A Trump Reelection and U.S. Government Bond Yields?

Expectations are firming that Donald Trump will win the Republican nomination, but the presidential election race is currently 50/50. If Trump were reelected as U.S. president, what would it mean for U.S. Treasuries?

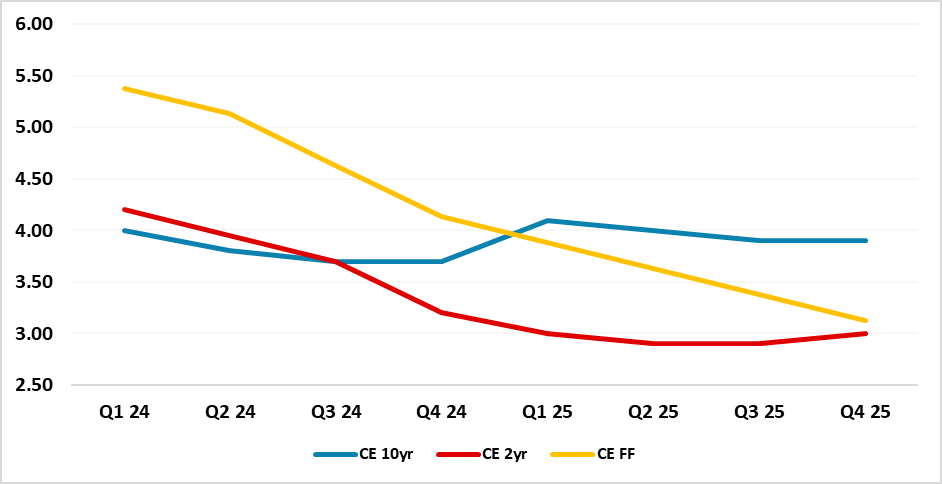

There would be a very full agenda for financial markets in 2025 if Trump were reelected. For U.S. Treasuries, the key issues would be the budget deficit and rule of law (plus associated rating agencies downgrades) and whether Trump would be effective in pressuring the Fed into faster and deeper rate cuts. This promises turbulence for U.S. Treasuries, but it would also likely accelerate the ongoing swing to a positive shape yield curve in the 10-2yr area of the curve that we see occurring (Figure 1).

Figure 1: CE Baseline Forecasts Assuming a Biden Victory (%)

Source: Datastream/Continuum Economics

Source: Datastream/Continuum Economics

Though Nikki Haley enjoyed a healthy showing in New Hampshire, political analysts remain of the view that Donald Trump is on course to be nominated as the Republican contender. However, moderate and centrist Republican voters are wavering on whether they will vote for Trump or simply not vote. The outcome of numerous court cases for Trump is also a swing factor for moderate and centrist voters, as a formal prosecution could decide the election. However, President Biden also faces the risk that some Democratic voters could decide not to vote, given concerns over U.S. support for Israel in Gaza and immigration/cost of living concerns. An independent candidate could also take votes from Biden and Trump. This far out a Biden/Trump presidential election looks 50/50. What would happen if Trump is elected and what does it mean for financial markets? This is a complex set of questions, but we sketch some initial thoughts and look at U.S. Treasuries, as this would have a spillover impact on U.S. equities and the USD.

· Deficits/Rule of Law and Rating Downgrades. A president Trump would be focused on extending tax cuts from his first term due to expire in 2026, with perhaps some expenditure cuts including climate friendly spending from Biden IRA act. If the House and Senate were controlled by the Republicans then this would be highly likely. Bottom line is a president Trump would likely not do much to reduce budget deficits and could actually add to them. This would upset ratings agencies, but they would be more alarmed about any substantive weakening of the rule of law. Trump campaign is focused on sacking senior civil servants to be replaced by Trump followers, which causes serious question about U.S. democracy. The chance of multiple rating agencies downgrading the U.S. could then be higher in 2025, if the agencies fear that Trump appointment will undermine U.S. institutions. This could hurt the long-end of the U.S. Treasury curve.

· Jawboning the Fed. A reelected president Trump would likely not reappoint Powell in 2026 and would look to push his advocates for this and other Fed roles. However, the senate would likely be reluctant to endorse non-credible candidates, as it did in Trump’s first term. The other alternative is that Trump tries to jawbone the Fed into cutting more aggressively in 2025 and 2026. This could help the short-end, if the Fed partially bends to Trumps wishes.

· 10% universal baseline tariff. Trump could push forward once again on tariffs using the argument of national security issues, as he did with tariffs in his 1 term. Other countries would retaliate and risk hurt global business sentiment. Once again some senate push back would be seen. If implemented it is mixed for U.S. Treasuries. On a one off basis it would temporarily boost inflation on a modest basis, but a global trade war is risk off and positive for U.S. Treasuries.

· End Ukraine War and weaken NATO support. Trump has said he would end the Ukraine war in one day, which would likely involve a ceasefire deal on present Ukraine lands taken by Russia. While European countries would be outraged, Ukraine would find it difficult to fight on without a U.S. president backing serious and sustained funding. If the war remains deadlocked by early 2025 then congress could end up accepting a ceasefire idea, but not quickly reducing Russia sanctions. The other alternative is that a reelected Trump threatens to withdraw from NATO. This would be a step too far for Congress, especially the Senate. However, Trump call for Europe to pay more for its defense would likely see most Republicans supporting. For U.S. Treasuries, a Ukraine ceasefire without lifting Russia sanctions would likely not have much lasting reaction, but could cause temporary volatility.

This would be a very full agenda for financial markets in 2025 if Trump were reelected. For U.S. Treasuries, the key issues would be the deficit and rule of law and whether Trump would be effective in pressuring the Fed into faster and deeper rate cuts. This promises turbulence for U.S. Treasuries, but it would also likely accelerate the ongoing swing to a positive shape yield curve in the 10-2yr area of the curve.