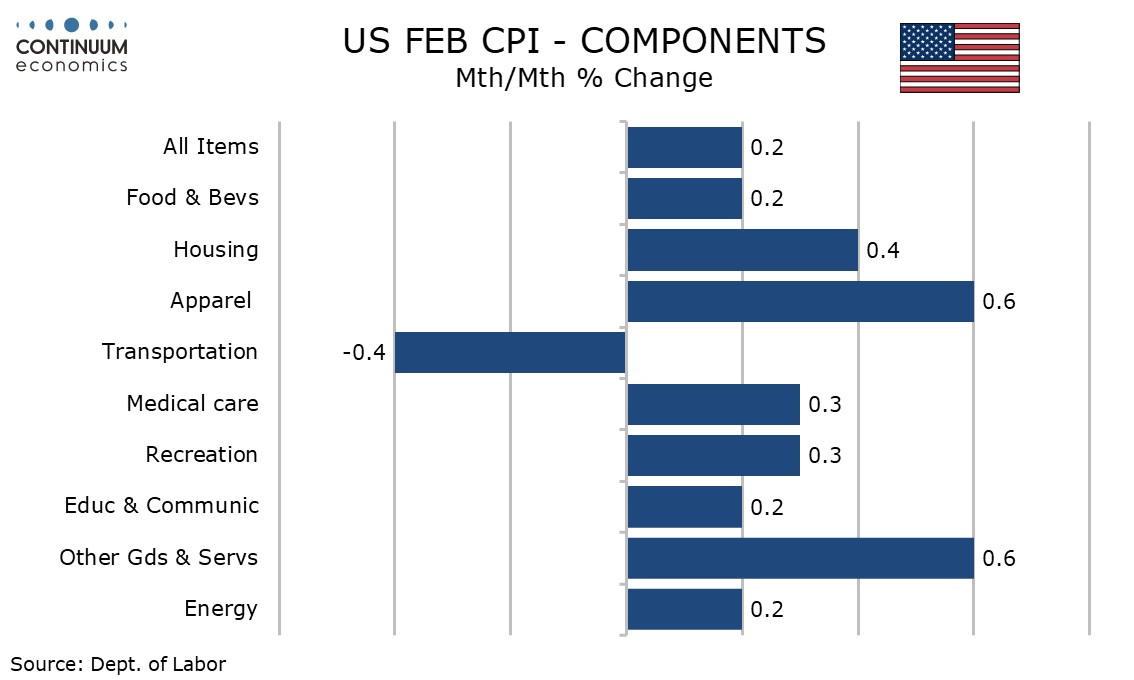

Food and energy both rose by 0.2%, food moderating despite continued surging in the price of eggs with dairy products and fruits/vegetables declining, while energy’s gain came despite a 1.0% fall in gasoline, with energy services up by 1.4%.

Commodities ex food and energy rose by 0.2%. Used autos with a 0.9% rise slowed from 2.2% in January and apparel rose by 0.6% after a 1.4% January decline. Recreation commodities with a 0.7% decline were the main restraint, but most components were subdued.

Services less energy services rose by 0.3%. The main restraint was a 0.8% decline in transport services following a 1.8% increase in January, with air fares down by 4.0% and auto services seeing moderate gains after a strong January. Owners’ equivalent rent rose by 0.3% for a fourth straight month. Recreation services were firm with a rise of 0.7%.

Yr/yr CPI slipped to 2.8% from 3.0% and the ex food and energy rate fell to 3.1% from 3.3%, the latter reaching its slowest since April 2021.

This suggests the Fed continues to make progress, albeit slow and bumpy, towards reducing inflation to target. It remains to be seen in tariffs will threaten that progress. We expect they will.