CBRT Continued Monetary Tightening Cycle on December 21, but with a Lesser Pace

As we pencilled a 250 bps policy rate hike by Central Bank of Turkiye (CBRT) on December 21 MPC meeting, CBRT continued its monetary tightening cycle by lifting the key rate from 40% to 42.5%. This is the seventh straight rate hike by CBRT since May presidential elections, simply to fight against galloping inflation and weakening Turkish Lira (TRY). According to the statement published, CBRT remained concerned about the strong course of domestic demand, the stickiness of services inflation, and geopolitical risks that keep inflation pressures alive while it strongly signalled that the cycle will be completed shortly by underlining that the aggressive tightening cycle will be done "as soon as possible" as it faces down years of soaring inflation. We expect CBRT to further hike the rate to 45% in the first MPC of 2024, which is scheduled for January 25.

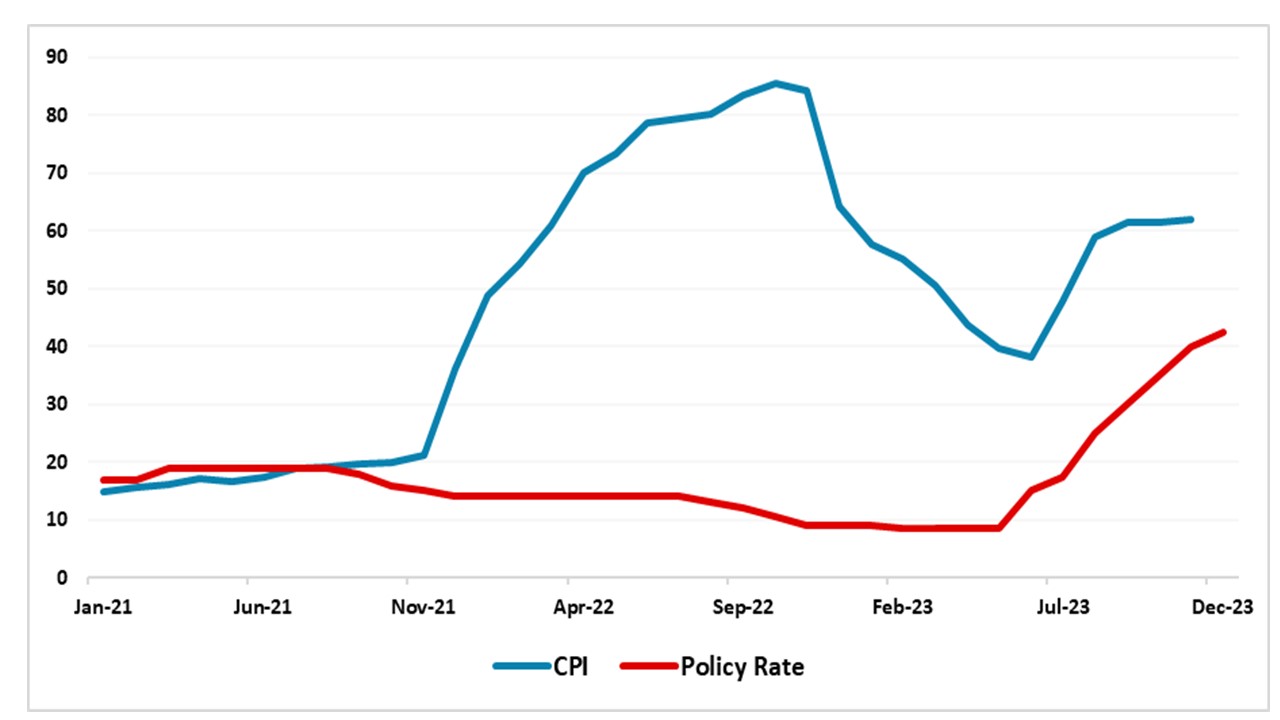

Figure 1: CPI (YoY, % Change) and Policy Rate (%), January 2021 – December 2023

The CBRT raised the policy rate from 40% to 42.5% on December 21 MPC meeting to establish the disinflation course as soon as possible, to anchor inflation expectations, to control the deterioration in pricing behaviour and to squeeze demand, as inflation continues to bite with CPI surging to 62% annually and 3.3% monthly in November. One good news for the country is that the pace of the inflation continues to decelerate in the last months, partly signalling the success of tightening process. In a similar vein, CBRT emphasized on December 21 that domestic demand continues to moderate, pricing behaviour started to show signs of improvement, external financing conditions improving, foreign exchange reserves increasing, and there is a positive impact of demand rebalancing on current account balance, coupled with accelerated surge in domestic and foreign demand for Turkish lira denominated assets, showing the effectiveness of the traditional monetary policy.

MPC statement on December 21 was remarkable as it strongly signalled CBRT plans to complete tightening cycle in the near term if the pace of the inflation would allow. The statement said that “Monetary tightness is significantly close to the level required to establish the disinflation course, (thus) the Committee reduced the pace of monetary tightening. The Committee anticipates to complete the tightening cycle as soon as possible while the monetary tightness will be maintained as long as needed to ensure sustained price stability.”

Despite signs of improvement, we anticipate the inflation would continue to surge, particularly in the first half of 2024. We think the minimum wage increase in January 2024 coupled with elevated upward pressures in services and the impact of natural gas prices will push prices up further in Q1 2024. Upside risks like weakening currency, increasing energy prices, deteriorated pricing behaviour and expected hike in public spending before the 2024 local elections remain strong, which would likely also drive inflation in early 2024, as the impacts of the strong monetary tightening are still feeding through. (Note: TRY has weakened by 36% against the USD in 2023 to date). We foresee relative slowdown in the inflation trajectory in the second half of 2024 thanks to CBRT’s hawkish bias and contractionary fiscal policies.

In addition to this, we think an important point to underscore about Turkish inflation trajectory is the monetary illusion, which continues to be largely impactful. First, after the steep hikes in the minimum wage and salaries of the civil servants in 2023, Turkish people have had the tendency to view their wealth and income in nominal terms, rather than recognizing their real value adjusted with galloping inflation, which triggered the consumer demand to increase, as galloping inflation created the public's concern that 'everything will become more expensive'. In addition, as the real interest rates were negative, we think people mostly stopped saving and tended to spend their income as quickly as possible before they would lose their purchasing power. As the real interest rates are not deeply negative anymore following CBRT’s steep rate hikes, we think this vicious cycle (inflation becoming the cause of the increase in demand, and the increase in demand becoming the cause of inflation) would be partly broken in 2024 helping the inflation to cool off, but the transition will take time (here).

Within this framework, we are of the view that Central Bank continues to regain credibility as it strongly signals determination in pursuing traditional economic policies until the inflation is under better control, which will probably help attract foreign investments and improvement in the current account balance. Our projection is that policy rate will be raised up to 45% in Q1 2024, and stay there in 2024 as soon as inflation shows significant improvement.