China Finance Weakest Links: Small Banks and Property Finance

China authorities appear to have the financial stability spill over from the property sector until control currently, through a combination of direct support for housing and forced mergers of weak banks (mainly rural so far). This game plan will likely be followed for the next few years. However, this all means residential property investment will be an economic headwind to growth for years to come.

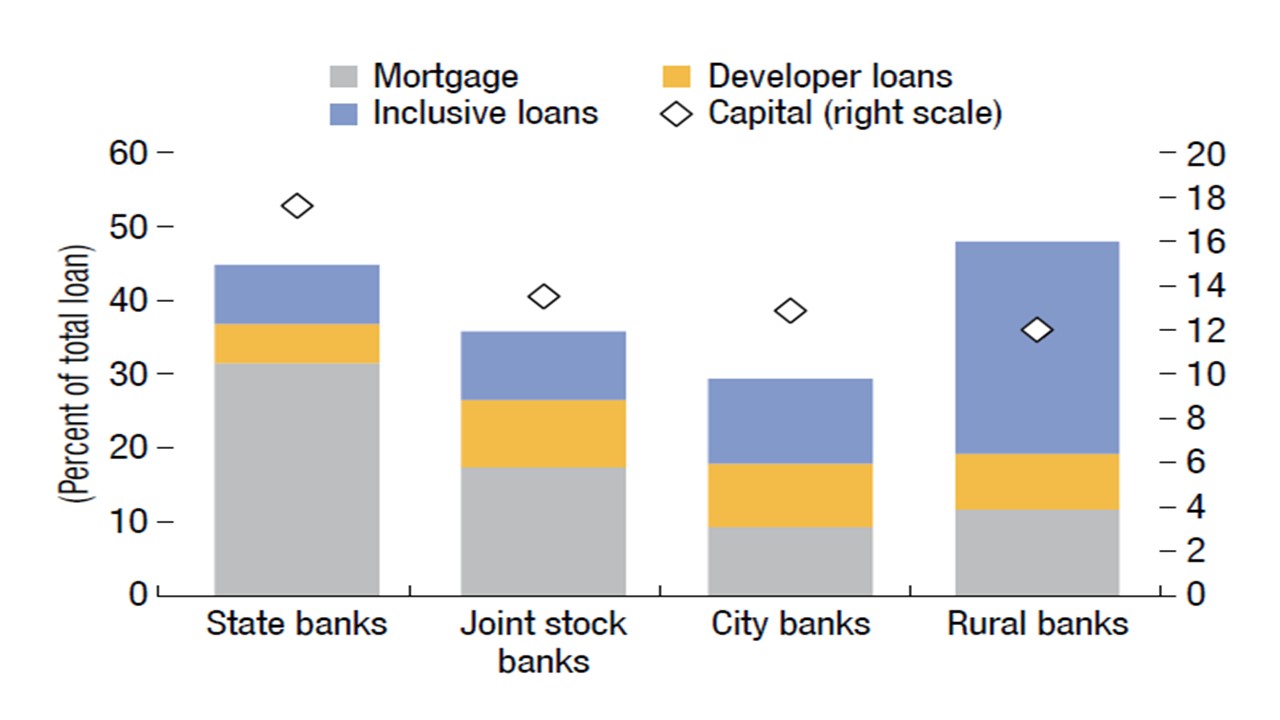

Figure 1: China Banks Loan Exposure by Counterparty Sector (% of Total Loans)

Source: IMF GSFR April 2024

China residential property hangover continues to hurt developer’s liquidity and solvency, which risks rising non-performing loans for lenders. The lenders most at risk are small banks and wealth management and trust businesses. Rural banks have the lowest capital ratios and the highest exposure (Figure 1). The risks are amplified for the weakest local government financial vehicles (LGFV), who depend on property transaction to raise tax and are faced with higher spreads versus government bonds as investors differentiate good from weak LGFV’s. A couple of points suggest that the authorities currently have control of the financial stability spill over.

· Avoiding defaults. China authorities have sort to ensure that unfinished homes are completed to avoid souring sentiment and to keep revenues flowing. Secondly, mortgage rate floors are being removed, while deposits are being cut to help buyers and in turn developers and LGFV’s. Thirdly, the authorities have announced Yuan300bln to fund local authorities purchases of excess housing inventory to relieve pressure across the industry. On the margin this is also allowing a narrowing of bond spreads and could stabilise financing for weaker developers/LGFV’s and banks.

