China: 3rd Plenum Incremental Not Game Changing

The 3 plenum July 15-18 will likely see some additional measures that will support or stimulate China economy. However, they are unlikely to be game changers, such as a Yuan2-4trn program of buying most unsold homes or structural increase in the unemployment/health and pension safety nets to free up excess household savings to boost medium-term consumption growth.

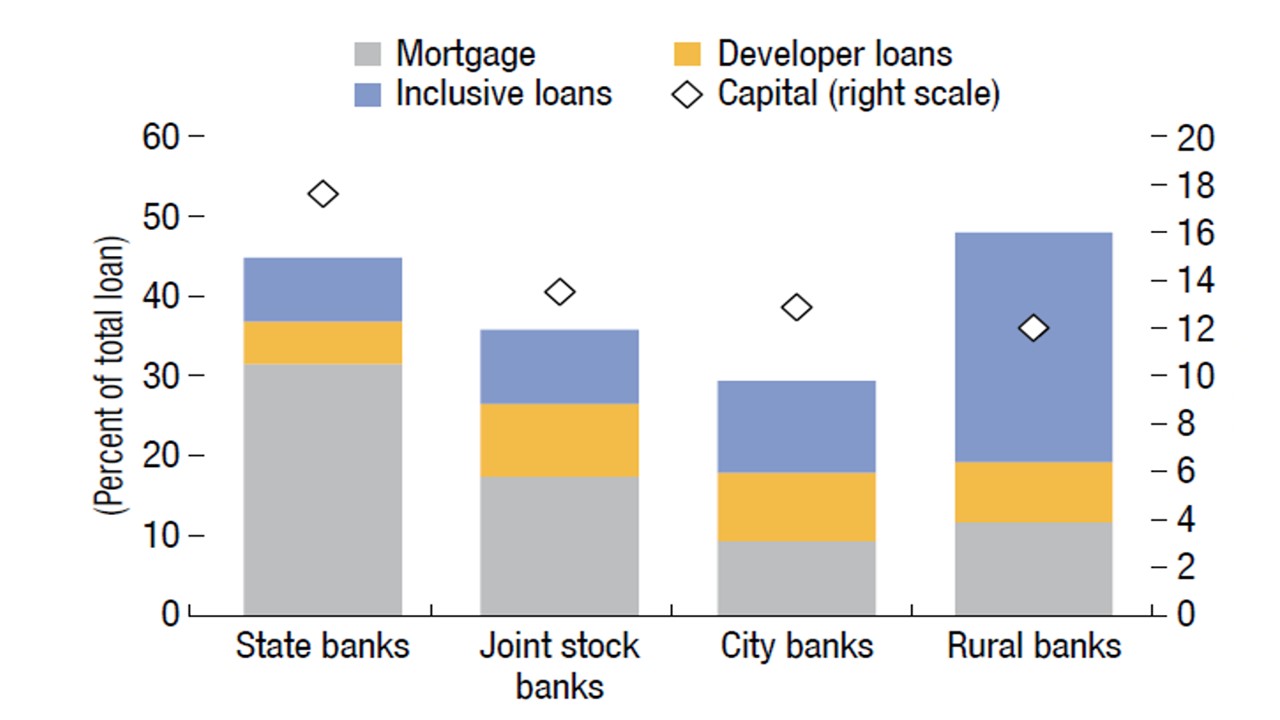

Figure 1: Nominal GDP and 3yr Moving Average and 10yr Government Bond Yield (%)