· Forced mergers for weaker banks. China authorities have encouraged the process of consolidation among weaker rural banks into larger regional banks. China has been reluctant to follow the path of resolving banks with haircuts to lenders to the institution, as it would cause a knock of effect of confidence through the financial system. This process of rolling up debts could see major banks eventually taking over some mid sized banks if required, rather than the route of resolution and failure. While some argue this is not the optimal route, it allows the authorities more control of the banking system and avoids wider spill over.

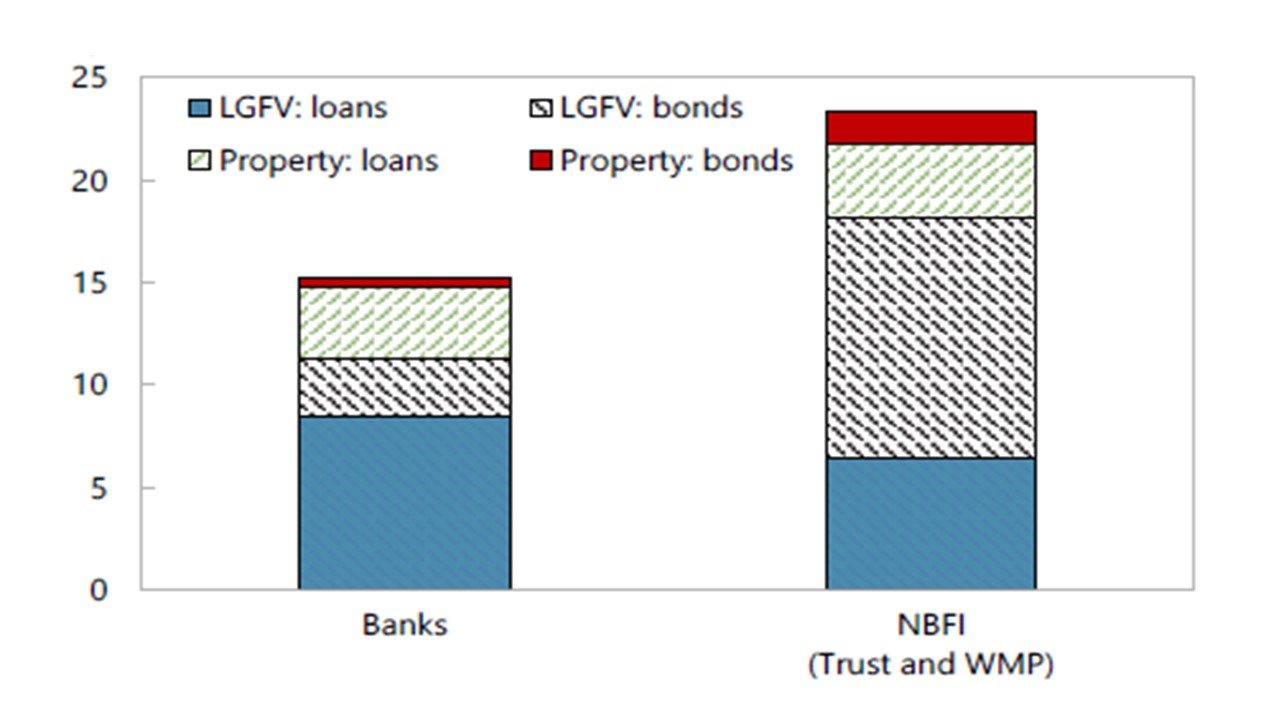

Figure 2: On Balance Sheet Exposure to Developers and LGFV’s (% of Total Assets)

Source: IMF China Select Issues Feb 2024

Nevertheless, the scale of official direct intervention in the housing market is modest rather than a game changer (here). The IMF has estimated that excess inventory could take until 2030 to unwind, which would suppress new housing starts and prices and thus prolong the weakness in the sector – the IMF also estimate that new housing demand will slow noticeable due to population aging and less rural to urban migration (here). Market estimates vary between Yuan2-7trn if all the excess inventory were to be purchased by China authorities. Secondly, China authorities are discouraging a fall in housing prices to take account of excess inventory and weaker structural demand for housing for fears that it could cause a 2 wave of problems for the property sector. This all suggests that the problems will remain multi year and will hangover weaker developers/LGFV’s/banks and non-banks. One to watch and monitor. However, this all means residential property investment will be an economic headwind to growth for years to come.