Source Continuum Economics

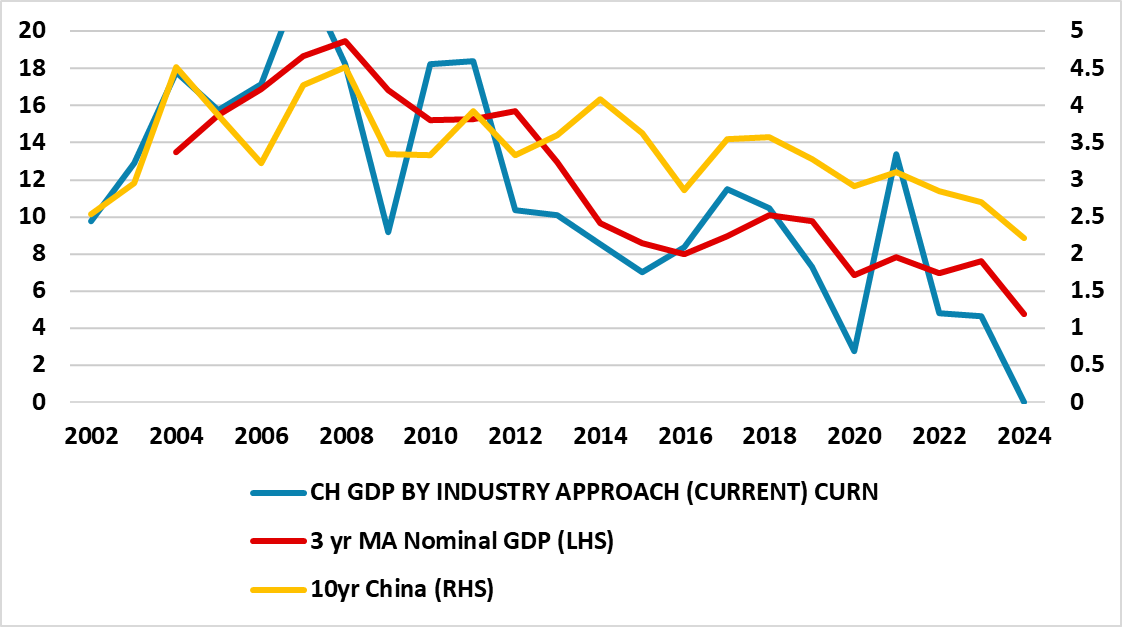

China 10yr government bond yields are being depressed by a flight to quality (Figure 1), as domestic investors worry about the spillover of the property bust into the financial sector and wider economy. Risk aversion is causing some concerns about smaller rural banks and weaker city banks (Figure 2), that is producing a bias for safe assets and is one of the reasons why China equity market is in the doldrums. Though China has a policy of forced mergers to rescue weaker banks (here), businesses and households remain worried. Problems on transparency also exist with the 2023 PBOC financial stability report remaining 6 months overdue. 10yr China government bond yields have been below nominal GDP, but the weaker trend in nominal GDP growth is also causing a bias towards government bonds as well.

Can China 3 Plenum on July 15-18 herald policy changes that will materially shift sentiment towards China markets?

Figure 2: China Banks Loan Exposure by Counterparty Sector (% of Total Loans)

Source: IMF GSFR April 2024

Editorials in official newspaper leave the impression that policy changes will be incremental rather than game changers. Some of the key issues are.

· Boosting households. So far the official policy focus has been to shift production from old economy housebuilding and exports to new economy high tech and renewables manufacturing. Economists rightly highlight that better consumption could make China growth more resilient and well balanced as well. Specifically better public sector provision of unemployment benefit/healthcare and pensions could help reduce the large precautionary savings of households and boost trend consumption. However, none of this appears to be a high political priority. Instead, focus appears to be on higher VAT rates and perhaps an inheritance tax, which could provide extra fiscal funds but would not boost consumption.

· Private businesses. China authorities have been taking more positively about private businesses role in the economy, but sentiment remains weak after the crackdown in numerous sectors (e.g. tech/healthcare and education) and an official sense that greed in the 1990-2019 had gone too far. However, any changes to help private business is likely to be incremental, which is a concern as private businesses are the key driver of employment growth in China. Meanwhile, in the residential property sector the focus remains on a prolonged multi year muddle through, rather than a game changer to absorb most of the excess housing inventory – estimates are that this could cost the government Yuan2-4trn rather than Y300bln currently allocated.

· Hukou fine tuning. Some reports have suggested that the authorities may allow rural homes to be saleable and help movement towards urban areas. However, international economists suggestion that the Hukou system be abandoned to boost the rural to urban migration appear highly unlikely, as China authorities want to control this process.

· Tech and Energy self-sufficiency. Reemphasis of the important role that technology industries play in domestic self-sufficiency are widely expected, while a continued drive to build up renewable energy production is also anticipated. This is good economics for China, both given the bans that the U.S. has imposed on technology exports to China and also to secure domestic electricity for industries and electric vehicles. It also provide resilience and security if the world gets more hostile in the coming years, which could be a renewed consideration for China’s authorities with growing anticipation that Trump could win the November U.S. presidential election.

Overall, the 3 plenum will likely see some additional measures that will support or stimulate China economy. However, they are unlikely to be game changers and that why we still forecast 4.0% GDP growth for 2025 (here).